Summary

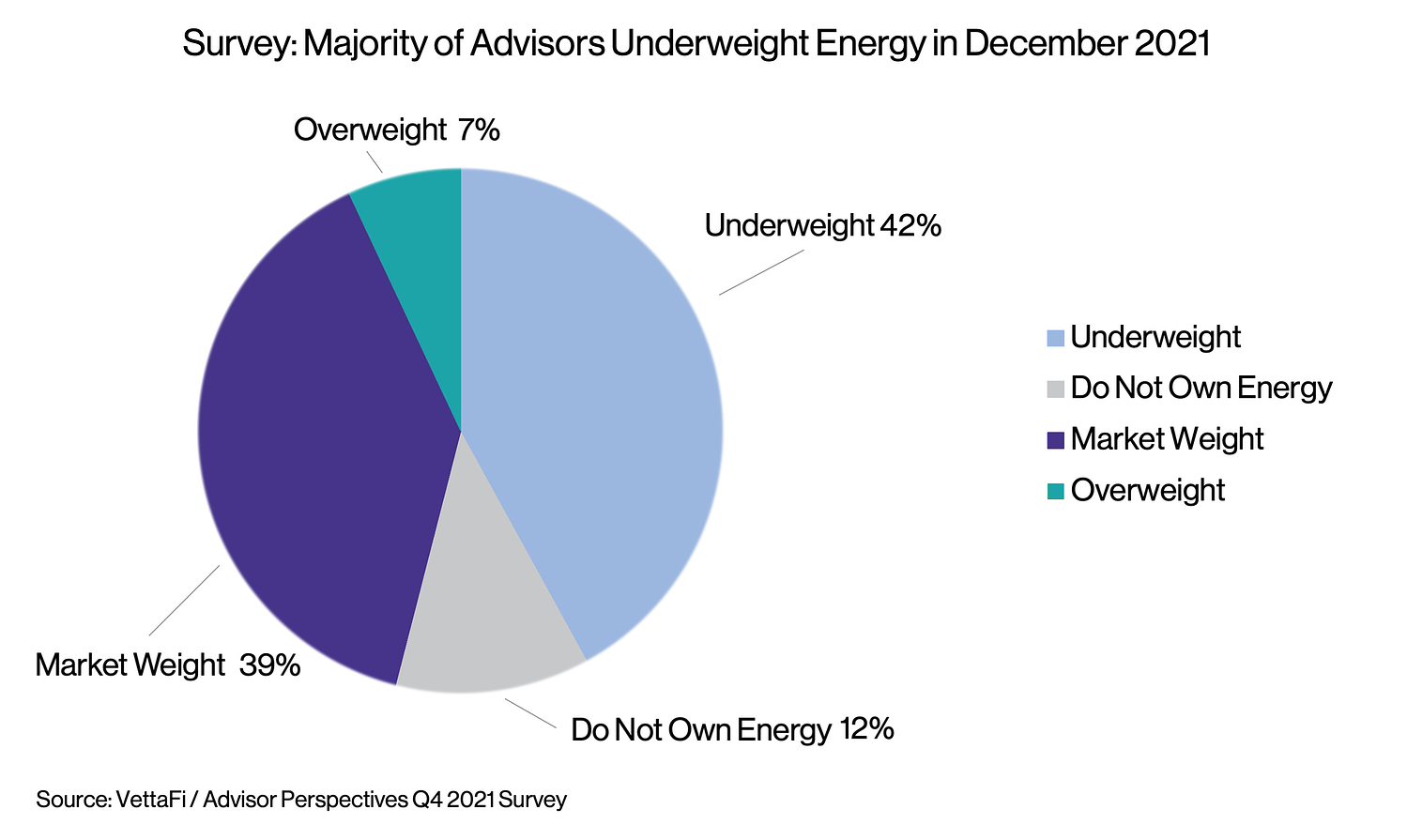

- For the energy sector, several years of underperformance over the last decade left many investors on the sidelines. In a survey of financial advisors in December 2021, more than half of the respondents were underweight energy.

- Investors that have been underweight energy may be looking to allocate more to the space given its attractive qualities in periods of high inflation and rising interest rates.

- For those looking to add energy exposure, their allocation can be tailored for their needs and expectations by tilting their energy portfolio toward certain subsectors.

With the volatility in markets, investors may be reexamining their portfolios and reconsidering certain allocations. For investors that rebalanced their portfolios at the end of 2021, much has changed in a relatively short timeframe. Russia’s invasion of Ukraine and the resulting implications were likely not on the radar for 2022 outlooks. Other concerns like inflation, rising rates, and supply chain issues were anticipated but may have played out differently than was expected. Amid the turmoil in markets, the energy sector has been a bright spot this year. Today’s note discusses why investors may need to revisit their energy exposure and how that exposure can be tailored to meet investor needs or preferences.

