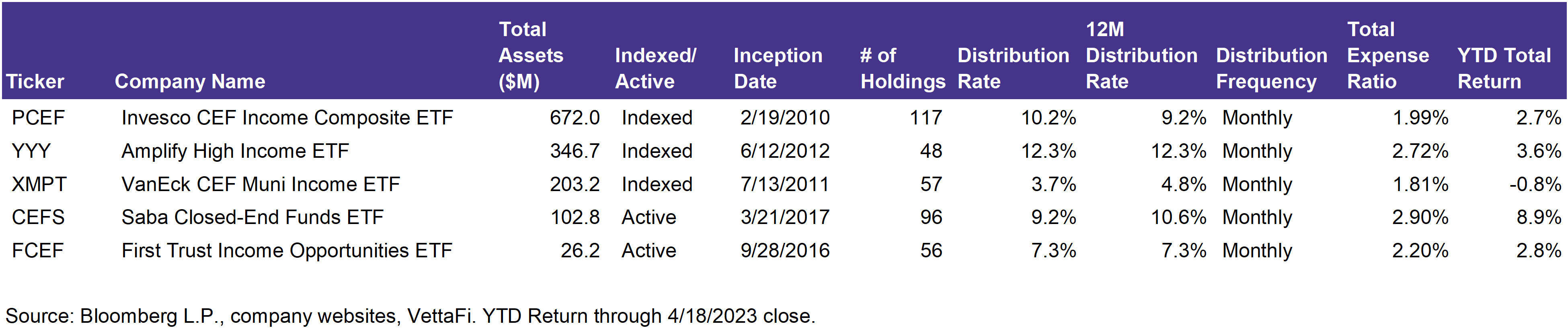

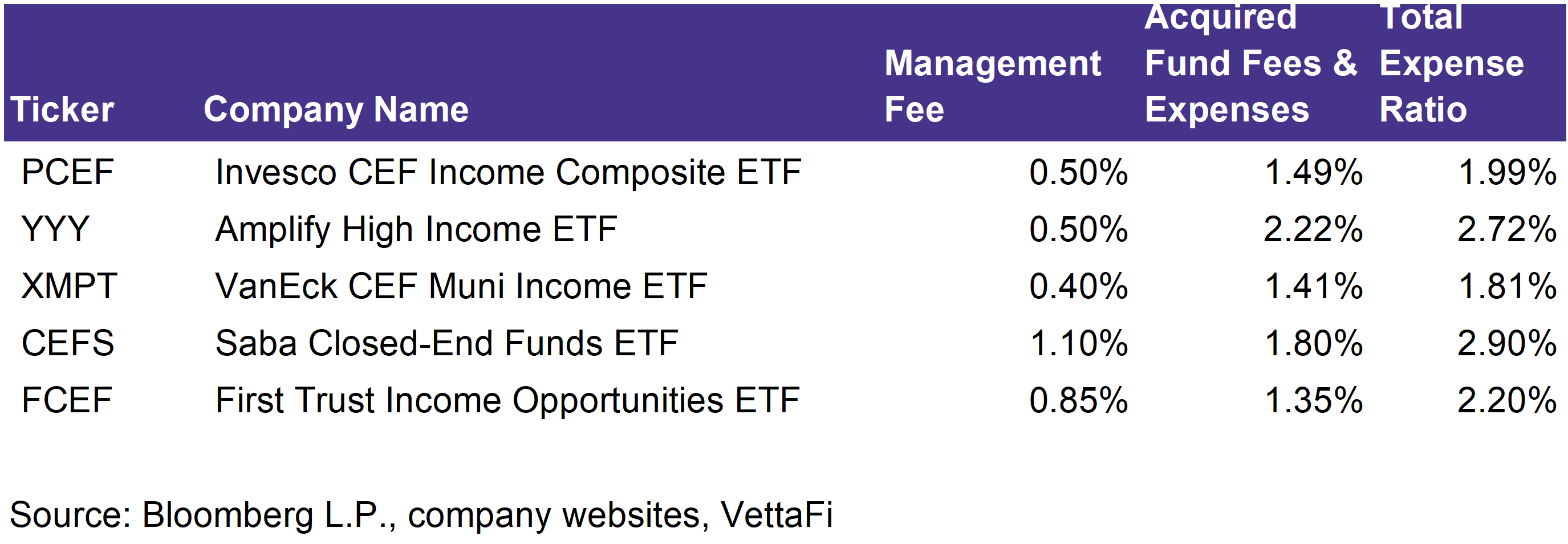

Closed-end funds are known for their high distribution rate and potential to provide current income. But many investors are unfamiliar with their structure or uncomfortable with their premium/discount volatility. Placing closed-end funds in an ETF wrapper can offer accessibility to a wider range of investors or make it easier for even an experienced closed-end fund investor to get access to a higher distribution rate with less independent research. Fund-of-funds are associated with higher fees, but indexed closed-end fund ETFs have only around a 0.50% management fee while the underlying fund fees contribute to the bulk of the expenses — so the ETF wrapper itself is still relatively low cost. There are only a few options for ETFs of closed-end funds, but they are all very different strategies and may appeal to different types of investors. In this note, I will provide a brief overview of the different ETFs of closed-end funds including PCEF, YYY, XMPT, CEFS, and FCEF.

