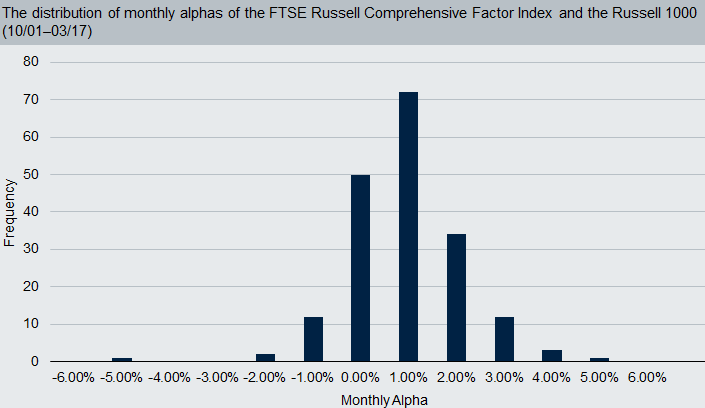

Abby Woodham, ETF Strategist for Deutsche Asset Management, argued that as investors make investments using a smart beta strategy, investors should think about some additional considerations before making the jump, such as the investment’s historical net fee returns, appropriate benchmark, statistically significant estimated alpha, costs to achieve the alpha, excess return and risk.

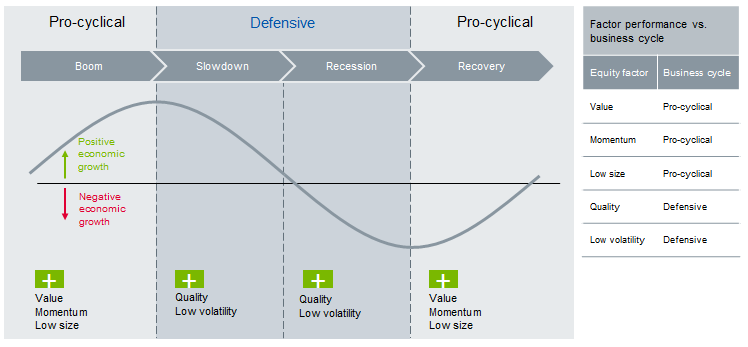

Furthermore, Woodham argued that some smart beta factors may do better than others during specific market conditions. For instance, when looking across a normal market cycle, the factors including value momentum and low size may outperform during periods of positive economic growth or booms and pro-cyclical recoveries. However, quality and low volatility shine during periods of market slowdowns and recessions.

“Market moves are hard to predict. Since individual factor upswings may be hard to time, we believe combining factors can help investors weather a variety of economic environments,” Woodham said.

Alternatively, investors may consider a multi-factor approach that helps keep a long-term, strategic portfolio diversified across various market conditions.

“Investors may help diversify their portfolios by shifting from industry and country diversification to factor diversification,” George Rector, ETF Consultant for Deutsche Asset Management, said. “Individual factors often maintain low correlations with one another, potentially lowering overall volatility when combined.”

For instance, investors may consider the Deutsche X-trackers Russell 1000 Comprehensive Factor ETF (NYSEArca: DEUS), Deutsche X-trackers Russell 2000 Comprehensive Factor ETF (NYSEArca: DESC), Deutsche X-trackers FTSE Developed ex US Comprehensive Factor ETF (NYSEArca: DEEF) and Deutsche X-trackers FTSE Emerging Comprehensive Factor ETF (NYSEArca: DEMG), which combine five single factors into a multi-factor strategy, including value, size, momentum, low volatility and quality.

“Factors are like the nutritional components of a stock, characteristics that explain a stock’s risk and return. Blended together properly, these factors can potentially make a significant contribution to outperforming traditional market-capitalization weighted benchmark indices,” Rector said.

Financial advisors who are interested in learning more about smart beta investments can watch the webcast here on demand.