While 2023 was the year of Fed rate hikes, the fixed income market is expecting 2024 to be the year of rate cuts. At the December 2023 meeting, the Federal Reserve’s own guidance was for three 25 basis point reductions in 2024.

However, consensus estimates were for double the number of cuts. The market expectations coming into 2024 were for six rate cuts (150 basis points). The first one was expected in March. As economic data emerges, sentiment is shifting. We should hopefully get some more clarity when the Fed meets next week.

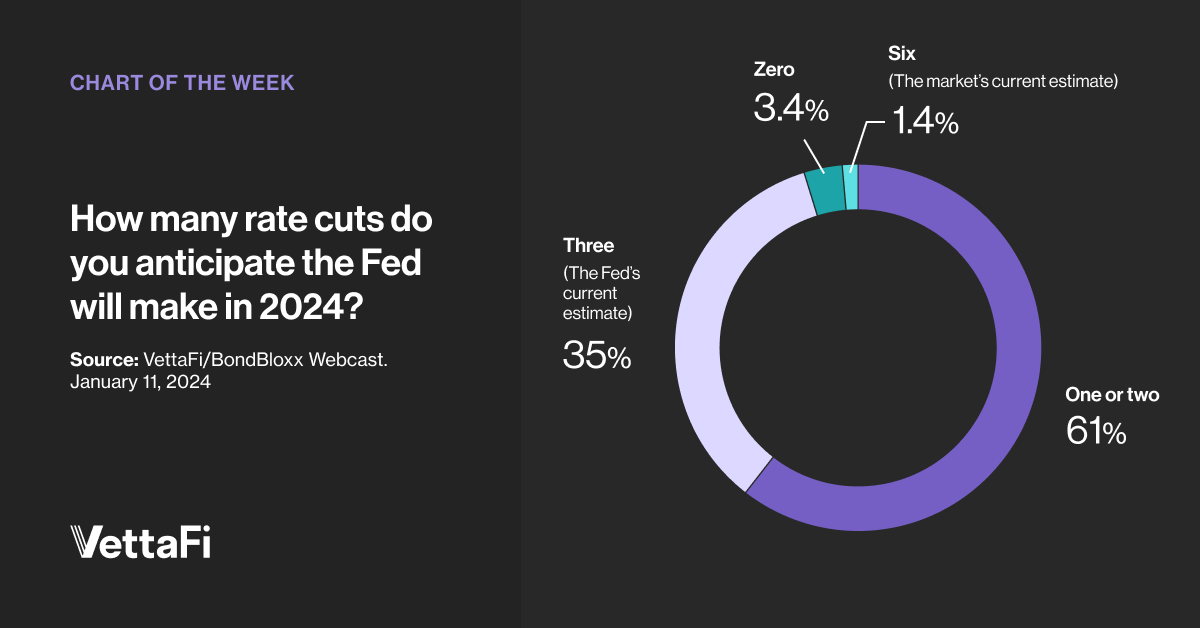

In mid-January, during a webcast with BondBloxx, VettaFi asked advisors, “How many rate cuts do you anticipate the Fed will make in 2024?” We listed the market’s current estimate and the Fed’s current estimate to provide some background information. However, most respondents (61%) forecast just one to two rate cuts. Meanwhile, just over a third (35%) believe three cuts are coming. The market’s current estimate was unpopular with this subset of advisors, as 1.4% of them agreed with the then-market’s estimate.

Intermediate-Term Bond ETFs in Demand

To start 2024, investment-grade bond ETFs have been popular. The iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) had net inflows of $4.6 billion year to date as of January 22. The fund has an average duration of approximately eight years and sports an SEC yield of 5.0%.

Meanwhile, in the first few weeks of 2024, the Vanguard Intermediate Term Corporate Bond ETF (VCIT) gathered an additional $2.0 billion. It had an average duration of 6.0 years. If the Fed cuts aggressively in 2024, LQD and VCIT would be beneficiaries.

Relooking at Short-Term Funds

However, advisors believing rates are more likely to hold steady in 2024 might prefer lower-risk alternatives. The iShares 1-5 Year Investment Grade Corporate Bond ETF (IGSB) also has a 5.0% yield, but is far less interest rate sensitive. IGSB has an average duration of 2.5 years and had approximately $100 million of net inflows to start 2024. Similarly, the Vanguard Short Term Corporate Bond ETF (VCSH) could see further demand. It pulled in more than $600 million in the first three weeks of 2024.

Is It Time for Active Management?

Actively managed fixed income ETFs have discretion on how much rate risk to take on. Managers can adjust the fund’s duration as new details on monetary policy emerge. However, you need to periodically check to make sure the exposure fits with your and your clients’ expectations.

For example, the PIMCO Active Bond ETF (BOND) had an average duration of 5.7 years as of the end of December. This was below the 6.2 years for the widely followed Bloomberg Aggregate Bond Index. BOND also has a 5.0% yield. The Capital Group Core Plus Income ETF (CGCP) is another example of an actively managed bond ETF taking on less interest rate risk. CGCP’s average duration was 5.6 years. The fund had a yield of 5.5% aided by some high yield exposure.

For more news, information, and strategy, visit the Fixed Income Channel.