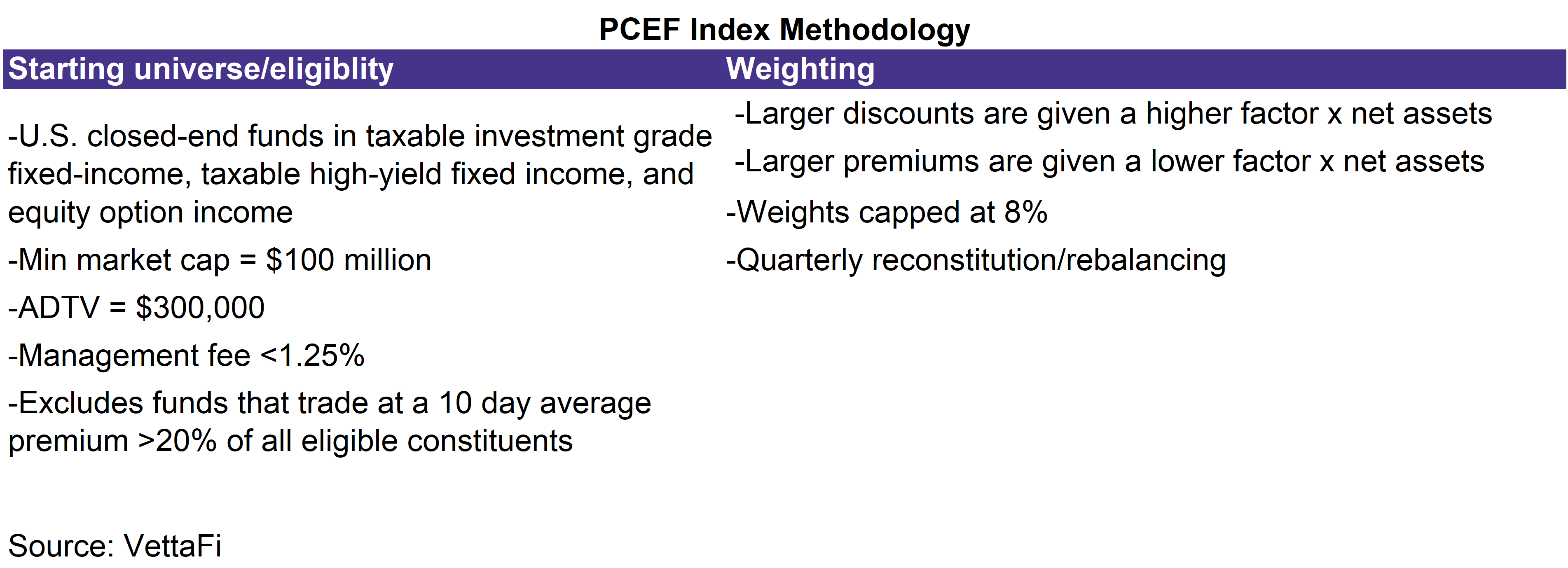

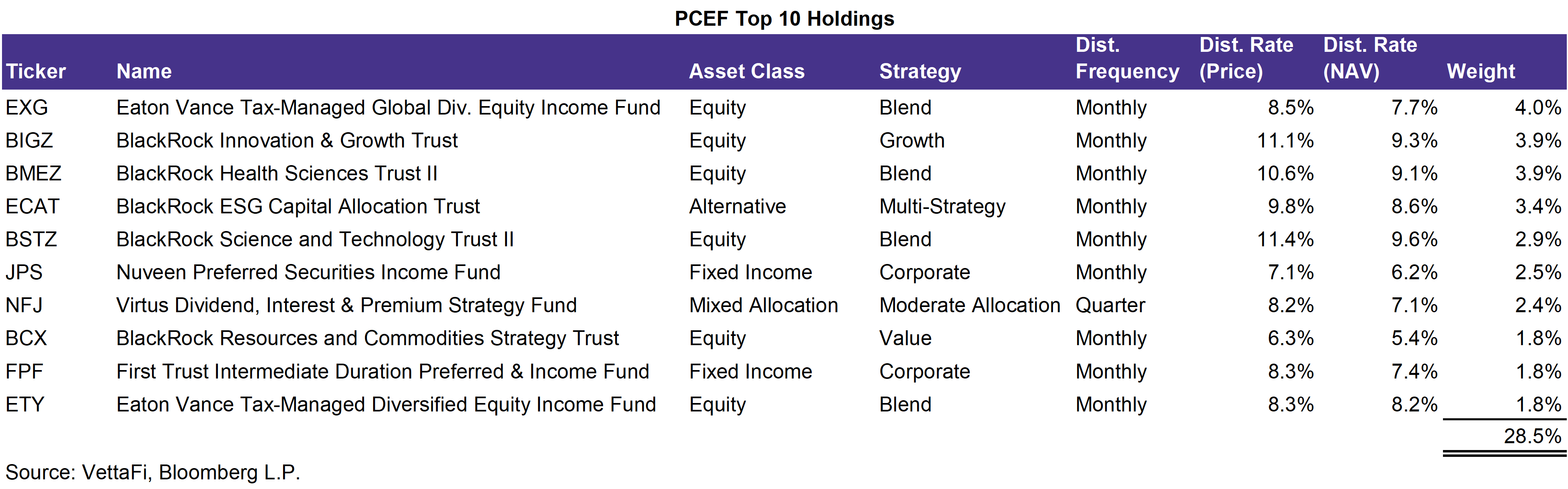

Invesco CEF Income Composite ETF (PCEF) – PCEF is the oldest and largest ETF of CEFs. The ETF tracks an index called the S-Network Composite Closed-End Fund Index (CEFX) which invests in taxable investment-grade fixed income CEFs, taxable high-yield fixed income CEFs, and equity option CEFs. PCEF takes a broad view of the taxable closed-end fund market (ex-municipals) and gives a larger weight to holdings with wider discounts. Buying CEFs at wider discounts has historically led to higher returns while buying CEFs at excessive premiums can be associated with distribution cuts. Although this is a passive ETF, quarterly rebalancing helps keep the weights tilted toward funds with higher discounts. Currently, the ETF has around 38% equity CEFs, and 54% fixed income CEFs, with the remaining amount in alternative and mixed allocation funds.

