Advisors have long turned to active management to gain fixed income exposure. Thus far in 2024, this has persisted due in part to macroeconomic uncertainty. There remains consensus that the Fed will cut interest rates but when and how aggressively is not clear.

VettaFi tracks Treasury yields and most of the macroeconomic data that Fed watchers are mindful of. We also regularly hear from advisors on their beliefs about rate cuts. While we do not provide our own forecasts, we know the right people to help us out.

On April 18, VettaFi will be hosting a Fixed Income Symposium. This three-hour event will feature experts from some of the leading asset managers. We will be discussing the timing of the Fed’s next moves, whether it is prudent to take on interest rate or credit risk, what bond sectors look most appealing, and more.

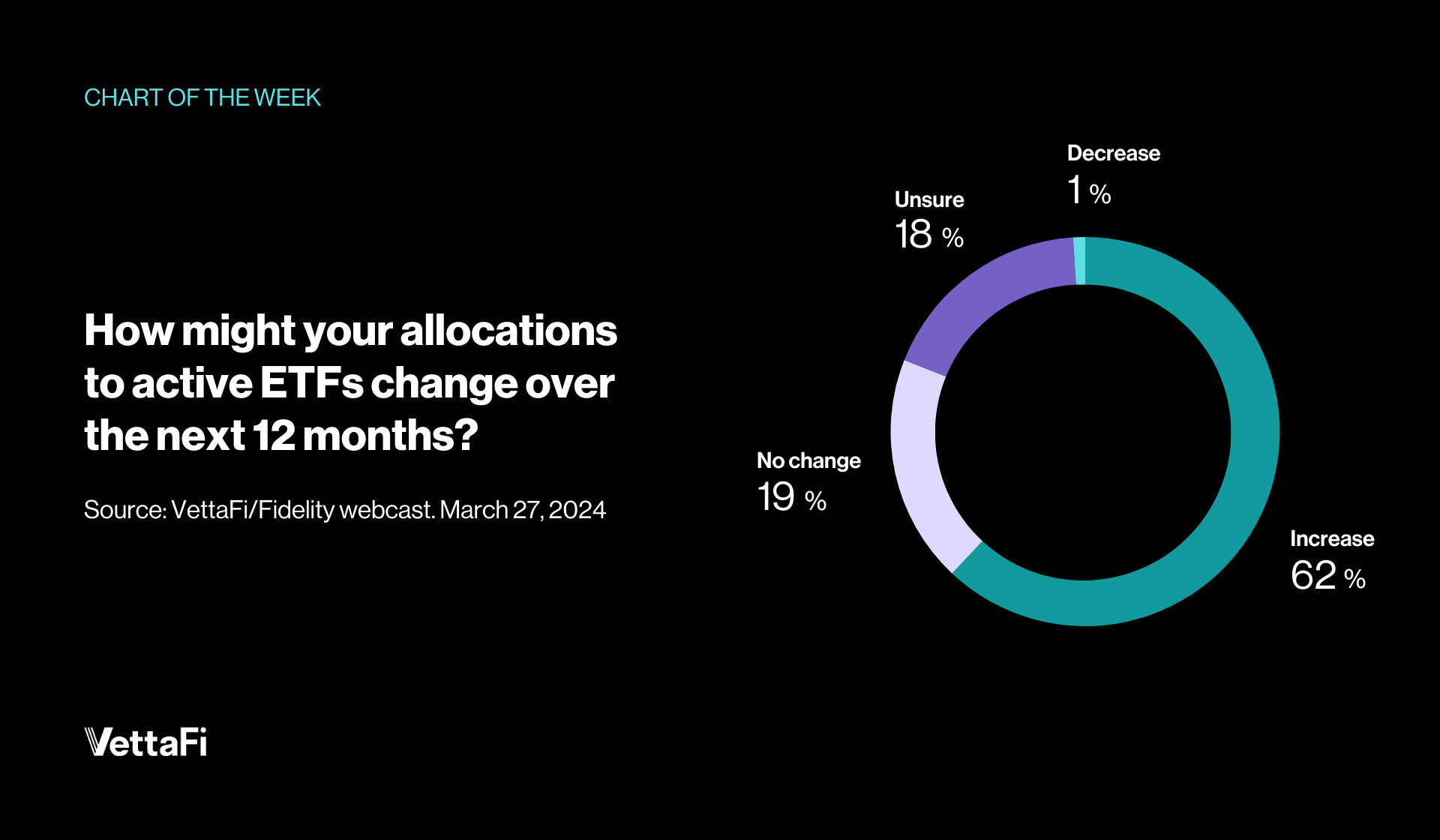

We are not alone in wanting to leverage active managers. During a late March webcast with Fidelity, we asked advisors a key question. “How might your allocation to active ETFs change over the next 12 months?” The majority (62%) responded with “increase”, while only 1% said “decrease”. The remainder were either unsure or did not expect to make changes in the next year.

Kicking Off the Symposium

The opening session of the Fixed Income event will feature active managers from ETF providers PIMCO and T. Rowe Price. Sonali Pier will be one of the speakers. Pier is a PIMCO managing director and portfolio manager focusing on multi-sector credit opportunities. One of the funds she co-manages is the PIMCO Multisector Bond Active ETF (PYLD). The $530 million fund is a best-ideas strategy seeking attractive risk-adjusted yield.

PYLD holdings include investment-grade and high-yield credit in addition to hefty exposure to securitized debt. Recently the fund’s yield was 5.7%. We plan to ask Pier about PIMCO’s views on Fed policy and where she and her colleagues see the best risk and reward opportunities.

Focusing on Short-Term Bonds

Joining Pier and VettaFi will be Alex Obaza, a portfolio manager for T. Rowe Price. Obaza is an executive vice president and runs the T. Rowe Price Ultra Short-Term Bond ETF (TBUX). The $130 million fund primarily invests in short-term corporate bonds and asset-based securities. The fund sports a 5.4% yield.

We also plan to ask Obaza for his views about the impact on potential rate cuts and why advisors should consider moving out of money market funds and into bond ETFs.

There will be other sessions throughout the day featuring active managers. For example, we will have Doug Longo of Dimensional Fund Advisors and Julian Potenza of Fidelity Investments. Longo and Potenza will talk about the short-term bond ETFs they manage and how the funds can potentially fit into a client’s portfolio. Managers from American Century, Capital Group, John Hancock, Panagram, and Touchstone will also be answering questions from VettaFi and advisors.

Join us on April 18 by registering for the Fixed Income Symposium, and learn from some leading asset managers.

For more news, information, and analysis, visit VettaFi | ETF Trends.