In a market environment where careful optimism has dominated, how best should investors take advantage? The high-rate environment has tamped down the disruptive firms that did so well in past years. At the same time, the simple, passive funds sticking so close to the “Magnificent Seven” alone may miss out on other opportunities. An active growth ETF brings a broader remit that can seek opportunities other growth funds may miss.

See more: 3 Active ETFs Sending Buy Signals Right Now

The T. Rowe Price Growth Stock ETF (TGRW) may then appeal to investors. The active growth ETF charges 52 basis points (bps) for its approach. It seeks out firms with strong cash flows, above-average earnings growth, earnings momentum stability, and more.

That approach has helped it return 51% over one year, outperforming its ETF Database Category and FactSet Segment averages. Those averages returned 31% and 26.7%, respectively, much less than TGRW achieved in that time frame.

As an active growth ETF, T. Rowe Price brings its expertise and broad asset management resources to managing the strategy. That lets them adapt not only to events and changes in market outlooks but also empowers the ETF to overweight or underweight various stocks.

For example, currently, TGRW significantly underweights Tesla (TSLA) compared to a passive growth ETF like the iShares S&P 500 Growth ETF (IVW). IVW weights the up and down electric vehicle company at 2.36%. TGRW, by contrast, only weights it at 0.74%.

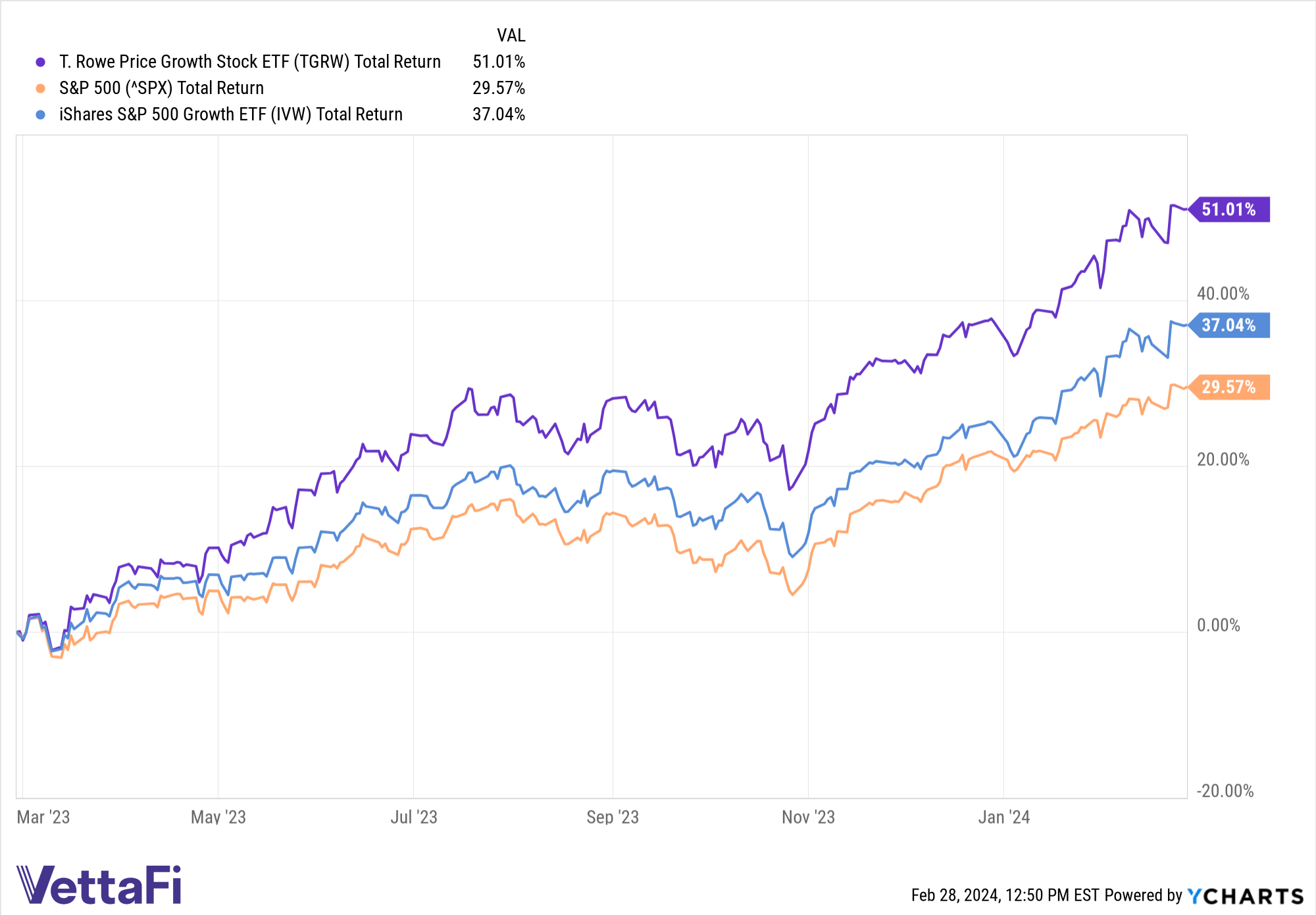

Per YCharts, TGRW has done well.

That may have contributed to TGRW’s outperformance, too. The strategy has significantly outperformed IVW over the last one-year period, per YCharts. TGRW has also outperformed the S&P 500 in that time, as demonstrated in the chart above.

Taken together, the ETF presents one notable option should rates fall or investor confidence grow. If the economy has truly pulled off a soft landing, a flexible strategy with a broader remit for growth could intrigue.

For more news, information, and analysis, visit the Active ETF Channel.