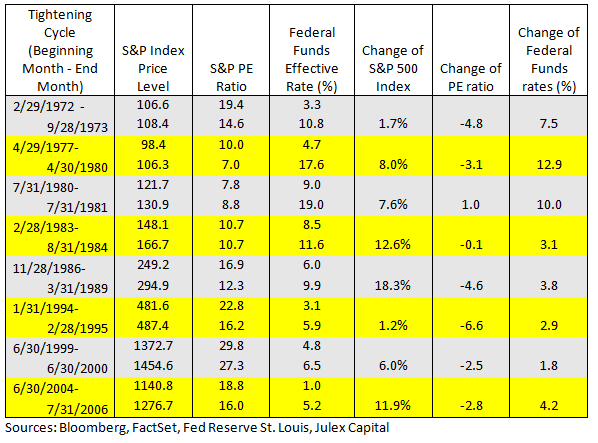

Table 1: Stock Market Performance During Fed Tightening Cycles

![]()

According to FactSet, as of February 9th, for Q4 2017, with 68% of the companies in the S&P 500 reporting earnings, 74% of the companies have beaten estimates. The blended earnings growth rate is 14.0%. All eleven sectors have positive earnings growth. The strong fundamentals and corporate earnings growth could have contributed to the quick market recovery this week. As of today (Feb. 16th), the stock market has recouped most of the losses from last week.

Taken as an individual factor, rising interest rates is a negative for stocks, but it is one of the many factors determining stock market performance. Economic fundamentals and corporate earnings play important roles as well.

Henry Ma is the President & CIO at Julex Capital Management, a participant in the ETF Strategist Channel.