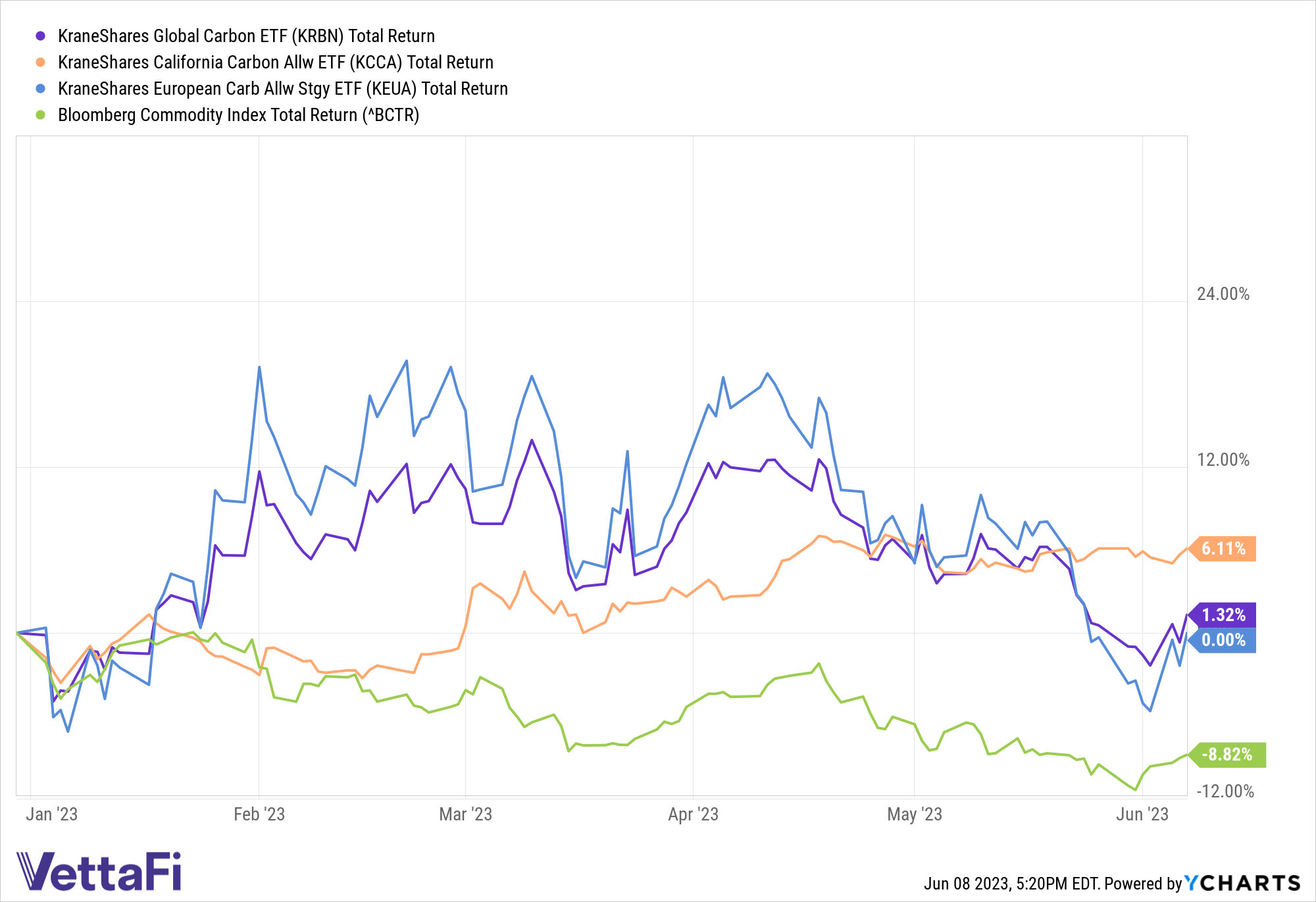

Many commodities are off their 2022 highs as recession concerns continue to weigh heavily on demand forecasts. Investors looking to enhance or change their commodity exposures this year should consider the addition of carbon allowances. Carbon allowance ETFs are outperforming broad commodities YTD and add strong diversification potential to portfolios.

Broad commodities, measured by the Bloomberg Commodity Index, are down collectively for the year. The Bloomberg Commodity Index gives diversified exposure to global commodities through futures and is down 8.82% YTD. The index’s construction accounts for liquidity and production while also preventing the overrepresentation of a single commodity or sector.

In contrast, the KraneShares California Carbon Allowance ETF (KCCA) is up 6.11% YTD as of 06/07/23. The KraneShares Global Carbon ETF (NYSE: KRBN) is up 1.32% and the KraneShares European Carbon Allowance ETF (KEUA) is flat for the year on weaker energy prices.

Cap-and-trade markets issue carbon allowances that equate to one ton of carbon dioxide. Participants are capped at allotted emissions each year and any overages must be covered by the company. They are regulated, mandatory markets that cover various industries and accounted for 17% of emissions last year, reported Reuters. Governments raised over $63 billion last year alone from the sale of carbon allowances.

Carbon allowances stand to benefit as countries work to curtail emissions. Many major carbon allowance markets have built-in tightening mechanisms that reduce allowance supply over time. Reduced supply and increasing demand are likely to create upward price pressure on carbon allowances in the coming years.

Invest in Outperforming Commodities YTD With KraneShares

The KraneShares European Carbon Allowance ETF (KEUA) offers targeted exposure to the EU carbon allowances market. The fund is benchmarked to the IHS Markit Carbon EUA Index, an index that tracks the most-traded EUA futures contracts. It’s a market that is the oldest and most liquid for carbon allowances. The market currently offers coverage for roughly 40% of all emissions from the EU, including 27 member states and Norway, Iceland, and Liechtenstein.

The KraneShares California Carbon Allowance ETF (KCCA) offers targeted exposure to the joint California and Quebec carbon allowance market. This includes California’s cap-and-trade carbon allowance program. It’s one of the fastest-growing carbon allowance programs worldwide and is benchmarked to the IHS Markit Carbon CCA Index. The CCA includes up to 15% of the cap-and-trade credits from Quebec’s market.

The KraneShares Global Carbon ETF (NYSE: KRBN) was the first of its kind to offer an investment take on carbon credits trading. The fund provides diversified exposure to major carbon markets worldwide. KRBN tracks the IHS Markit Global Carbon Index, which follows the most liquid carbon credit futures contracts in the world. This includes contracts from the European Union Allowances (EUA) and California Carbon Allowances (CCA). It also includes the Regional Greenhouse Gas Initiative (RGGI) markets, and the United Kingdom Allowances (UKA).

For more news, information, and analysis, visit the Climate Insights Channel.