Hello, VettaFi Voices! The Wall Street Journal mentioned today that the 10-year Treasury yield is the highest it’s been since 2007 as we head into another earnings season. Rates are on everyone’s mind. They’ve risen from essentially zero to over 5% in less than two years. But even though mortgage rates continue to rise, housing prices are still high. And today we learned that September’s inflation rate came in higher than expected. There’s likely another rate hike coming along before the end of the year. We don’t have any investments banks collapsing yet, at least.

Should investors be positioning themselves in a similar way to what would have worked best during the 2008 crash? If not, how should they be adjusting their portfolios, if at all? Is a soft landing still possible? Is the Fed’s rate-hiking regime doing what it’s supposed to do?

Todd Rosenbluth, VettaFi Director of Research: It’s not at all as bad as you think it is. CPI “spiked” to 3.7%, ahead of the 3.6% that I believe was expected. As I type this at 10:06 a.m. ET, the yield on the 10-year bond was up 4 basis points on the day at 4.64%, still slightly off the highs of close to 4.8% about a week ago. The stock market seems to be relatively calm for now, with the index behind SPY down 20 basis points in the first hour of trading.

Flight to Safety Helping to Stabilize Rates?

It seems possible that the spike in bond yields, in a flight to safety, has done the work the Fed might have done in raising rates one final time in a couple of weeks. But the flows have been very defensive. In fixed income, in the past week, the ultra short index-based ETFs, the SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) and the iShares Short Treasury Bond ETF (SHV), led the pack, followed by the actively managed ultra short PIMCO Enhanced Short Maturity Active ETF (MINT).

Higher credit risk and/or longer duration ETFs like the iShares iBoxx $ High Yield Corporate Bond ETF (HYG), the iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB), and the SPDR Bloomberg High Yield Bond ETF (JNK) have seen strong net outflows. Money is in motion and advisors have lots of questions. This is why I’m excited to have experts join me on October 27 for the VettaFi Income Strategy Symposium.

We have confirmed speakers from Amplify, Capital Group, Fidelity, Goldman Sachs, and T. Rowe Price joining us. We will be talking about whether taking on credit risk is warranted; the benefits of active management, what income alternatives exist outside of bonds, like covered call strategies, closed end funds, etc. Funds like the Amplify CWP Enhanced Dividend Income ETF (DIVO), the Capital Group Core Plus Income ETF (CGCP), the Fidelity Total Bond ETF (FBND), and the T. Rowe Price U.S. High Yield ETF (THYF) are likely to be referenced.

While we VettaFi Voices have some answers, these professionals are focusing on just this topic. So the virtual event will be a must-attend two hours.

Floating Rate Bonds Get Attention

Jane Edmondson, VettaFi Head of Thematic Strategy: Floating rate bonds have seen positive interest in the uncertain rate environment. This includes funds like the Invesco Senior Loan ETF (BKLN) and the PIMCO Senior Loan Active Exchange-Traded Fund (LONZ) for senior bank loans, and funds like the SPDR Bloomberg Investment Grade Floating Rate ETF (FLRN) and the iShares Floating Rate Bond ETF (FLOT). Is there flows data to substantiate that movement?

Rosenbluth: BKLN saw over $500 million in net inflows in the last three months but slight outflows thus far in October. FLOT, which is investment-grade-focused as opposed to BKLN, which has more credit risk, pulled in $200 million in the last three months. From a performance standpoint, senior loan ETFs like the Franklin Senior Loan ETF (FLBL) and LONZ are among the top-10 best-performing fixed income ETFs in 2023. Protecting against higher rates can certainly make sense if you are as fearful as Heather is.

Heather Bell, VettaFi Managing Editor: I’m not fearful! I just want to retire before I’m 80.

Zeno Mercer, VettaFi Senior Research Analyst: Persistent inflation and rates continuing to rise (or maintain) coupled with rising debt levels (including student loans) would make it prudent to avoid areas with higher consumer-focus in the near term. People are stretched thin, and savings are eroding.

The savings rate last notched at 3.9% below the long-term average of 8.8%. More exposure to less-impacted (non-onsumer) areas feels appropriate right now. This would even mean, in my opinion, potential and continued impact to even some larger names like Apple, which is also facing some hurdles in China for numerous reasons.

AI Spending Likely to Continue for Now

Given what we’ve seen so far with layoffs coming simultaneously as Big Tech increases exposure and investment in AI, we think that trend will persist. There likely won’t be a slowdown in AI ecosystem spending anytime soon at the enterprise or government levels.

