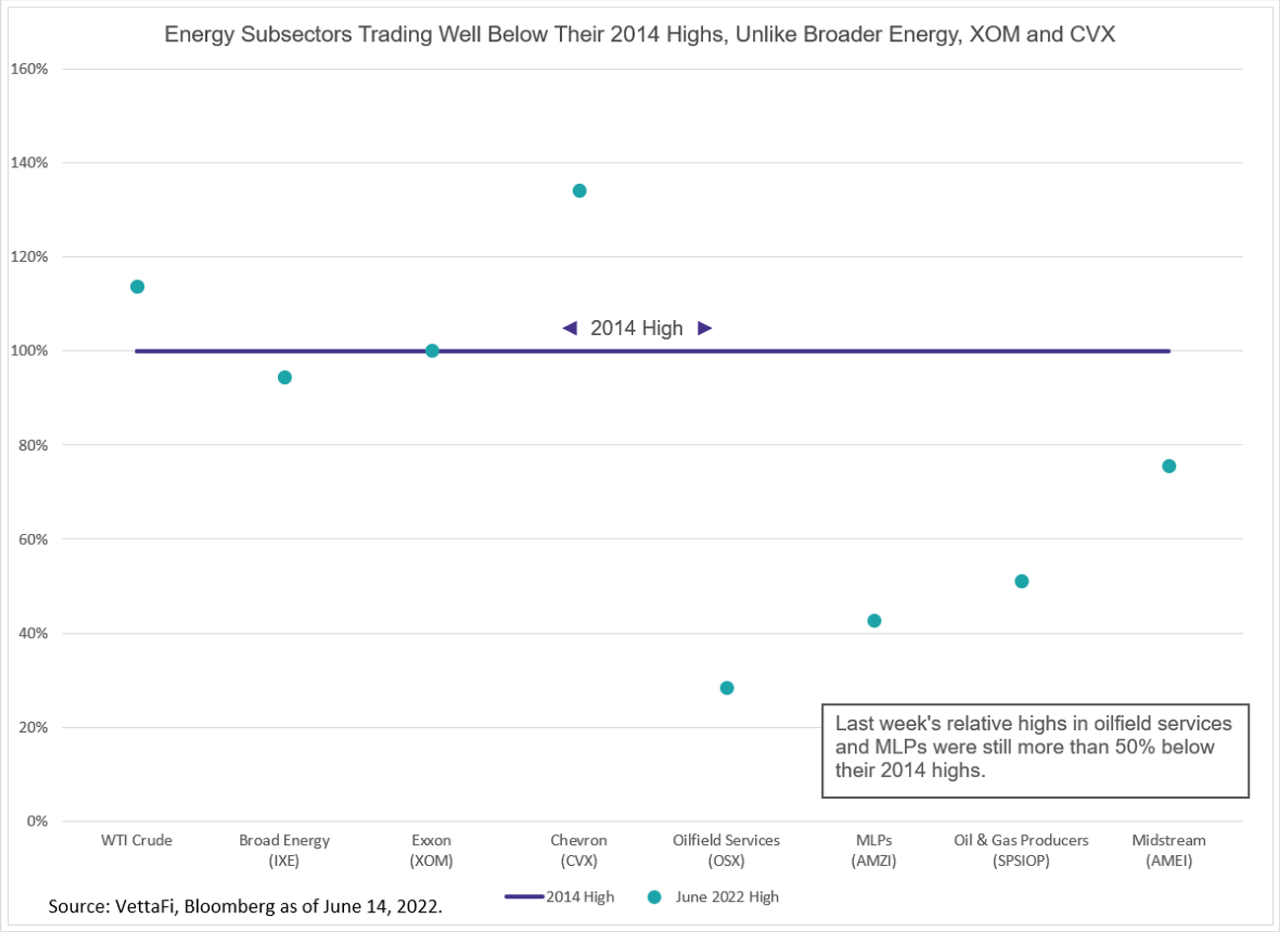

Earlier this month, Exxon’s (XOM) share price closed above $100 for the first time since 2014. That was also the same year that oil prices last saw $100 per barrel prior to the rally in recent months. Today, oil prices are well above their high watermark from June 2014, but the same is not true for energy subsectors.

The chart below compares June 2022 highs (blue dots) with 2014 highs, which are set at 100% (orange line). For example, the recent high for oilfield services represented only 28.4% of the sector’s June 2014 high. In other words, the oilfield services index was recently trading more than 70% below the high experienced in June 2014, even though oil prices today are higher than in 2014. At the other extreme, Chevron’s (CVX) recent high is more than 30% above its high notched in July 2014.

What Does This Chart Tell Investors?

Investors that have seen year-to-date gains in their energy holdings of 30%, 50%, or even more following a strong year in 2021 may be wondering if the space has run too far, too fast. For investors thinking about taking profits, this chart may provide helpful perspective. Recent price appreciation should be viewed in the context of several years of underperformance over the last decade.

Last week, broad energy, represented by the Energy Select Sector Index (IXE), was trading just shy of its high from 2014, while subsector indexes were not even close to their 2014 highs. Keep in mind that Exxon and Chevron represent approximately 23% and 20% of the IXE by weighting, respectively. Arguably, these names have disproportionately benefitted as investors adjust their portfolios to replicate energy’s greater weighting in broad market indexes — currently at 5.1% of the S&P 500 compared to 2.7% at year-end 2021. Additionally, these companies are benefitting from strong environments in both their upstream and downstream business lines. These factors have likely contributed to the strength in these names.

In short, energy investors, especially those with positions focused on certain subsectors like oilfield services, MLPs, or oil and gas producers should view last week’s relative highs in context. For those considering adding energy exposure, the pullback since June 8 may have created a compelling entry point.

For more on energy subsectors, please join our 30-minute LiveCast next week, or for more on allocating to energy, please see this note.

For more news, information, and strategy, visit the Energy Infrastructure Channel.