Bull vs. Bear is a weekly feature where the VettaFi writers’ room takes opposite sides for a debate on controversial stocks, strategies, or market ideas — with plenty of discussion of ETF ideas to play either angle. For this edition of Bull vs. Bear, James Comtois and Karrie Gordon debate the investment case for value stocks in the current market environment.

James Comtois, staff writer, VettaFi: Greetings, Karrie! I’m contacting you from Dave’s Discount Warehouse, where I’m looking to fill my cart with some good deals on value stocks.

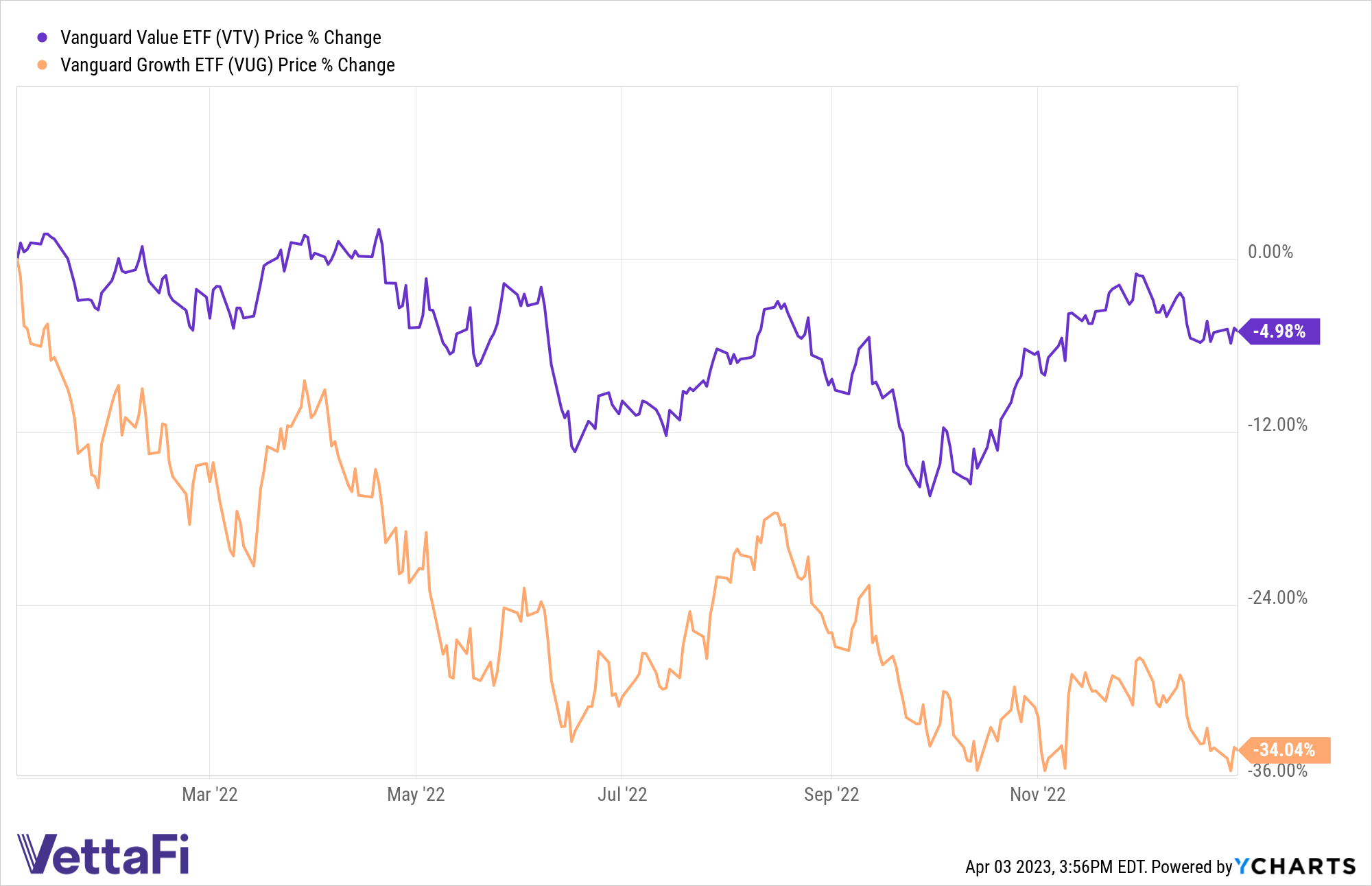

After growth stocks spent a decade eating value’s lunch, value is making a real comeback. Not only did U.S. value stocks outperform growth for the first time in over a decade last year — the MSCI World Value Index outperformed its growth counterpart by more than 20 percentage points. But the largest value-focused ETF, the Vanguard Value ETF (VTV), outperformed the largest growth ETF, the Vanguard Growth ETF (VUG), by 31 percentage points in 2022. That’s the largest outperformance of value over growth in more than 20 years.