Speaking of government, there are a lot of earmarked funds backing into big projects from the Chips and Science Act, the Inflation Reduction Act, and infrastructure bills, which are really going to start ramping up in 2024 and beyond. Call me a techno-optimist, but I do think we can ease inflation with increased deployment of AI, especially at the government level and in healthcare administration. Healthcare costs have been soaring for decades, including and especially premiums for households. CPI has been criticized for underweighting healthcare spend.

Admittedly, I don’t focus much at all on fixed income markets other than monitoring debt levels and downstream exposure/impact for the index constituents.

Closing thought — and not an explicit endorsement — but you know what came out of the 2008 financial crisis? Bitcoin.

Edmondson: The Simplify Interest Rate Hedge ETF (PFIX) is having another great year, up 38% YTD. It’s probably too late to hedge rates at this point, but who knows? Higher for longer, but how much higher?

Convertibles are the other hot area due to all the new issuance. Calamos just launched the Calamos Convertible Equity Alternative ETF (CVRT).

Digging Into the Economic Data on Rates

Rosenbluth: Yes, they just recently launched an active ETF that I covered recently. The Calamos ETF is actively focused on the equity side, and CVRT is different from the iShares Convertible Bond ETF (ICVT) and the SPDR Bloomberg Convertible Securities ETF (CWB) that are index based.

I’m leveraging some of the great work Jen Nash, VettaFi’s economic and market research analyst, is doing on our Advisor Perspective website.

