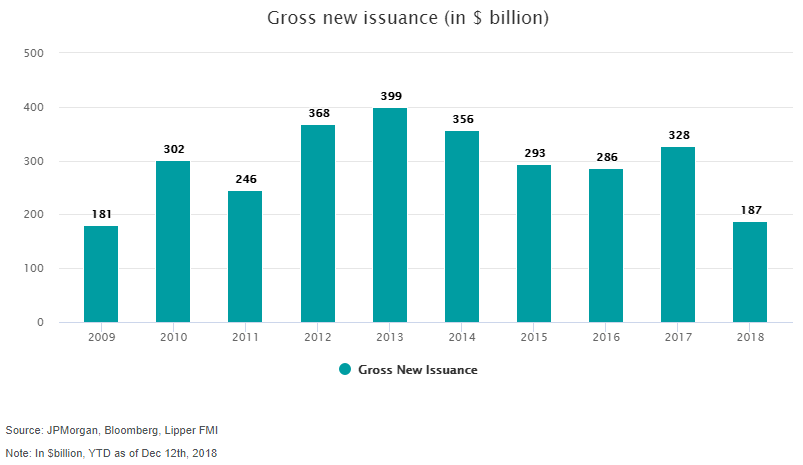

Another factor is the maturity of high yield bonds. Given the favorable economic situation of the past few years and the low rates, high yield issuers were able to issue longer term debt at favorable rates leaving their funding needs well-contained. Further, higher rates and the increasingly uncertain economic outlook may be causing many issuers to deleverage and repay their debt, rather than refinancing older bonds. Finally, less M&A activity can help explain the decrease. Companies may use debt as part of a financing plan when acquiring another firm, and the decrease in activity helps explain why there are less gross new issuances.

Let’s go back to our economic lesson. We’ve established there is a shortage. We know it is likely not because high yield companies are in great distress. The next question is, how is that relevant to the investor? There are many factors that determine bond prices, such as interest rates, the overall risk environment, default rates, alternative investment opportunities etc., but the scarcity of high yield bonds is a positive determinant that could potentially lead to positive returns.

High yield bonds are facing a shortage in supply, largely due to less gross new issuance and more bonds being called. Issuers are wary of adding debt at higher costs, since rates are rising. The overall scarcity of bonds may be great news to a smart investor. The shortage pressures prices to go up and may provide an opportunity, suggesting that those willing to try surfing this wave could see solid returns.

1) Index: LF98TRU, data from Bloomberg.

2) Unemployment rate was at a low of 3.7 percent and real average hourly earnings increased 0.3 percent in November 2018.