By Luke Oliver, DWS

DWS has long been a champion of environmental, social and governance (ESG) factors incorporated into the investing methodology. While mainstream opinion is that ESG is a niche strategy, we believe responsible investing will continue to grow in prominence. Some investors think ESG factors are difficult to understand. But the main principles of this approach are as simple as A, B, C… An advanced methodology to address systematic risks that can potentially result in ESG funds beating the market. This new norm is coming up fast, as seen by the development of new ESG funds and flows into the space. In other words, ESG investing is really about getting back to the basics. Don’t think of it as a restriction, instead, consider it an additional screen with the potential to offer outperformance.

1. Advanced Methodology

In order to break the mindset that environment, social and governance factors should be applied tactically instead of being mainstreamed, let’s first breakdown the methodologies used in ESG investing. And what best way to address systematic ratings of companies than looking at what the indices are doing? Let’s take for example MSCI’s ESG Leaders indices.

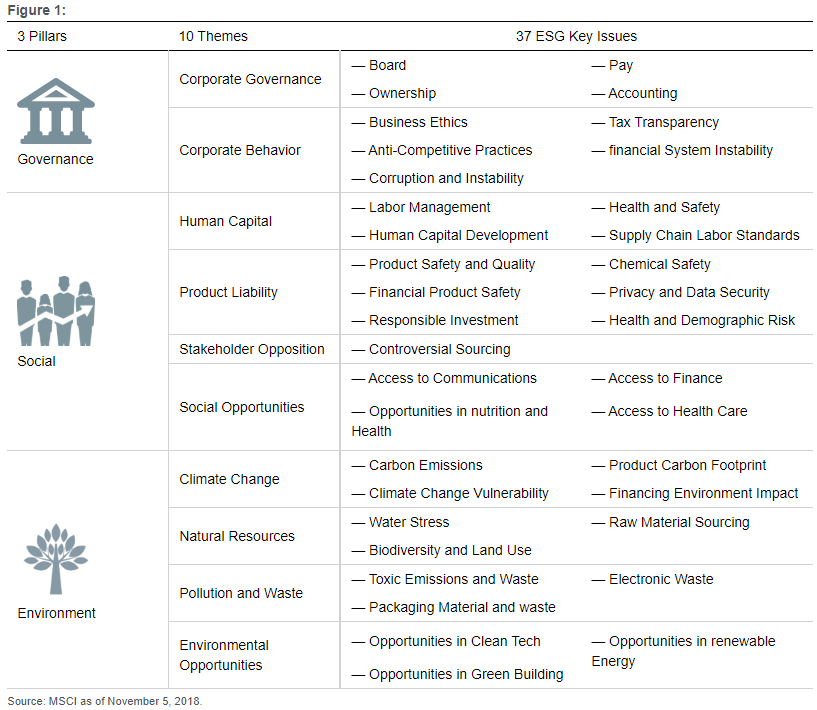

The index provider starts by excluding controversial businesses. Those can range from industries such as gambling and weapons manufacturing, to name a few prominent examples. The second step is to rate and rank companies in the universe based on ten key themes spread across more than thirty ESG issues. Finally, the index uses a top down approach, selecting the best ranked securities and including them in the index at a similar sector weight as the base MSCI EAFE index.

For those wondering what the key issues are, figure one1 goes into more details about each theme. But the real takeaway should be that most of these issues are characteristics that make good, sound investing sense and their integration into valuation methods is long overdue.

In an era where consumers are immersed in digital content, who wouldn’t hold companies accountable for their policies regarding data privacy and security? Let’s take it one step further: who wouldn’t demand a product that seeks safety and quality standards?

2. Beating the Market

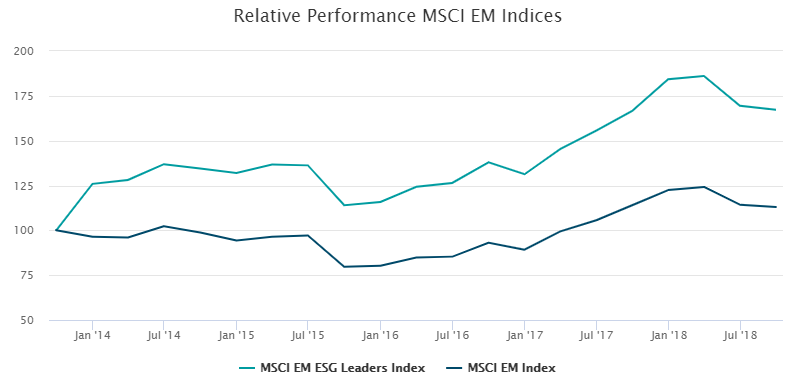

The MSCI ratings can reveal characteristics that could have a substantial impact on the performance of a company. In figure two2, the reader can compare the benchmark to the ESG screened index in the emerging market world that intuitively tends to exhibit weaker corporate governance, the difference is stark. The MSCI EM ESG Leaders index (M1EFES)3 has outperformed the regular MSCI Emerging Markets Index (NDUEEGF)4 from a historical perspective consistently in the last 1, 3 and 5 years5 . In fact, the five year outperformance was 2.43%, with just thirteen basis points of additional volatility. The governance factor in ESG can uncover systematic risks that might go unnoticed otherwise and the relative performance of EM ESG leaders against the base EM index shows investors can potentially mitigate the mentioned risks.

Figure 2:

Source: Bloomberg as of September 28, 2018. Past performance may not be indicative of future results. Refer to above and footnote 3 and 4 for index definitions.