Closed-end funds typically appeal to a niche group of income investors. But when you package these into ETFs, you have the potential to do two things: 1) attract new investors and 2) create a core holding for CEF investors. (In a previous note, I discussed and compared the five ETFs of CEFs in detail.)

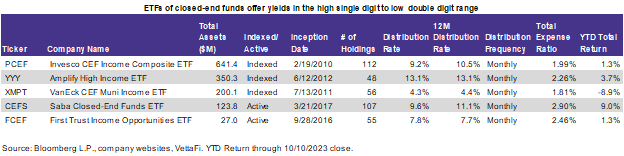

Compared to other large income-generating ETFs like the Alerian MLP ETF (AMLP), the iShares Core US REIT ETF (USRT), and the iShares iBoxx High Yield Corporate Bond ETF (HYG), closed-end fund ETFs like the Invesco CEF Income Composite ETF (PCEF) actually have much higher distribution rates with the caveat that closed-end funds can be more volatile due to their premium/discount mechanism. But will investors — who are now growing more cautious in the current economic environment — invest in closed-end funds versus relatively safer fixed income instruments? This note looks at ETFs of closed-end funds and some of their advantages.

The interest rate environment has put many CEFs out of favor this year.

Closed-end funds have grown out of favor this year due to rising rates. As the cost of borrowing increases, it becomes harder for both consumers and corporations to borrow money. A majority of CEFs use leverage to magnify their returns. So expenses have been extremely high and have eaten into returns. Many funds had to cut their distributions and suffered from widening discounts. But for short-term market fluctuations (which this environment hopefully is), some closed-end funds may be more well-positioned than others to maintain distributions until returns start improving. But this can be difficult to assess even for experienced closed-end fund investors.

ETFs provide diversification benefits for closed-end funds.

In an uncertain environment, I believe both passive and active ETFs can provide benefits over individual security selection. Passive closed-end fund ETFs offer the benefits of diversification. This is mostly through softening effects of distribution cuts and providing a stable distribution stream though market downturns. Active closed-end fund ETFs may also offer higher distributions. Experienced fund managers may be better at selecting closed-end funds — also providing a higher and stable distribution stream.

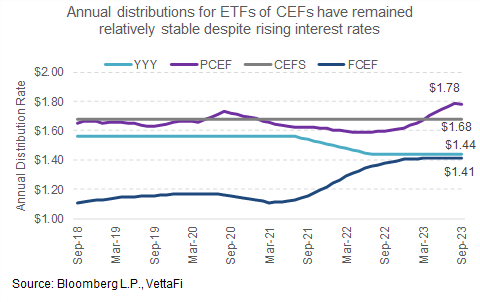

For example, PCEF is as passive ETF that represents the taxable closed-end fund universe. The ETF pays dividends based on its underlying holdings, so the biggest benefit of an ETF like PCEF is diversification. Many of its top 10 holdings have cut their distributions over the past year. In fact, several Blackrock funds cut their distributions under their managed distribution plans effective October and several Eaton Vance funds cut their distributions in late 2022. PCEF’s distribution in absolute dollars has remained relatively stable over the past couple of years.

Most of the other closed-end fund ETFs have their own managed distribution plan. Meaning, they have also been able to pay out a consistent distribution stream. While total return has diminished, there are opportunities to increase return when the market improves. Because closed-end funds are typically used to provide a stable income stream, total return may be less important in the short-term relative to the long-term.

The chart below shows the annual distributions for four of the five ETFs of closed-end funds (all except the municipal closed-end fund ETF). These ETFs have either maintained or grown their annual distributions over the past two years.

For more news, information, and analysis, visit the Innovative ETFs Channel.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for AMLP and PCEF, for which it receives an index licensing fee. However, AMLP and PCEF are not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of AMLP and PCEF.