So, while I’m here, is there anything you’d like me to pick up for you?

Karrie Gordon, staff writer, VettaFi: Hello again, James. It’s been a while! I really value your time chatting with me today about all the bear necessities of value investing and your offer to shop for me. I know value-focused ETFs have been having a heyday in the last year. That isn’t a surprise, given that value generally performs optimally before and at the beginning of recessions, but I think it’s worth digging into the complexity of value investing and why it may not be the best option for investors.

One of the most glaring issues with value investing is that, despite its popularity, there isn’t any kind of singular consensus on what makes a company a value buy or which metrics to measure to determine value. Even the major indexes use different metrics or weight their definitions of value differently. The S&P 500 Value Index measures value by book-value-to-price ratio, earnings-to-price ratio, and sales-to-price ratio and is a market-cap-weighted index full of large and mega-cap companies. The iShares S&P 500 Value ETF (IVE) offers exposure to the index, and top holdings include mega-caps Microsoft, Berkshire Hathaway, and Amazon. Unexpected, right?

On the other hand, another wildly popular value ETF, the Vanguard Value ETF (VTV), offers exposure to the CRSP U.S. Large Cap Value Index, which is also market-cap weighted, but measures value by book-to-price, forward earnings-to-price, historic-earnings-to-price, dividend-to-price, and sales-to-price ratio. You’ve also got funds like the Invesco S&P 500 Pure Value ETF (RPV) that use the same metrics as IVE but is factor weighted based on their value characteristics so that the strongest value stocks have the highest weight, with top holdings, including Paramount, Warner Bros, and General Motors.

To add complication to complexity, our head of research, Todd Rosenbluth, covered the S&P 500’s Style Index-based ETF rebalances that happened at the beginning of the year, with some major shake-ups for the value index that meant dropping long-time staples Exxon Mobil and Chevron (both moved over to the growth index). The S&P 500 Value index added Meta Platforms, Microsoft, and Amazon, making information technology the second-largest sector by exposure for the fund. Tech certainly isn’t something most people think of when they think of value. By many people’s definitions, these aren’t value companies. There’s a whole sidebar to be said here about how traditional value measurements fail to accurately capture intangibles and what that means for technology companies, but that’s a longer explanation for another time.

Comtois: Oh, I agree that not all value is created equal, and it does take a high degree of due diligence to find the right funds. Fortunately, that’s where active management can come in handy. For investors who need guidance on where the best values are, active value ETFs like the Cambiar Aggressive Value ETF (CAMX) or the T. Rowe Price Equity Income ETF (TEQI) may be worth looking into.

Value investing is also having a heyday in part to persistently high inflation and rising interest rates. An environment with higher inflation and higher interest rates has historically supported value stocks. While the Federal Reserve has done – and is doing – what it can to tamp down inflation, consumer prices are still persistently high and will continue to remain so for the foreseeable future.

The onshoring and so-called “nearshoring” of supply chains could mean we’re heading towards a new era in which inflation remains elevated for longer since deglobalization makes it more difficult for companies to reduce labor and raw material costs. If inflation stays high, there’s no reason that we shouldn’t take the Fed at its word that it will continue to raise rates to bring inflation down to 2%.

The Fed has just made its ninth consecutive rate hike, raising the target range for the federal funds rate to 4.75% and 5% (and the Fed may raise interest rates to nearly 6%). In higher rate environments, current earnings tend to become more valuable and future earnings less valuable, which benefits value stocks. While inflation is coming down, it’s unlikely that we’ll enter an environment of low-interest rates anytime soon.

Results of Chasing the Value Investing Trend

Gordon: It is the kind of environment that value investing traditionally thrives in, which makes understanding what value is even more important. But there are so many investing pitfalls for those less familiar who are looking to chase the value trend.

