After large-cap value indexes outperformed growth peers in 2022, growth strategies have returned the favor in the first few months of 2023 as the macroeconomic and earnings pictures have shifted. Despite this, VettaFi’s advisor engagement data for April showed rising interest in large-cap value strategies from the prior month. Furthermore, many advisors told us they have boosted their value exposure this year.

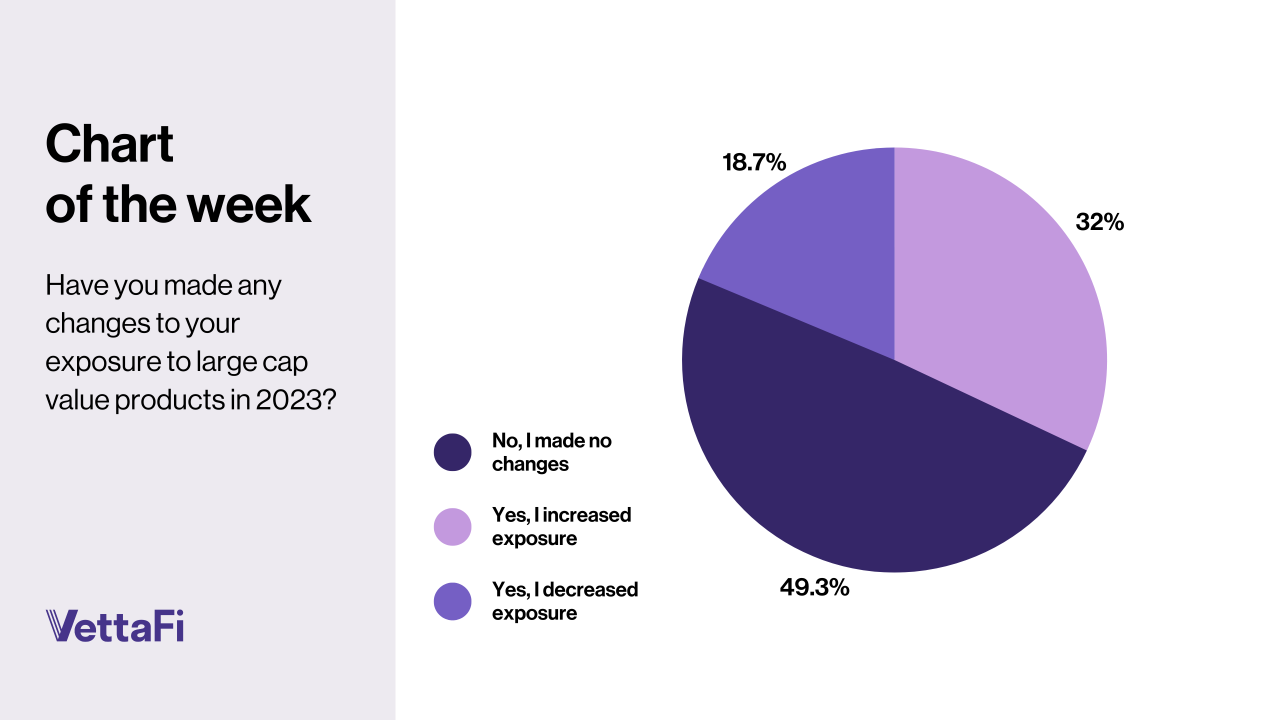

During an early May webcast with DFD Partners, VettaFi asked advisors, “Have you made any changes to your exposure to large-cap value products in 2023?” While nearly half of the respondents (49%) have not made an adjustment, more advisors said they had increased exposure (32%) than decreased exposure (19%).

32% of respondents said they had increased exposure to large cap value, compared to 19% who said they had decreased exposure.

We did not ask advisors for specifics on what large-cap value ETFs they purchased. However, there’s been some disparity in the 2023 flows to some of the historically popular funds.

Reminder to Look Inside Large-Cap Value ETFs

The Vanguard Value ETF (VTV) has been in demand in 2023, gathering $3.5 billion of new money and pushing its asset base up to $100 billion, despite the fund declining 0.9% year-to-date as of May 9. VTV’s top holdings include Berkshire Hathaway (BRK.B), Chevron (CVX), Exxon Mobil (XOM), JPMorgan (JPM), and Procter & Gamble (PG).

In contrast, the iShares S&P 500 Value ETF (IVE) and the SPDR Portfolio S&P 500 Value ETF (SPYV), which manage $24 billion and $15 billion, respectively, were up 5.3% to start the year. Nonetheless, these large-cap value ETFs had a combined $2.3 billion in net outflows. The relatively strong performance for the pair of ETFs that track the same index has been aided by having Amazon (AMZN), Microsoft (MSFT), and Meta Platforms (META) among their top holdings. Other top stocks include Berkshire Hathaway, JP Morgan, and Procter & Gamble.

Stocks that have historically often been found in growth index strategies shifted in late 2022 to S&P 500 Value index funds. Meanwhile, IVE and SPYV do not own Chevron and Exxon Mobil. This is because the energy heavyweights are considered growth stocks by the index provider.

See more: “Bull vs. Bear: Value Investing Status: It’s Complicated”

Meanwhile, the iShares Russell 1000 Value ETF (IWD), which manages $50 billion, had net outflows of $4.7 billion in the beginning of 2023. This still-popular large-cap value offering rose 0.8% year-to-date as of the end of last week. IWD owns Meta Platforms, but Chevron and Exxon Mobil join Berkshire Hathaway and JPMorgan among the top holdings.

Large-Cap Value ETFs Come in Active Packages Too

Asset managers and index providers do not always agree with one another on what is a “large-cap value” stock. As such, it is always important to know what’s inside an ETF.

The four large-cap value ETFs mentioned above are market cap-weighted and track an index. However, some advisors might want an active management approach to value investing. The American Century Focused Large Cap Value ETF (FLV) is one such active offering. FLV recently celebrated its three-year anniversary and was up 1.1% to start 2023.

The $230 million ETF held top-10 stakes in more moderately sized Duke Energy (DUK), Medtronic (MDT), and Raytheon Technologies (RTX), as well as mega-caps Berkshire Hathaway, Johnson & Johnson (JNJ), and Procter & Gamble. FLV pulled in just under $10 million thus far in 2023. While a modest amount, this stands in contrast to some index-based offerings that incurred large redemptions.

For more news, information, and analysis, visit the Core Strategies Channel.