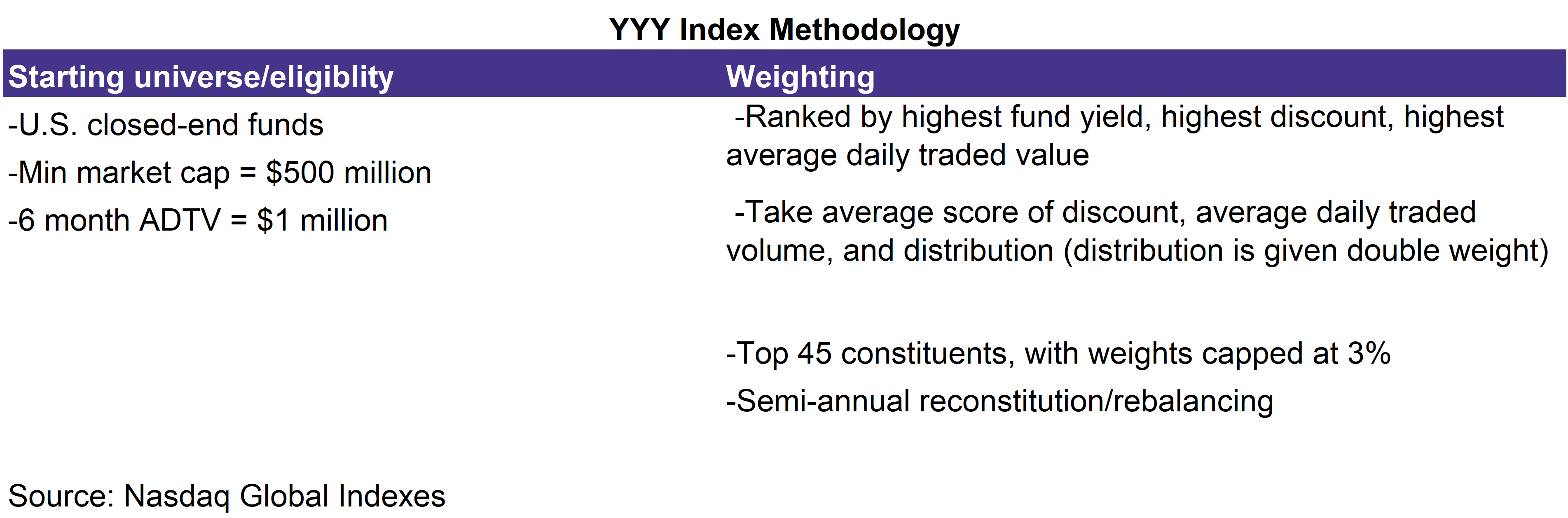

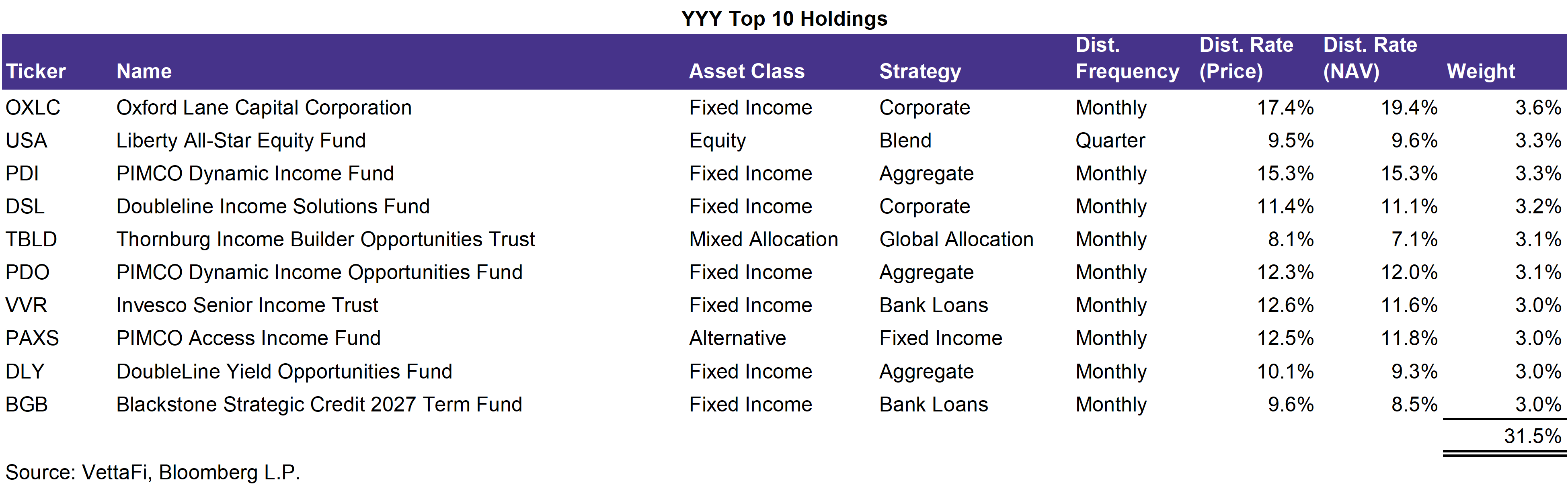

Amplify High Income ETF (YYY) – YYY is the second largest ETF of CEFs. Like PCEF, the ETF is also index-based and tracks an index called the ISE High Income Index (YLDA). But while PCEF attempts to benchmark the taxable closed-end fund universe, YYY’s primary objective is to provide current monthly income and selects only 45 CEFs to accomplish this. These 45 CEFs are selected and weighed by a scoring method that includes the discount, average daily traded volume, and distribution (distribution is given twice as much weight). Because weighting is focused on the fund distribution, this ETF currently has the highest yield out of all the CEF ETFs. Compared to PCEF, YYY has a higher allocation to fixed income CEFs (78% of its portfolio).

