When investors and advisors consider adding an ETF to their portfolios, a few key attributes stand out. Performance and cost matter, but so too does a strategy’s AUM. Strategies that surpass AUM milestones can sometimes receive new interest from investors looking for ETFs with sufficient liquidity. The active fixed income ETF TAGG, the T. Rowe Price QM U.S. Bond ETF, recently experienced such a milestone and may be worth a closer look.

TAGG added $65.9 million in ETF inflows over the last five days, according to VettaFi. Those inflows helped lift the strategy’s AUM above $100 million, a significant moment for the strategy that launched in 2021. So why might those new inflows have arrived now for TAGG?

The strategy’s active approach to investing across a wide range of debt offerings could be one reason. Active ETFs have picked up some notable interest this year from investors looking for adaptable strategies that lean on manager expertise to outperform simpler indexes. At the same time, with the Fed likely nearing the end of its rate hikes, renewed interest in investment great bonds may be growing.

See more: “So Far in 2023, Active ETFs Top Performance Charts”

Seeking to take advantage of some inherent flaws in fixed income indexing, this active fixed income ETF takes a total return approach while investing in intermediate- to long-term debt offerings. It considers areas including investment-grade corporate and government debt, agency obligations, mortgage-backed securities, and more. Its active approach uses quantitative models and fundamental research to select its bonds.

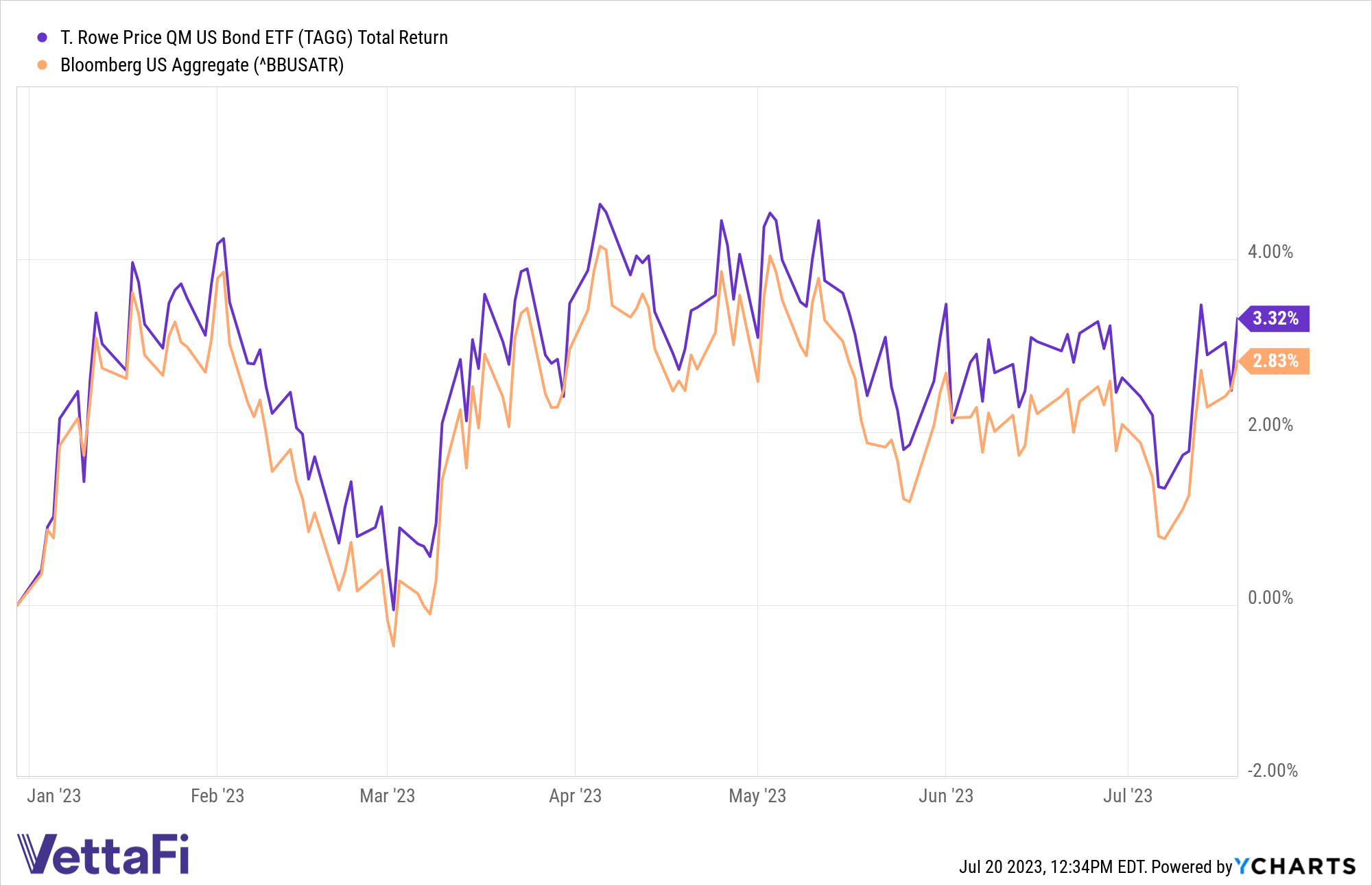

TAGG aims to outperform the Bloomberg U.S. Aggregate Bond Index, its benchmark, with a risk profile similar to the index itself. Charging just eight basis points (bps), competitive with many passive strategies, TAGG has outperformed the index on a YTD basis, returning 3.3% after fees. The index has returned 2.8% over the same time frame.

The active fixed income ETF TAGG has outperformed its benchmark index YTD.

Taken together, TAGG’s new milestone, extremely low active management fee, approach, and performance YTD may merit new attention. The active fixed income ETF hit a buy signal on Thursday, as well, with its price above both its 50- and 200-day simple moving averages (SMAs). For investors and advisors looking to lean on the growing interest in active investing and considering duration, keep an eye on TAGG in the months ahead as a possible replacement for core U.S. aggregate bond exposure.

For more news, information, and analysis, visit the Active ETF Channel.