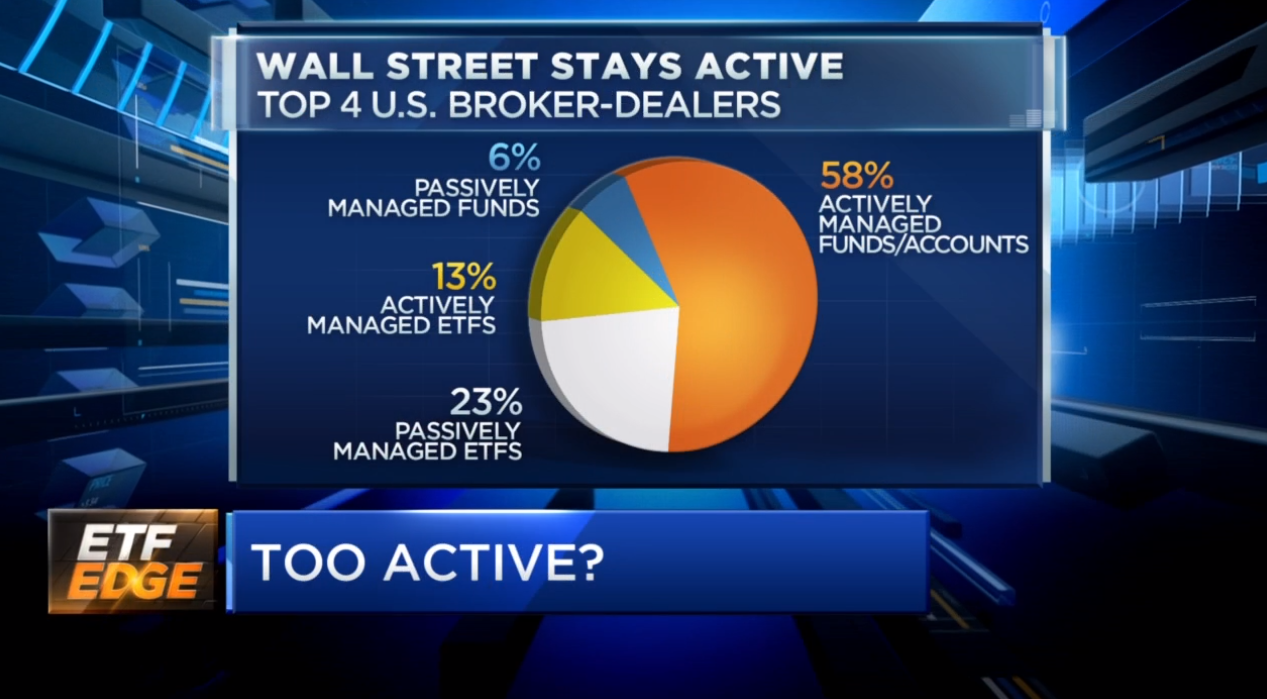

During CNBC’s ETF Edge on Monday, host Bob Pisani discussed a Wall Street Journal article citing a study showing brokers at four major Wall Street firms have just 29% of their clients’ managed-fund assets in passive index funds. This is well below the 45% passive rate for independent investment advisors.

As Pisani explains, it’s not too much of a surprise, as brokers have naturally wanted to show they can pick some active fund managers who outperform at this point. ETF Trends CEO Tom Lydon pointed out that the SPIVA (S&P Indices Versus Active) report that S&P puts out shows how more than 90% of active managers underperform over 10 years.

“When we’re talking about fees, performance has to be in that same dialogue,” Lydon states. “As we continue on, those advisors that tend to be in the wirehouse area that don’t have enough allocated towards passive, and have had higher fees, and most importantly, if they’re actually making 12B-1 fees, or they’re making other Commission’s that aren’t naturally disclosed in a more public way, there’s a lot of room for consolidation.”

The Late Adopters

Pisani then asks Bitwise’s Matt Hougan if Wall Street firms should be embracing passive investment more seriously than they have been. Hougan believes so, noting how it will happen, and those holding out are just the late adopters.

Hougan believes the number is going to move up from 29% to well over 50% in the next few years. With some thinking the indexes are now larger than active management that the game is over. It actually could be just starting, and people are going to continue to grow, and the wires are going to have to catch up quickly, or they’ll be left behind.

GTS Principal Reginald Browne chimed in about implications. He noted how fee compression will be seen across the board, particularly in active. However, he also thinks there’s always room for active management in asset allocation. It won’t totally go away, and a lot of those assets will be ported over into semi-active transparent ETFs being introduced sometime next year.

Related: Tom Lydon Talks Decisive Schwab Move In Race To Zero

“If my belief is that the pie is big enough for every type of incident to be utilized, it really comes down to price transparency and best advice for a client,” Browne continues. “So, if the advisor is still using an active strategy, it’s probably the best thing for his client, but single factor-beta ETFs, the cost is pretty inexpensive, and I think they’ll be adopted farther going forward.”

When questioned about how an actively managed ETF could help the active management industry, Browne explained how the winners will stay on top by continuing to deliver the best thing for the client. Mostly, however, it’s about the delivery of the model, and the ETF wrapper is going to become the investor choice utilization model.

Watch Tom Lydon And The Panel Discuss Active Management on CNBC:

For more market trends, visit ETF Trends.