By Eric Dutram, DWS

Rising rates in the U.S. Treasury market are putting pressure on bond investors of all sizes and styles

This is a potential flashpoint for the fixed-income market because, as we all know, rising yields tend to be a negative for bond prices.

Fortunately, different bonds are not equally affected by rising rates. While there are several aspects to consider, a key part of the impact may depend on where a bond is located along the yield curve.

That is because various spots along the curve will produce bonds with different levels of sensitivity to changes in interest rates. This concept is known as ‘duration’ and securities with lower durations generally fare better in a rising rate environment. As shown in the chart below, there is an astounding difference between 2-, 5- and 10-year duration instruments and their performance as yields rise.

In fact, a 50 basis point increase in yields for 2-year duration debt has the same price impact as what a 10-year duration investor experiences with just a 10 basis point increase in yield. In a more extreme scenario, when yields rise by 200 basis points, a 2-year duration bond will lose about 4% of its value compared to a whopping 20% for 10-year duration debt.

| Bond duration | 2 years | 5 years | 10 years |

| Yield change | Bond price change (does not include income) |

||

| +5 bps | (0.10%) | (0.25%) | (0.50%) |

| +10 bps | (0.20%) | (0.50%) | (1.00%) |

| +20 bps | (0.40%) | (1.00%) | (2.50%) |

| +50 bps | (1.00%) | (2.50%) | (5.00%) |

| +75 bps | (1.50%) | (3.75%) | (7.50%) |

| +100 bps | (2.00%) | (5.00%) | (10.00%) |

| +200 bps | (4.00%) | (10.00%) | (20.00%) |

- Duration is the measure of the sensitivity of a bond’s price to changes in interest-rates.

- Bonds with longer durations carry more interest-rate sensitivity.

- As can be seen in the above example, it would take a 50 bps increase in interest-rates on the short-end of the curve to have the same impact on a 2-year duration bond as a 20 bps move would have on a 5-year duration bond, all else being equal.

- A key component to offsetting the price impact of duration risk is the income generated by the security.

Source: DWS. For illustrative purposes only.

This analysis does not take into account other factors such as downgrades, defaults, or changes in spread that may still lead to negative outcomes.

Tightening cycle

It is important to remember that bond investing is about more than just price. Total return – the combination of yield as well as price — must be considered as well. So, while rising rates might crimp bond prices, don’t forget that they will also boost yields for fixed-income instruments. Thus, it is crucial to consider bond portfolios that can weather rising rates and offer opportunities for income in some areas to make up for any price decline in others.

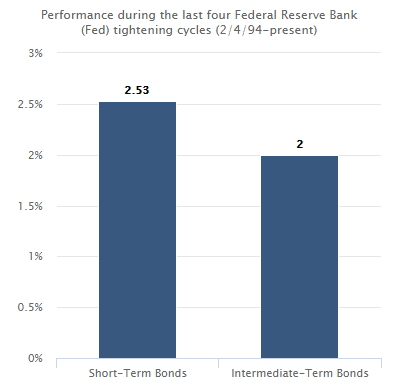

A great example of this is in the chart below which takes a closer look at both short- and intermediate-term bonds in the last four Fed tightening cycles. Despite higher rates from the Fed, both short-term and intermediate bonds managed to post positive returns.

![]()

Source: Morningstar Inc. as of 12/31/17. Performance is historical and does not guarantee future results. Intermediate-term bonds are represented by the Bloomberg/Barclays U.S. Aggregate 7-10 year bond index. Short-term bonds are represented by theBloomberg/Barclays U.S. Aggregate 1-3 year bond index. Index returns assume reinvestment of all distributions and do not reflect fees or expenses and it’s not possible to invest directly in an index.