Investors were likely underweight energy going into 2022.

For the energy sector, several years of underperformance over the last decade left many investors on the sidelines. The strong performance in 2021 was still not enough to win over investors broadly. Late last year, we commissioned a third-party survey that included responses from over 600 financial advisors. Interestingly, more than half of the advisors surveyed were underweight energy or did not own the sector at all in December 2021. Energy was the best-performing sector last year, up 46.6% on a price-return basis, but it still only accounted for a measly 2.7% of the S&P 500 at year end, as the rest of the market continued to move higher. In other words, energy remained a very small portion of the broader equity market and easy to ignore.

Investors can arguably no longer ignore energy.

With the rise in commodity prices following Russia’s invasion of Ukraine and weakness in other sectors, energy has arguably ascended to a weighting in broad market indexes that makes it difficult to ignore. The Energy Select Sector Index (IXE) is up 46.4% on a price-return basis this year through May 20 compared to the -18.4% decline in the S&P 500 over the same timeframe. After the dust settled on a harrowing week for markets, energy was 4.8% of the S&P 500 by weighting as of May 20 – a significant improvement from 2.7% at year-end 2021. Investors that have been underweight energy may be looking to allocate more to the space for several reasons beyond replicating benchmarks. These could include the benefits of energy’s real asset and commodity exposure in an inflationary environment, the attractiveness of value-oriented sectors like energy in a rising interest rate environment, and the potential to use energy as a hedge for geopolitical risk. But not all energy investments are the same, and tailored exposure can be particularly beneficial in volatile markets.

How can I tailor energy exposures to meet certain objectives?

If an investor simply wants energy exposure to match the broader market, then it is easy enough to buy an energy sector fund or household energy names that tend to dominate sector benchmarks, like Exxon (XOM) and Chevron (CVX), at a weighting in line with the relevant benchmark. However, if an investor wants energy exposure more tailored to his or her views, preferences, or needs, then he or she should consider a broader menu of options and tilting the energy exposure to align with his or her objectives. That likely means giving a greater weighting to certain subsectors within an energy allocation. The examples below highlight different ways to gain energy exposure based on an investor’s views and preferences.

“I want energy exposure, but I’m concerned about a pullback in commodity prices.”

Investors who are worried about the potential for a recession or a pullback in oil and natural gas prices will probably prefer more defensive energy exposure like the integrated majors or midstream/MLPs. The majors tend to be defensive because of their size, diversification, and strong balance sheets, while midstream/MLPs are defensive by nature of their fee-based businesses (i.e. less exposure to commodity prices). For investors that have been avoiding energy, an allocation to midstream/MLPs or the majors could be a good way to dip their toes back into the energy sector with the potential for less volatility relative to other subsectors.

“I think oil prices are going to go even higher.”

Investors bullish on oil prices will likely want more exposure to oil producers or perhaps even direct exposure to the commodity. This can be achieved by investing in the stocks of oil producers or in investment products tracking oil. Relative to the majors or larger exploration and production companies, smaller oil producers are likely to provide greater upside as oil rallies but also come with greater risk. Smaller oilfield services companies can also be a higher beta way to express a bullish oil view.

