The European Commission passed the much-contested Carbon Border Adjustment Mechanism into law this month. Europe’s CBAM is the first tariff of its kind to impose levies on carbon emissions used to produce goods and will likely spur long-term changes.

The CBAM is a mechanism that creates a more even playing field for participants of the EU cap-and-trade market. Putting a tax on the carbon emissions associated with the production of select goods provides a two-fold benefit. It eliminates the cost advantages outside companies currently have and incentivizes greater emissions transition. That’s according to Luke Oliver, managing director, head of climate investments, and head of strategy at KraneShares, in the Climate Market Now blog.

The tariffs will initially be applied to iron, steel, cement, aluminum, fertilizer, and electricity generation. This will eventually expand to encompass more goods and sectors but the initial phase kicks in next year. Long-term, CBAM will capture over half of the import emissions for sectors covered under the EU cap-and-trade program.

A Guide to Europe’s Carbon Tariff

The tariff kicks in next year but importers will only need to report greenhouse gas emissions used in their imports. Direct and indirect emissions will be reported but indirect emissions ultimately will only be taxed for specific sectors.

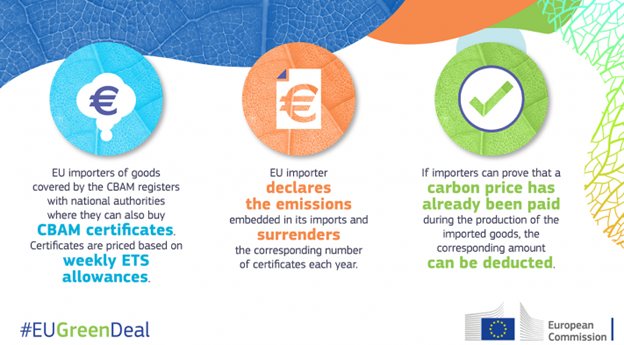

Image source: European Commission

CBAM rolls out full implementation beginning in 2026. Importers must declare all imports and associated GHG emissions each year. They must purchase and surrender CBAM certificates to cover all emissions each year. Any certificates not used can be sold back to the EU as they aren’t tradable. Certificate prices are based on current weekly prices of carbon allowances from the EU’s carbon market.

“The certificates are sold at an equivalent price to the rolling weekly average price of the daily EU Allowances (EUAs) auctions held within the EU ETS,” Oliver explained. This “ensures that importers’ costs are identical to that paid by European industrials.”

Global Impacts and Localized Support for EUA Prices

A key component of CBAM is that imports will be exempt if the exporting country has an existing carbon pricing system with “equivalent” pricing.

“The general view is that major industrial exporters such as India, China, Russia, and the U.S. will be hardest hit,” wrote Oliver. This is because “they are major global exporters of iron and steel, cement, fertilizer, and aluminum”.

Countries including Canada, Australia, the U.K., and the U.S. are researching their own CBAM equivalent. The U.S. is the only country of the four to not have a national carbon market.

CBAM could create longer-term pressure for countries to develop their own carbon markets to remain competitive. Within the EU, it could also result in more buyers of European Union Allowances (EUAs).

“Numerous experts have suggested that importers may hedge their exposure to CBAM certificate prices by taking positions in EUA futures,” Oliver explained. This would culminate in “driving demand higher and raising the price of EUAs for European buyers.”

Alongside CBAM implementation will come the elimination of free allowances currently issued to certain sectors. As these free allowances phase-out, more market participants will create greater demand, likely resulting in positive price pressures for EUAs long-term.

See also: “An Advisor’s Guide to the EU Carbon Market“

Investing in Europe’s Carbon Allowances Market With KEUA

The KraneShares European Carbon Allowance ETF (KEUA) offers targeted exposure to the EU carbon allowances market and is actively managed.

The fund’s benchmark is the IHS Markit Carbon EUA Index. This benchmark tracks the most-traded EUA futures contracts, the oldest and most liquid carbon allowances market. Currently, the market covers roughly 40% of all EU emissions, including 27 member states and Norway, Iceland, and Liechtenstein. KEUA has an expense ratio of 0.78%.

The KraneShares Global Carbon ETF (NYSE: KRBN) is the first of its kind to offer an investment take on carbon credits trading.

KRBN tracks the IHS Markit Global Carbon Index, which follows the most liquid carbon credit futures contracts in the world. This includes contracts from the European Union Allowances (EUA) and the United Kingdom Allowances (UKA) overseas. It also includes the California Carbon Allowances (CCA) and Regional Greenhouse Gas Initiative (RGGI) markets domestically. KRBN has an expense ratio of 0.78%

For more news, information, and analysis, visit the Climate Insights Channel.