For many advisors, 2022 was likely the year they rediscovered the merits of value investing. The value style of index-based ETFs that favors stocks with relatively low price-to-earnings and price-to-book ratios significantly outperformed the growth style that prefers companies with strong sales and earnings growth records. Based on VettaFi’s survey data, the majority of advisors expect the value index style to remain in vogue in 2023, while growth investing is likely to be relatively out of favor. However, at the end of 2022, while many were on vacation, there was a major reminder to look inside an index ETF because passive does not mean static.

In late December, the S&P 500 Style Index-based ETFs underwent an annual rebalance and reconstitution process. In addition to scoring all S&P 500 constituents for three-year sales and earnings per share growth rates, the growth factor includes a 12-month price momentum metric. As a result of the annual review, what is now inside the broad growth and value style ETFs, as well as the pure growth and value ETFs tied to the S&P 500 Index, are significantly different from what they were a month ago.

The iShares S&P 500 Growth ETF (IVW) recently had approximately $30 billion in assets, the largest of the S&P 500 Growth-based ETFs ahead of products from iShares and State Street Global Advisors. Late last month, IVW added some mega-cap energy and healthcare companies historically seen as part of the value style, including top-10 holdings Chevron, Exxon Mobil, and UnitedHealth Group, while removing some previously prominent growth companies like Meta Platforms. Following the rebalance, Alphabet, Amazon.com, Apple and Microsoft remain in the growth ETF.

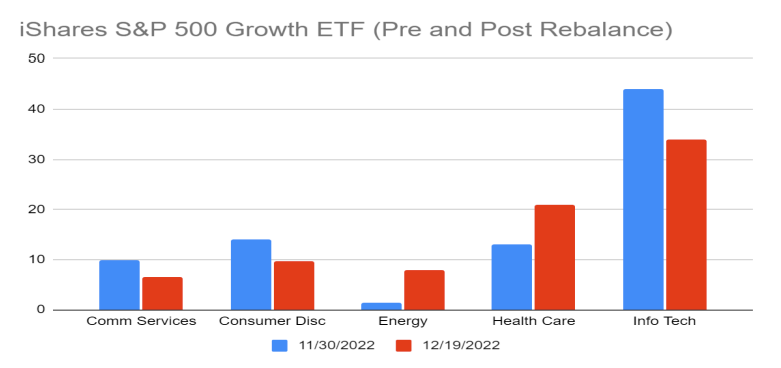

From a sector perspective, as shown below, exposure to energy (7.9% of assets post rebalance, up from 1.4% pre rebalance) and healthcare (21%, 13%) rose sharply. Meanwhile, stakes in the communications (6.6%, 9.8%), consumer discretionary (9.6%, 14%), and information technology sectors (34%, 44%) were slashed.

The inverse occurred for the iShares S&P 500 Value ETF (IVE), a $25 billion slow and steady version of the IVW race horse. Chevron and Exxon Mobil were sold out of IVE and replaced in the top-10 holdings with Amazon.com, Meta Platforms, and Microsoft; in the S&P-style indexes stocks can be both growth and value constituents if they score favorably.

From a sector perspective, information technology became IVE’s second largest sector (17% of assets post rebalance, up from 11% pre rebalance), behind financials (20%, 15%) while consumer discretionary also jumped (10%, 6%). Meanwhile, energy (1.6%, 8%) and healthcare (9.4%, 18%) shrunk notably. For many investors, energy companies have been the classic value companies, but their relative strength in 2022 made them less appealing compared to Bank of America, Cisco Systems, and JPMorgan.

While the index constituent changes directly impact ETF investors, there are broader implications as the S&P style benchmarks are used by some active managers for performance purposes and sector limitations. Value managers might be looking to Amazon.com and Microsoft, while growth managers might turn to energy companies rather than take on benchmark risk.

Amazon.com and Meta are not among the deepest value stocks in the S&P 500 Index, but many of their consumer discretionary and communication services peers now are holdings within the Invesco S&P 500 Pure Value ETF (RPV),which recently had $3.5 billion in assets.

RPV holds 88 of the most undervalued companies in the broader index according to S&P Dow Jones Indexes. The ETF’s weightings were boosted in late December for consumer discretionary (16% of assets post rebalance, 5.9%) and communications services (14%, 5.5%) sectors with the ETF now owning Dish Network, Ford Motor, General Motors, and Paramount Global among its largest positions. Meanwhile, exposure to energy, financials, and healthcare sectors were slashed.

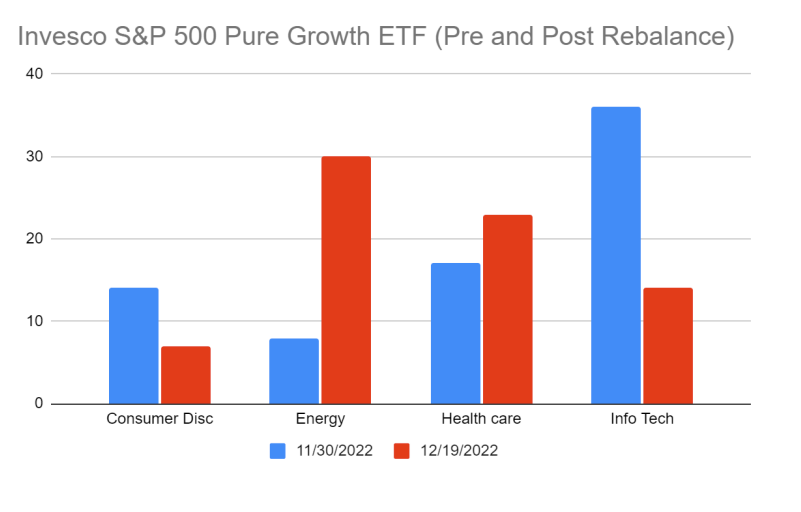

For those advisors seeking hefty exposure to energy and healthcare, the Invesco S&P 500 Pure Growth ETF (RPG) is now a surprising alternative as the $2.2 billion fund has more than half of its assets in the two sectors. With the addition of Chevron, Exxon Mobil, UnitedHealth Group and many others, the weightings climbed for the energy (30% of assets post rebalance, 8% pre rebalance) and healthcare (23%, 17%) sectors, while they fell sharply for information technology (14%, 36%) and consumer discretionary (7%, 14%).

If you came into 2023 looking to a value ETF to outperform growth once again like many advisor peers, make sure you look back under the hood because the securities inside a fund, not its past performance, are the drivers of future results.

If you came into 2023 looking to a value ETF to outperform growth once again like many advisor peers, make sure you look back under the hood because the securities inside a fund, not its past performance, are the drivers of future results.

For more news, information, and strategy, visit the Innovative ETFs Channel.