Each week of out- or underperformance is generally independent and binomial in nature. So we can adjust our prior beliefs regarding a fund or ETF’s chances to outperform based on the actual instances of outperformance (as illustrated in the chart below). For example, FVD’s adjusted chances for outperforming its style benchmark (the Russell 1000 Value Index) were estimated to be about 54% after accounting for the fact it beat its style benchmark 96 out of the 171 weeks considered.

Sources: Morningstar Direct and CLS Investments. Weekly returns from 12/29/2013 to 4/8/2017. Russell 1000 Value Index used as style benchmark.Do the Odds Favor Your Active Fund or Smart Beta ETF’s Ability to Outperform?

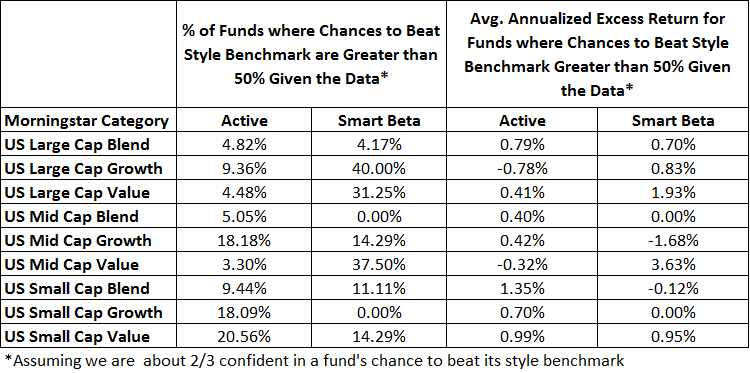

So, what do our results show? In general, across all categories, there is a lower percentage of active mutual fund managers and smart beta ETFs whose chances to outperform their style benchmarks are greater than 50%. This averages out to about 10% of active mutual fund managers across each Morningstar category and 17% of all smart beta ETFs in the same categories. The exceptions that we observed for smart beta ETFs were in the U.S. mid-cap blend and U.S. small-cap growth categories. In those categories, no smart beta ETFs were identified as having a greater than 50% chance of outperforming their style benchmarks in a given week.

We also observed the average excess returns of the active mutual funds and smart beta ETFs identified as having greater chances to outperform were similar, but varied based on each Morningstar category. In most cases, excess returns were slightly higher for smart beta ETFs in certain Morningstar categories as compared to their active mutual fund peers.

The Key Takeaway for Investors

Based on our study, the evidence is not necessarily conclusive as to whether active mutual funds or smart beta ETFs have a distinct edge over each other. However, the data does show signs that some smart beta ETFs have slightly higher chances on average to outperform their style benchmarks than their active manager peer in the same style category.

The key point investors should take away is that skill/edge is not just a function of an investment style, but rather the degree of consistency any fund (active or smart beta) has in repeating its process over time. As with anything, further evaluation and data will help our beliefs evolve. Only time will tell which approach will be more beneficial for investors.

Joe Smith, CFA, is a Senior Market Strategist at CLS Investments, a participant in the ETF Strategist Channel.

Disclosure Information

This information is prepared for general information only. Information contained herein is derived from sources we believe to be reliable, however, we do not represent that this information is complete or accurate and it should not be relied upon as such. All opinions expressed herein are subject to change without notice. The graphs and charts contained in this work are for informational purposes only. No graph or chart should be regarded as a guide to investing.

2506-CLS-4/28/2017