Julex Capital

Articles by Julex Capital

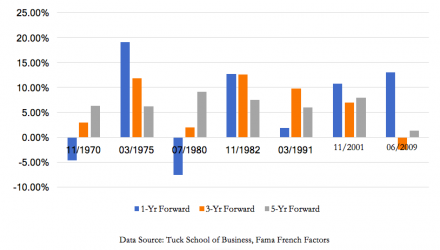

Eight Graphs to Show Why You Should Be Bearish on US Stocks

By Henry Ma, CIO, Julex Capital Management, LLC Weakening economic data, tightening monetary and liquidity conditions, elevated inflation, declining corporate…

Henry Ma, Ph.D., CFA. President and Chief Investment Officer

Dr. Ma has two decades of hands-on and leadership experience in investment management. Prior to founding Julex, he managed a global macro hedge fund with Geode Capital Management. Earlier, he served as Director of Quantitative Research and Financial Engineering with Loomis Sayles & Co., and Director of Quantitative Research and Risk Management with Fortis Investments, where he led quantitative research and risk management efforts. Dr. Ma also worked as Director of Fixed Income Strategies at Sun Life Financial, where he helped manage $30 billion in fixed income assets. His investment career began with John Hancock Financial Services as a Senior Associate Investment Officer. Dr. Ma is a published author and an industry speaker on quantitative investing and risk management. He earned a Bachelor and a Master in Economics and Management from Peking University and a Ph.D. in Economics from Boston University.

Jeffrey MegarCFA, Managing Director

Jeff brings over 25 years of investment management experience to Julex Capital, predominately as an institutional portfolio manager. Prior to joining Julex, Jeff worked briefly at F-Squared Investments. Previously, he had portfolio management oversight of a high yield bond mutual fund and institutional strategies at State Street Global Advisors where he was a Vice President and Senior Portfolio Manager.Prior to State Street, Jeff was a Senior Portfolio Manager at Fortis Investments where he helped establish Fortis’ structured credit business, launching the firms inaugural Collateralized Loan Obligation (CLO). While at Fortis, he established a comprehensive investment and credit review process and managed the firms Leveraged Loan platform. Before Fortis, Jeff held various credit position at CypressTree Investment Management and Prospect Street Investments. He received is BA in Economics from Framingham State University and his MBA in Financial Management from Northeastern University. In addition he holds the Charted Financial Analyst designation.

Liam FlahertyOperations and Trading

Liam joins the team at Julex after graduating from nearby Babson College with a BS in Business Administration and a dual concentration in Computational Finance and Quantitative Methods. While at Babson, he studied topics such as the Options and Futures Market, the function of various fixed income instruments, how to perform financial simulation and run time series forecasts, and how to value risky securities. In addition, he was able to pursue of a wide range of interests, both pure and applied, in mathematics and statistics disciplines. Most notably, he presented his independent research on “The Applications of Linear Algebra to the Optimization of Baseball Strategy” at the New England Symposium of Statistics in Sports in 2017. Prior to joining Julex, Liam worked as a contractor for MFS Investments on their Offshore Fund Treasury Team, and as an intern for MassMutual on their Trading and Valuation Teams.

Bo Wang, Ph.D.Research

Dr. Wang joined Julex after he received his Ph.D. in Economics from Boston College (BC), and MS in Quantitative Economics, BS in economics and mathematics (double major) from Renmin University of China (RUC). Bo has a strong background in quantitative economics and finance and broad interests in mathematical fields like abstract algebra, topology, numerical computation, and stochastic differential equation. During his graduate studies at BC, Bo devoted himself to the dynamic copula modelling techniques. His dissertation focuses on the semiparametric copula estimation and structural break test. His recent work “Copula-based time series with filtered non-stationarity” has been published in the Journal of Econometrics (2020). Also, Bo has passed the CFA exam level III and FRM exam level I.