The retail trading hype surrounding Reddit forum users gripped the capital markets, but more importantly, it underscored the pure power of social media influence. This is leading to launches of new social sentiment ETFs. One way to play the movement is with the Global X Social Media ETF (SOCL).

Global X’s SOCL provides some of the same exposure as the new VanEck ETF, but with its own spin.

“This is not a Reddit meme stock ETF,” said Jamie Wise, CEO of Buzz Holdings and the originator of the index. “This is about the broader conversation around stocks mentioned on social media platforms. We are using broad social media sources, principally Twitter and StockTwits.”

“We are aggregating the collective sentiment of the community,” Wise added.

Similarly, SOCL seeks to provide investment results that correspond generally to the price and yield performance of the Solactive Social Media Total Return Index. The index tracks the equity performance of the largest and most liquid companies involved in the social media industry, including companies that provide social networking, file sharing, and other web-based media applications.

SOCL gives investors:

- Efficient Access: Efficient access to a broad basket of social media companies around the world.

- Targeted Thematic Exposure: The fund is a targeted thematic play on the global social media industry.

- Strong performance: The ETF is up almost 100% within the past year.

Some International Exposure?

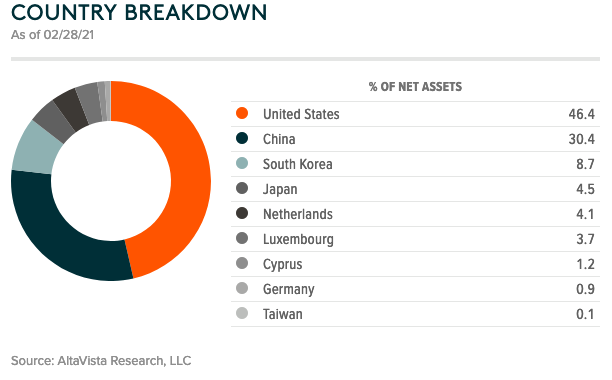

With exposure to countries like China, South Korea, and Japan, SOCL provides an international tilt too. Under the hood of the fund, investors will see tech giants like Hong Kong’s Tencent Holdings.

See also: BUZZ & The Portnoy Problem

“It should be noted that SOCL maintains a global focus, meaning that social media companies in both developed and emerging markets outside the U.S. are included in the underlying portfolio,” ETF Database analysis said. “It should also be noted that SOCL may include companies that maintain significant operations outside of the social media arena (GOOG is a good example of that situation).”

“The inclusion of these companies may diminish the correlation between SOCL’s price and the success of social media companies,” the analysis added further. “Finally, it is important to know that many social media companies are non-public, meaning that this ETF won’t necessarily include all components of this industry.”

For more news and information, visit the Thematic Investing Channel.