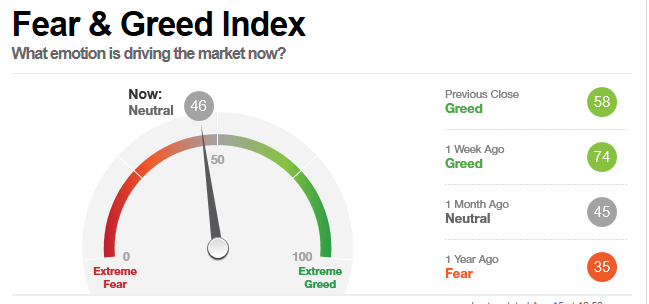

Just last week, after a bevy of positive economic data and outperforming earnings reports, the CNN Fear & Greed Index was in “Greed” territory, but that has since changed after the Turkey contagion began roiling the markets.

![]()

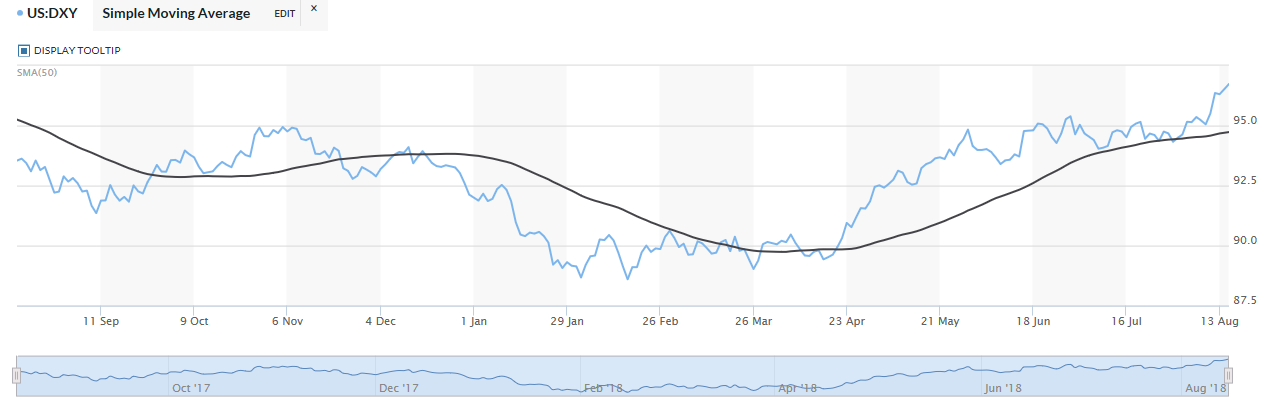

The byproduct of this effect is investors seeking refuge in safe-haven assets, like the U.S. dollar. The U.S. Dollar Index has been trading relatively below its 50-day moving average for the first half of 2018, but picked up past that indicator near the end of April, and has spiked above since the Turkey crisis.

Turkey Recovers as Global Markets Suffer

Turkey Recovers as Global Markets Suffer

Like a virus leaving an infected host, Turkey began its recover as reflected in the iShares MSCI Turkey ETF (NasdaqGM: TUR), which gained 2.91% as of 1:30 p.m. ET. Likewise, the Turkish lira recovered from depressed levels via the classic dead cat bounce against the U.S. dollar.

While the Turkish lira got a reprieve, the rest of the markets around the globe continued to feel the pangs of the Turkey contagion. The Euro Stoxx 50 ended its market session down 1.73% and China’s SSE Composite Index fell 2.08%.

The contagion was also felt globally in the ETF space with the iShares MSCI Emerging Markets ETF (NYSEArca: EEM) down 2.78% today and down 5.8% since last Friday. This appears to be the trend in the foreseeable future, unless Turkey is able to ameliorate its economic stance.

“While the initial collapse in the lira last week dragged down EM assets generally, they do not appear to have benefited from its recovery today,” said Oliver Jones at Capital Economics. “We suspect that they will continue to struggle regardless of developments in Turkey.”

For more investment strategies, visit ETFTrends.com.

For more investment strategies, visit ETFTrends.com.