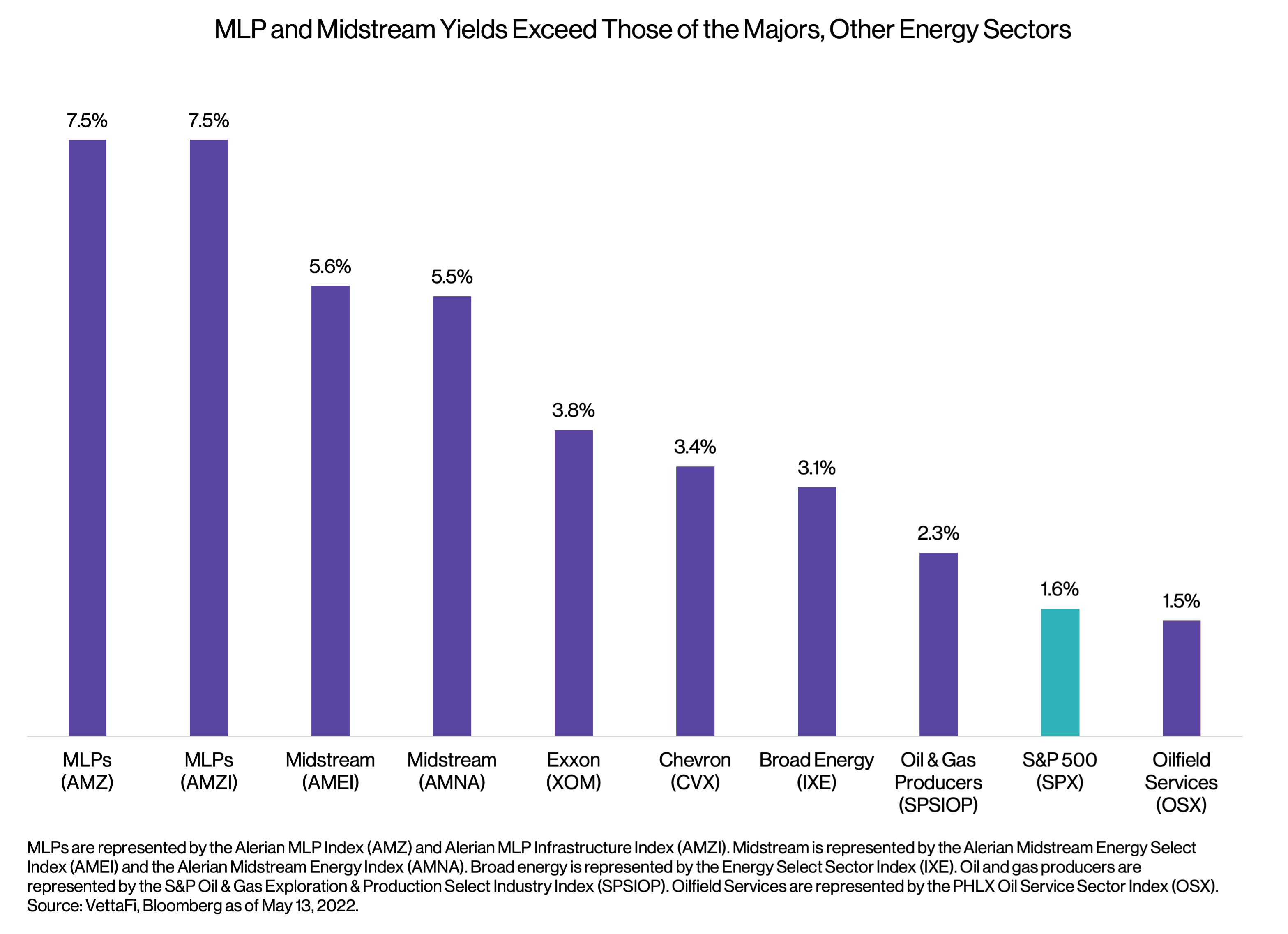

“I want energy exposure and income.”

The energy space broadly has been more focused on returning cash to shareholders through both regular and variable dividends (read more), and most energy allocations will probably offer yields that are above the broader market as shown below. Among energy investments, midstream/MLPs continue to offer the most generous yields. While energy infrastructure companies have a history of paying higher dividends given the fee-based nature of their businesses, the yield differences may also reflect the greater run-up in companies with more commodity exposure, which results in lower yields. For context, the MLP indexes below are up 16.4% on a price-return basis YTD through May 20, while the AMEI and AMNA indexes are up 18.2% and 20.9%, respectively.

“I’m primarily interested in using midstream or MLPs in an income portfolio.”

While midstream/MLPs provide more defensive energy exposure, many investors are primarily using the space for income. Depending on objectives and risk tolerance, a typical allocation to midstream/MLPs in an income portfolio may be around 5%. A higher income requirement and greater risk tolerance may result in an allocation of upwards of 10%. Investors primarily interested in tax-advantaged yield will likely favor MLPs or MLP-focused products, but investors desiring broad exposure to energy infrastructure will likely prefer exposure to both MLPs and corporations. Please see the “Related Research” section below for more information.

Bottom Line

Energy has been a relative bright spot in a very challenging market environment, but many investors may have been underweight energy going into 2022. For those looking to add energy exposure, their allocation could be tailored to their needs and expectations by tilting their energy portfolio in favor of certain subsectors.

AMZ is the underlying index for the JP Morgan Alerian MLP Index ETN (AMJ) and the ETRACS Quarterly Pay 1.5x Leveraged Alerian MLP Index ETN (MLPR). AMZI is the underlying index for the Alerian MLP ETF (AMLP) and the ETRACS Alerian MLP Infrastructure Index ETN Series B (MLPB). AMNA is the underlying index for the ETRACS Alerian Midstream Energy Index ETN (AMNA). AMEI is the underlying index for the Alerian Energy Infrastructure ETF (ENFR) and the ALPS Alerian Energy Infrastructure Portfolio (ALEFX).

Related Research:

Primer: Energy Infrastructure Investing

MLP ETFs and Finding the Right Fit for Your Portfolio Goals

Midstream and Oil Correlations: Is Frustration Warranted?

Inflation Worries? Not for Midstream/MLPs

For more news, information, and strategy, visit the Energy Infrastructure Channel.