A common mistake for value managers and investors is to search for companies trading at a low price-to-earnings ratio, see opportunities in cheap stocks, and invest. This doesn’t take into account whether the fundamentals of a company are weak or strong. Companies with cheap valuations could be that way because of poor management, governance, poor growth or outlook, weak balance sheets, or more. It’s easy to get caught in a trap. Value investing requires not only a lot of due diligence but also experience in understanding the myriad risks that each security faces — risks such as regulatory, litigation, and social risk like ESG, as well as risks to the industry the company is part of, market risks, economic risks, and so on.

Value investing means betting big on a company currently being priced below its intrinsic value (however you want to define that — again, remember the lack of clear consensus on definitions from earlier) on the belief that, at some point, the market will correct in favor of that stock, or that company will be able to overcome their challenges. Understanding the challenges that a company faces now and could face in the future, and the metrics associated with the “win conditions” for investors, so to speak takes experience that right now the financial industry is short on, according to David Einhorn, founder and president of Greenlight Capital.

The long bull run of equities and growth in the 2010s wasn’t kind to value: over the last decade, the S&P 500 Value Index had a 10-year annualized return of 10.56% as of January compared to just the broad benchmark S&P 500’s annualized return of 14.35%. In a time of massive value underperformance due to the strong tilt towards growth in a zero and low-interest rate environment, many value managers, both in the U.S. and abroad, went out of business or chose to change their strategies in an unfavorable environment. With value booming and less experienced value managers at the helm now — some dealing with a high inflationary environment for the first time in their professional careers — the potential to fall into any number of value investing pitfalls is higher than ever, creating an added risk for advisors and investors.

A Lingering Potential Downturn

Comtois: I won’t deny there’s a risk. But there are ways to mitigate that. If you’re not wanting to go the active route, you can do your own diligence with fully transparent, passive funds. Many large-cap value funds have blue-chip stocks of companies that have been around for years and are likely to stick around.

But of course, there’s another reason to investigate the value of value stocks: that Sword of Damocles dangling over markets known as recession. Many analysts and industry observers agree that an economic downturn is the most likely scenario to unfold over the next few months. During a prolonged bear market, it may be a good idea to have a basket of value stocks for large, stable companies at bargain basement prices, which an ETF like the American Century STOXX U.S. Quality Value ETF (VALQ) can provide.

See Also: Bull vs. Bear: Go Active for Low-Volatility Equity Exposure

Gordon: I’m glad you brought up VALQ and factor investing, it leads me to my final point. Since we’re talking value broadly, I think it’s worth mentioning one of the evolutions that has happened within value investing and has gained popularity is something called value factor investing, which analyzes a company’s current stock prices against its intrinsic worth, measured by earnings quality, liquidity, and growth prospects. Value factor investing doesn’t typically require as much legwork as traditional value investing as it is more systematic in nature. It has become increasingly popular for the flexibility it offers and its perception of carrying less risk.

Value factor investing can be fragile to popularity, however. The more people that pile into value factor strategies, the more the premium diminishes. It’s something that value is susceptible to broadly as well, particularly as an exodus continues to happen from growth ETFs. If a significant amount of investors move out of growth and into value, they will alter the value premium. The iShares Russell 1000 Growth ETF (IWF) is currently down $4 billion YTD in net flows, while the Vanguard Value ETF (VTV) is up $3.2 billion YTD.

James, it’s been great chatting, but I think I’m going to have to pass on your particular selection of bargain bin sales this time. I’m too much of a bear to forget about the worries and strife in value investing. Instead, I’ll stick to funds like the iShares MSCI USA Quality Factor ETF (QUAL) for its focus on strong company fundamentals, demonstrated through stable earnings growth, low financial leverage, and high return on equity. FlexShares US Quality Low Vol ETF (QLV) is another fund to consider that shares many holdings in common with some of the largest value ETFs but invests for volatility. Given continued market volatility and the challenge for equities in a recessionary environment, QLV could be a good addition to an equity sleeve focusing on companies that exhibit stability, financial strength, and enhanced risk-return characteristics.

Comtois: Well, I appreciate you taking the time to talk with me about the value of value, Karrie. I totally get your skepticism about value investing. But I think that, with the cost of credit higher than it’s been in years, an economic downturn is seen as nearly inevitable, and many blue-chip stocks trading at great prices while several long-duration growth stocks face serious performance issues, now’s the time for value stocks to shine. Or, to put it more succinctly, inflation is high, a recession is nigh, and value stocks are fly.

For more news, information, and analysis, visit VettaFi | ETF Trends.