The uses of ESG factors of course extend beyond emerging markets. Let’s take the example of Volkswagen. In 2013, MSCI ESG analysis identified concerns with the automaker’s corporate governance, as seen in its practices. By mid-2015, the index provider removed the stock from its ESG Leaders index. Just a few months later, the Dieselgate scandal hit the front page, which led to a significant price decline for Volkswagen shares.

It is interesting to note the company was not removed due to its environmental impact. Though MSCI couldn’t have predicted a scandal would break in that area, the research team identified a change in governance that prioritized returns and did not give a proper consideration of risks of such leadership decisions.

3. Coming Up: A New Norm

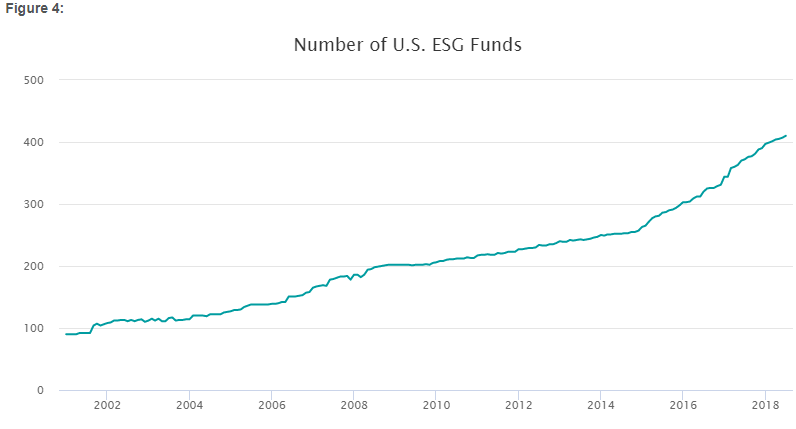

Despite a quasi-common sense approach and the potential for increased performance, someone might still wonder whether the time for thinking about ESG has arrived. Clearly, figures three and four6 show that not only assets in ESG steadily grew in the past eighteen years, but also that the offering of ESG funds increased.

Figure 3:

Source: Morningstar as of 6/30/18 Past performance may not be indicative of future results. See footnote 6 for additional information.

Source: Morningstar as of 6/30/18 Past performance may not be indicative of future results. See footnote 6 for additional information.

The potential is amplified when we think that $30 trillion worth of wealth will transfer from baby boomers to millennials in the next two decades. And 90% of millennials want to grow their allocations to responsible investments in the next five years7 .

Bottom Line

An alphabet represents the building blocks of a language, and it may be helpful to think of ESG principles as the building blocks of a practical approach to investing. Environment, social and governance factors are designed to reduce systematic risks, and this may help lead to outperformance when applied across a broad basket of components. This potential for success is observed particularly in markets where governance scores are more varied, though many markets may benefit from additional research and ESG principles. Finally, the focus of the market is changing, and younger generations are more in tune with ESG principles. Learn the basics of this new language now, or risk being left behind as demand for this type of approach seems poised to surge as generational dynamics change.

1 Source: MSCI.

2 Source: Bloomberg.

3 Ticker on Bloomberg: M1EFES Index.

4 Ticker on Bloomberg: NDUEEGF Index.

5 Ending September 2018.

6 Source: Morningstar as of 6/30/18. Data represents U.S. domiciled ETFs and Mutual Funds. Other includes Alternatives, Commodities, and Allocation funds.

7 Source: FactSet’s HNWIs’ Vision for the Wealth Management Industry in the Information Age.