By Rod Smyth, RiverFront Investment Group

The G20 meeting in Hamburg this past weekend turned out to be something of a G19 +1. It is unprecedented in the post WW ll era for the US to be so isolated from the rest of the world.

Europe has just completed a trade deal with Japan and is happy to form deeper relations with China as its relationship with Russia remains terse. All that said, our charts show that synchronized global growth is clearly occurring:

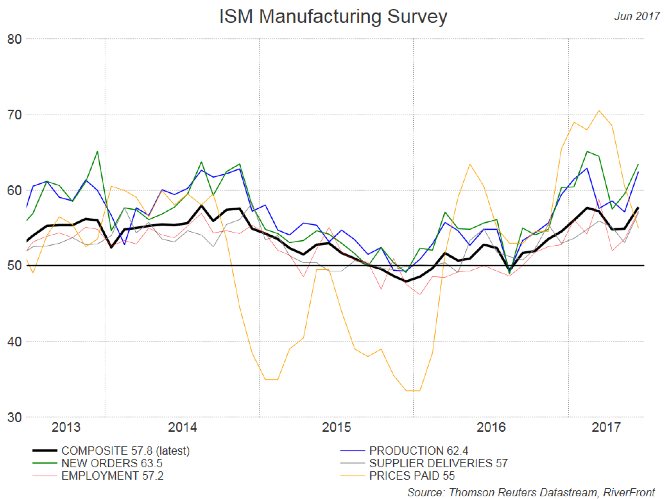

US purchasing managers survey index hits a 3-year high…

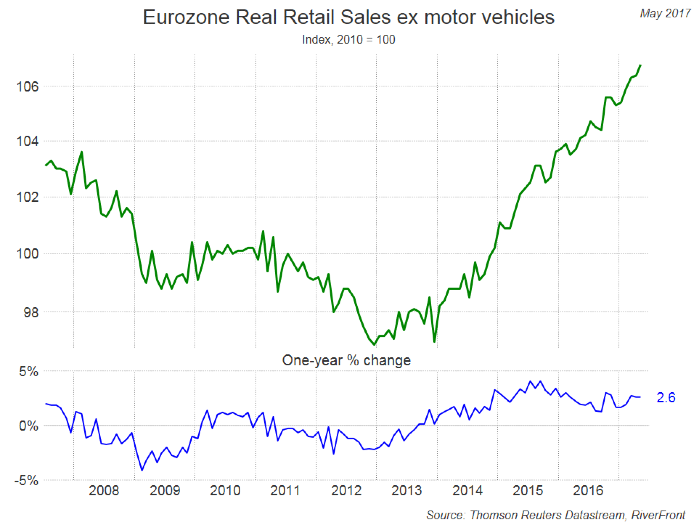

…Eurozone recovery seems to have become self-sustaining at a steady pace as retail sales settle into a 2.5% growth rate …

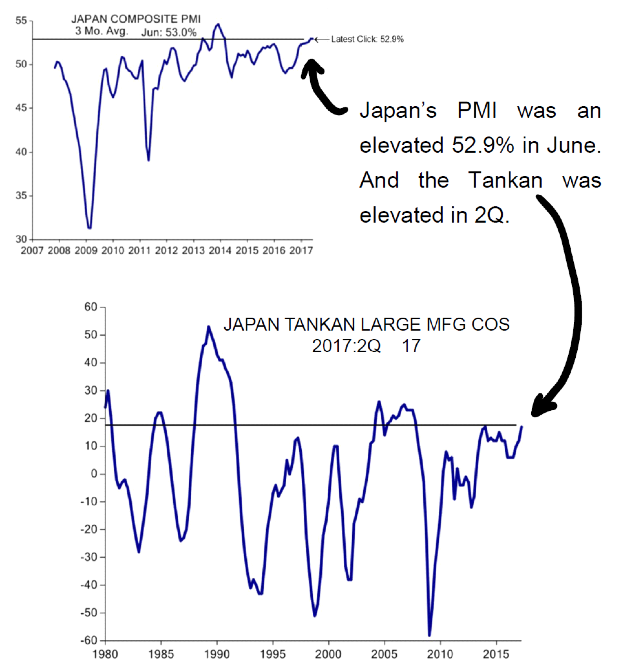

… even Japan is enjoying some of its highest corporate confidence in several years.

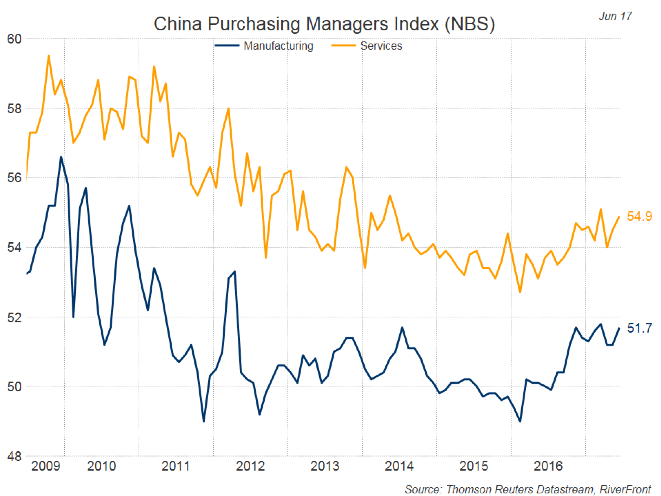

… while China’s purchasing manager surveys have improved over the last year.

We believe the bull market in global stocks is simply reflecting a positive environment for global earnings growth and the realization that while the world’s leaders have some major ideological differences, they are united when it comes to the desire for economic growth.

Rod Smyth is the Chief Investment Strategist at RiverFront Investment Group, a participant in the ETF Strategist Channel.

Important Disclosure Information:

Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

RiverFront’s Price Matters® discipline compares inflation-adjusted current prices relative to their long-term trend to help identify extremes in valuation.

Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.