By Luke Oliver, DWS Head of U.S. ETF Capital Markets

Every week there is a new article that comments on the meteoric rise of Exchange-Traded Funds (ETFs) with the connotation being that the “rapid expansion” of ETFs could create “financial weapons of mass destruction”. It makes for a dramatic narrative, and while ETFs have certainly changed the investing landscape since the financial crisis, what feels like a revolution is really just a transition to a new technology. And the flows are not actually that staggering.

Case in point, I constantly hear variations of the following stat:

ETFs have grown to $4 trillion from just $1 trillion in 2008 – shock! Horror!

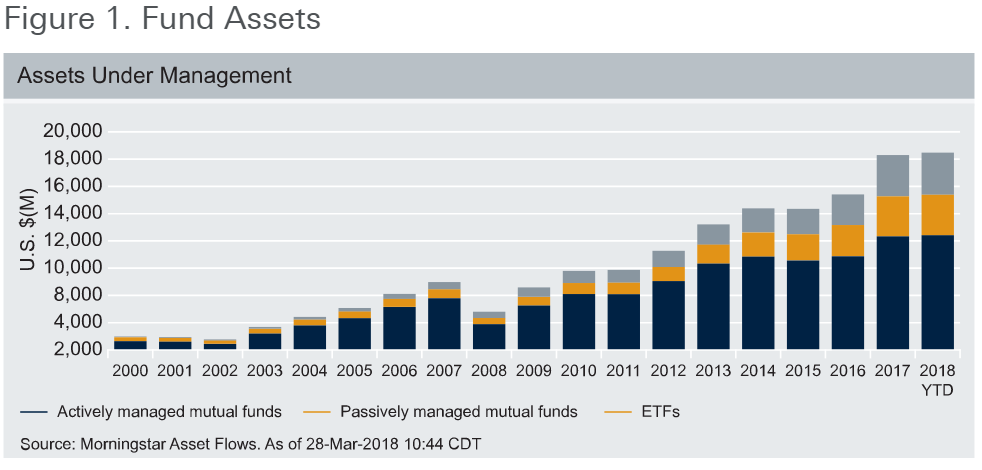

This is a little hyperbolic. The S&P500 is up 250% in that time (source: Bloomberg, 12/26/08-04/02/18), and as a general proxy, that almost gets you from $1 trillion to $4 trillion alone! Of course ETFs track various strategies and not all investors buy and hold, but you’ll agree this kind of growth is not particularly news worthy given the market performance we’ve seen. Mutual fund (MF) assets have grown from $4.6tn to $14.8tn over the same period and still account for 81% of total US fund assets (source: Morningstar). So, the sky isn’t falling on mutual funds, but things are certainly changing.

Two different trends

What is interesting is that there are in fact two very specific trends that have been playing out that often get lumped together. Passive investing and ETF investing. Passive is not synonymous with ETF. This is a huge misconception I come across regularly. Passive investing predates ETFs and passive mutual fund assets were established well before ETFs got a foothold. There were over $300 billion in passive mutual fund assets in 2000 (source: Morningstar). Even more interestingly, their assets have moved in close lockstep with ETFs since ETFs caught up in 2008. Surprising, isn’t it (Figure 1)?

![]()