![]() As investors look beyond traditional index-based fund strategies, it may be time to consider smart beta ETFs to meet a number of long-term objectives.

As investors look beyond traditional index-based fund strategies, it may be time to consider smart beta ETFs to meet a number of long-term objectives.

On the recent webcast (available on demand for CE Credit), Smart Beta—Here’s Where You Can Put It…, Rolf Agather, Managing Director of North America Research at FTSE Russell, explained that more and more investors are becoming aware of smart beta strategies and are incorporating them in a diversified portfolio. The percentage of asset owners reporting that they have not evaluated smart beta has significantly dropped to 12% in 2016 from 40% in 2014. Moreover, adoption rates have increased, especially in Europe this year.

Institutional investors are becoming a big driver of smart beta adoption. In 2017, asset owners with $1 billion to $10 billion in assets under management led smart beta adoption, with about 57% of such investors using smart beta. Adoption among the largest asset owners remain near 45% to 50% over the past three years.

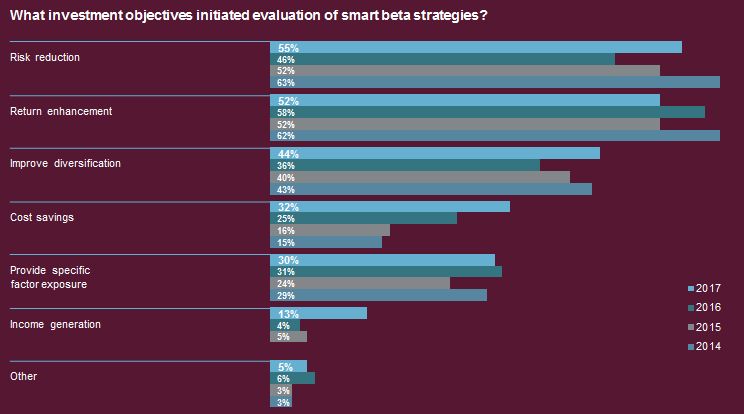

When evaluating a smart beta strategy, asset owners pointed to risk reduction as the greatest reason for investing in these ETFs, followed by return enhancement, improve diversification, cost savings, specific factor exposure and income generation.

Many smart beta investors are mainly utilizing the strategies as a strategic or long-term investment, with the minority using smart beta ETFs as short-term, tactical allocations.

Most smart beta ETF investors have allocated toward multi-factor combination strategies that combine various market factors into a diversified portfolio. Agather pointed out that 74% of asset owners are currently evaluating multi-factor combination strategies. Nevertheless, many still look to single factor picks that focus on low volatility, value, fundamental weights, high quality and momentum, among others.

“We expect growth in smart beta to continue at a robust pace, as the adoption expectations of asset owners who are currently evaluating initial or additional smart beta allocations remains strong and satisfaction with smart beta among current users remains high,” Agather said.

When evaluating these smart beta strategies, Robert Bush, ETF Strategist for Deutsche Asset Management, explained that an investor would find a smart beta does a good job if positive alpha when considering the portfolio’s beta and return relative to benchmark market returns. For instance, Bush pointed out that the FTSE Russell Comprehensive Factor Index has exhibited a high frequency of monthly alpha generation over the benchmark Russell 1000 in over 15 years of historical data.