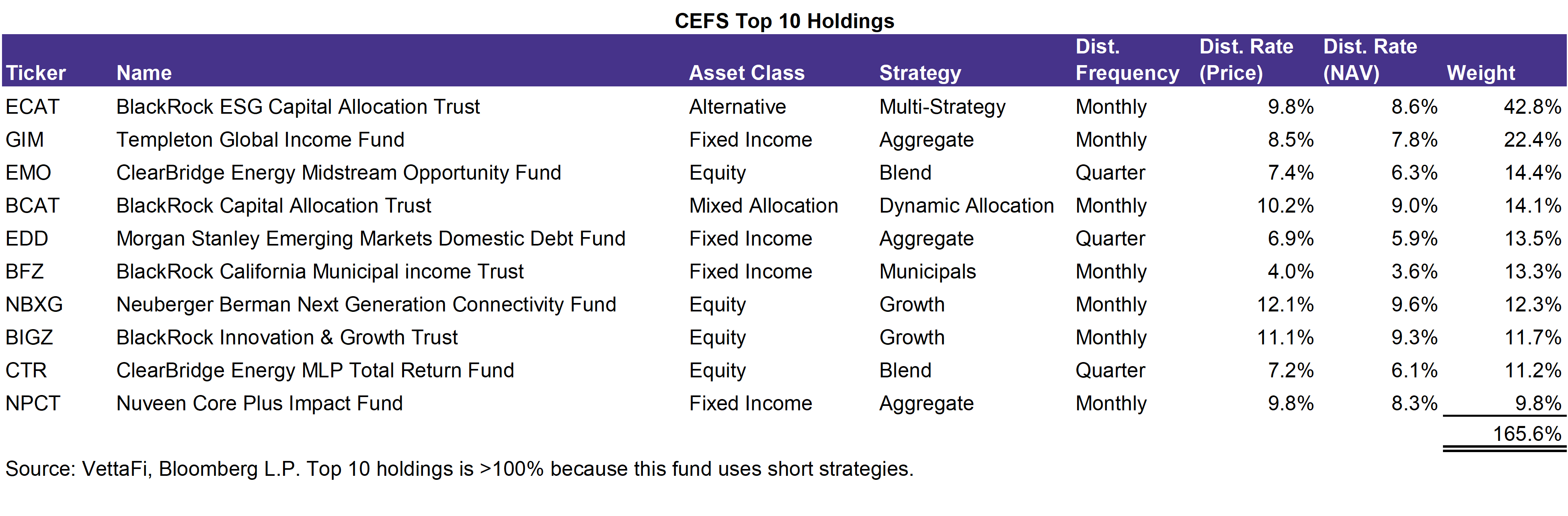

Saba Closed-End Funds ETF (CEFS) – CEFS is an actively-managed ETF and its primary objective is to generate high income by investing in CEFs that trade at a discount to their NAV while hedging the portfolio’s exposure to rising interest rates. Saba is a well-known closed-end fund activist, and CEFS holdings may reflect its views. This fund has the highest expense ratio and its management fees are over double the management fees of both PCEF and YYY. The fund, however, has paid a consistent distribution of $0.14/share each month since June 2017 (in some years it also paid a special dividend in December).