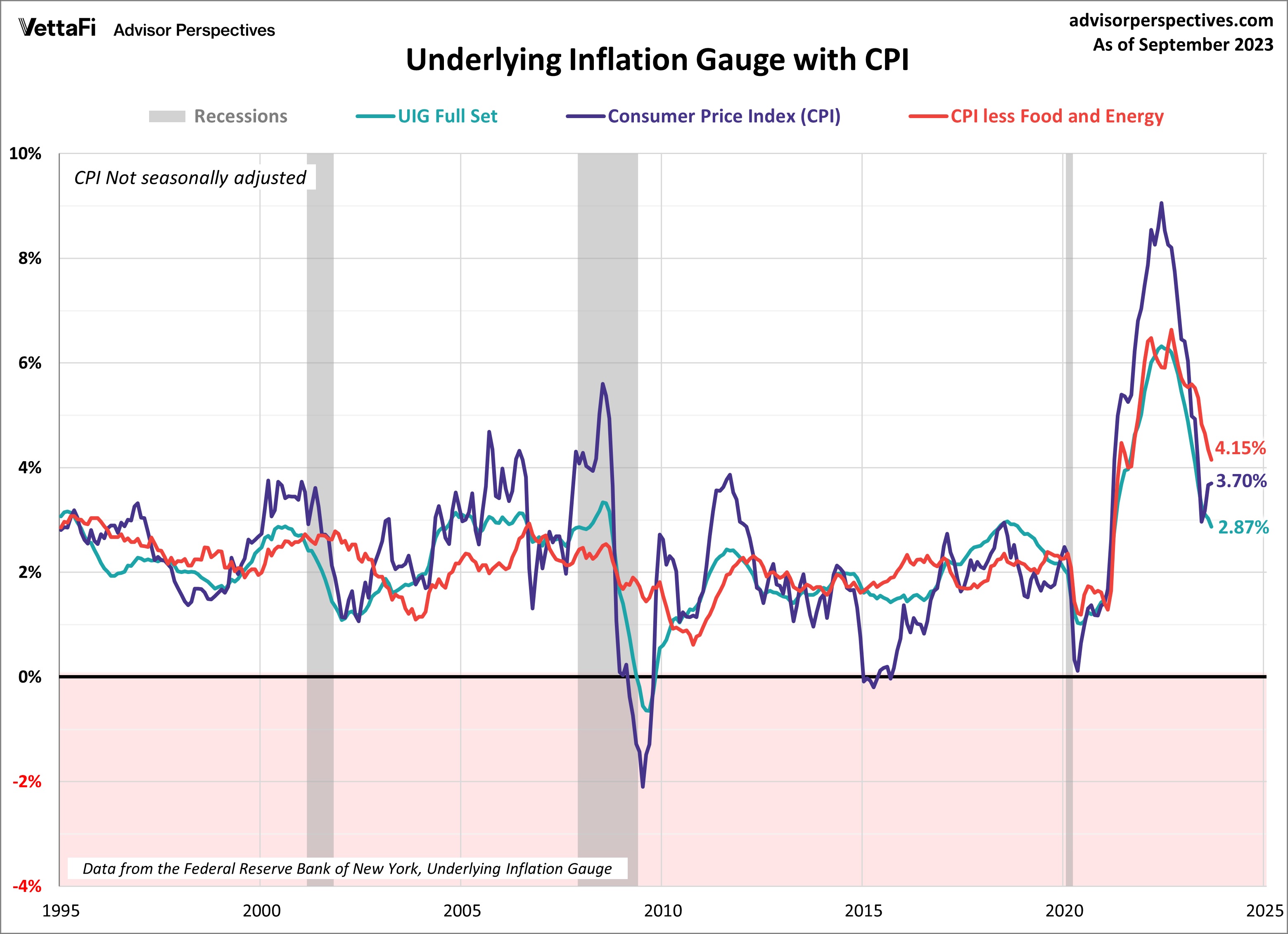

Headline inflation was unchanged in September, while core inflation continued to cool. According to the Bureau of Labor Statistics, the headline figure for the Consumer Price Index held steady at 3.7% year over year, which was slightly higher than the expected 3.6% annual increase. The core CPI reading was consistent with expectations at 4.1%, a slowdown from 4.3% in August.

The index for shelter was the largest contributor to the monthly “all items” increase, accounting for over half of the increase. An increase in the gasoline index was also a major contributor to the all items’ monthly rise. While the major energy component indexes were mixed in September, the energy index rose 1.5% over the month. The food index increased 0.2% in September, as it did in the previous two months. The index for food at home increased 0.1% over the month, while the index for food away from home rose 0.4%.

She also wrote: “One thing we can be certain about is this: Inflation volatility has a painful effect on lower-income households, those on fixed incomes, those with higher ratios of tuition, transportation, or medical costs … and all households whose discretionary spending is more dream than reality.”

A Consumer Perspective

Roxanna Islam Swan, VettaFi Associate Director of Research: I think it’s important to remember that retail investors are also consumers. So if the consumer is feeling their wallet stretch, that means retail investors are maybe looking at less money to invest and they’re going to be more cautious with what they invest in. Maybe they’ll look for some additional income through investments.

I ironically wrote a note on ETFs of closed-end funds this week. It’s not a traditional space many generalist investors/advisors look at, and returns have been up due to their use of leverage/higher borrowing costs. If you are interested in the space, ETFs of CEFs may help you gain some stability in distributions compared to individual fund selection with the potential of recovering returns when the rate environment recovers. The caveat is these tend to be volatile due to the premium/discount mechanism (but less so when packaged as ETFs). As I mentioned, they’re maybe not for all investors but still interesting to take a look at it if your primary objective is to find a stable income stream.

I think among equities, investors have already started to position themselves as more risk averse. There’s obviously still excitement left for large-cap tech/MAANG stocks and other AI-related investments. However, on a sector basis, things are starting to change. If you look at sector flows YTD, you have communications, tech, and consumer discretionary sector ETFs among the top five. But one-month flows show energy, utilities, and consumer staples in the top. The shift from consumer discretionary to consumer staples points to a risk-averse investor.

A Shift in Progress

Edmondson: It’s the shift from services to goods — I get it. The rise in gas prices and housing hurts. The irony is that rising housing costs is Fed-induced thanks to higher mortgage rates, which undermine supply and demand dynamics.

Swan: You mean goods to services, right? Services spending is still pretty strong. It’s what’s keeping the discretionary sector afloat when you look at the ETF holdings. From a broader consumer spending basis, it’s evident too. Real PCE is flat for clothing and down 10% for jewelry YTD. But things like spectator sports are up 10% YTD, while other live entertainment is up 23%.

So I think those higher rates have been getting consumers to switch to discount shopping like Costco (which had a good earnings beat recently) and also away from luxury goods (which were a hot topic in 1H23 but now losing some steam), but people are still spending on entertainment when they want to… for now.

Edmondson: Consumer discretionary (services) and consumer staples (goods) I think it will start to shift.

Islam: Yes, I agree! But certain consumer discretionary goods like apparel, retail, and leisure products –particularly higher-end ones — are growing out of favor.

I think it’s two separate things, personally. Within consumer discretionary, there’s a shift from discretionary goods to discretionary services, which has more to do with the way consumers are spending their money. But from an investment perspective, you would see more flows from investors into broad sector staples ETFs and out of broad discretionary ETFs when investors are more risk averse since staples tend to be less cyclical. It could also just be a trading tactic for those that see discretionary as overvalued.

For more news, information, and analysis, visit VettaFi | ETF Trends.