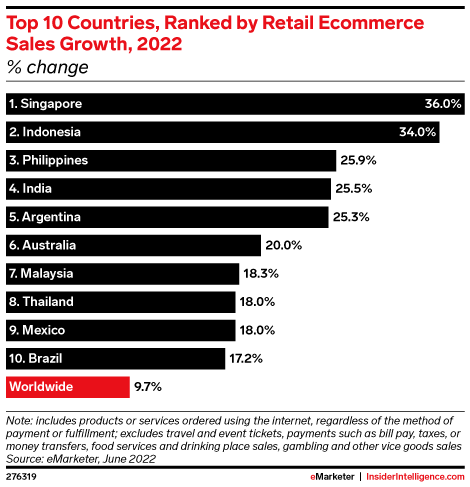

Southeast Asia is home to the three fastest-growing e-commerce markets in the world, with Latin American countries also among the top 10 markets, according to Insider Intelligence. Topping the list is Singapore, posting 36% digital sales growth this year. Meanwhile, Indonesia will see an increase of 34%, and the Philippines will see an increase of 25.9%. Coming in at number four is India at 25.5%.

Also among the fastest-growing e-commerce markets are Latin American countries, including Argentina (25.3%) and Brazil (17.2%).

The three largest countries on the list — India, Indonesia, and Brazil — will generate a combined “$230 billion in retail ecommerce sales this year, nearly double the rest of the top 10 combined,” said Insider Intelligence senior forecasting writer Ethan Cramer-Flood.

For investors looking to invest in the internet and e-commerce sectors within the developing world, EMQQ Global has a suite of emerging markets exchange traded funds that provide such exposure. These funds include the Emerging Markets Internet & Ecommerce ETF (NYSE Arca: EMQQ), the Next Frontier Internet & Ecommerce ETF (FMQQ), and the India Internet and Ecommerce ETF (NYSE Arca: INQQ).

“E-commerce growth in emerging markets remains as resilient as ever this year,” said Kevin T. Carter, founder and CIO of EMQQ Global. “Nine of the top 10 fastest e-commerce markets in the world in 2022 are major markets for EMQQ and FMQQ companies.”

By focusing on the internet and e-commerce in emerging markets, EMQQ looks to capture the growth and innovation happening in some of the largest and fastest-growing populations in the world. More than 60% of EMQQ’s assets are weighted toward China.

FMQQ, meanwhile, seeks to provide investment results that, before fees and expenses, generally correspond to the price and yield performance of the Next Frontier Internet and Ecommerce Index (FMQQetf.com). While it has the same investment philosophy as EMQQ, FMQQ has no China-based holdings. Securities must meet a minimum of a $300 million market cap and pass a liquidity screen that requires a $1 million average daily turnover.

Carter added: “It’s no surprise to see many of these countries in both Southeast Asia and Latin America. Two of our local champions in these markets, Sea Limited and Mercadolibre, continue to post impressive growth this year.”

Launched in April, INQQ intends to capitalize on India’s rapidly growing digital and e-commerce sectors. INQQ seeks to provide investment results that, before fees and expenses, generally correspond to the price and yield performance of the India Internet and Ecommerce Index.

“With penetration levels so low this year, this trend is likely to continue for the foreseeable future. And that’s one of the core things that make us excited for the long term,” Carter concluded.

For more news, information, and strategy, visit the Emerging Markets Channel.