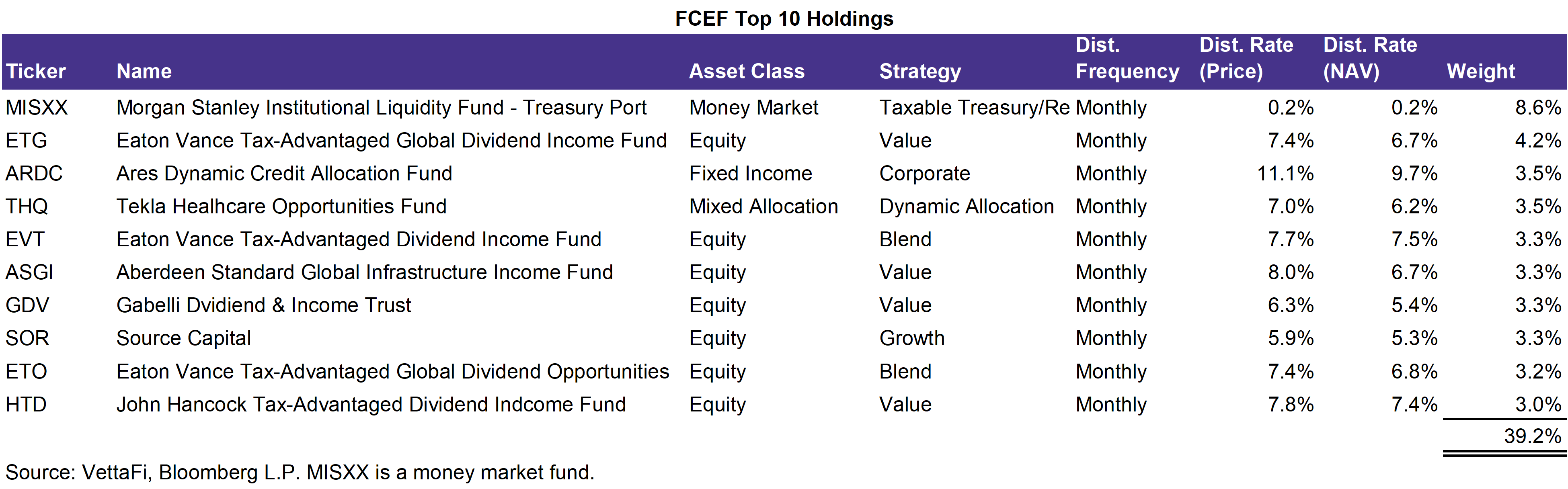

First Trust Income Opportunities ETF (FCEF) – FCEF is also actively managed, and its primary objective is to provide current income with a secondary emphasis on total return. As of April 2022, the fund changed its objective and is now permitted to invest in ETFs in addition to CEFs. FCEF’s holdings are still mostly CEFs except for 4.4% weight in ETFs and 8.6% weight in a money market fund.

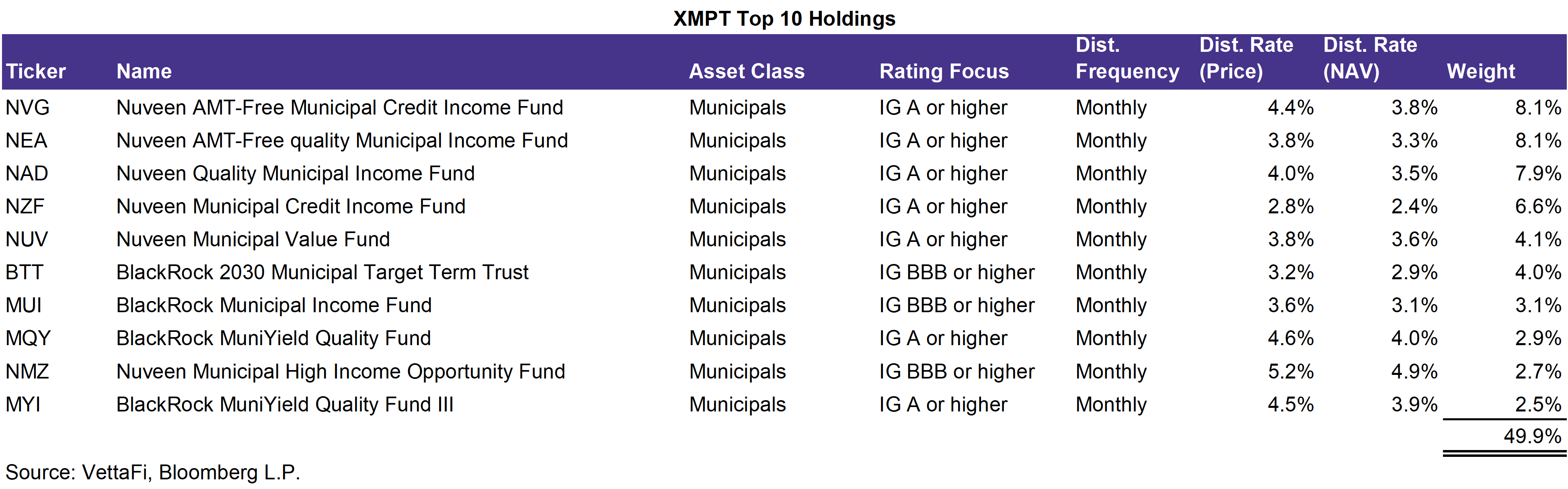

VanEck CEF Muni Income ETF (XMPT) – XMPT is the only ETF that focuses on municipal closed-end funds that are federally tax-exempt (does not include state municipal CEFs). The ETF follows an index that is constructed by the same index providers as PCEF so the selection and weighting methodology are essentially the same.

Bottom Line:

Investors have options when it comes to ETFs of CEFs. All five ETFs highlighted in this note have notably different strategies, asset class weightings, and top ten holdings (only PCEF and CEFS share two out of their ten top holdings). While fees may be higher due to their fund-of-funds structure, distribution rates are still relatively high compared to other asset classes and may be useful for investors looking for current income.

For more news, information, and analysis, visit the Innovative ETFs Channel.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for PCEF and XMPT, for which it receives an index licensing fee. However, PCEF and XMPT are not issued, sponsored, endorsed, or sold by VettaFi, and VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of PCEF and XMPT.