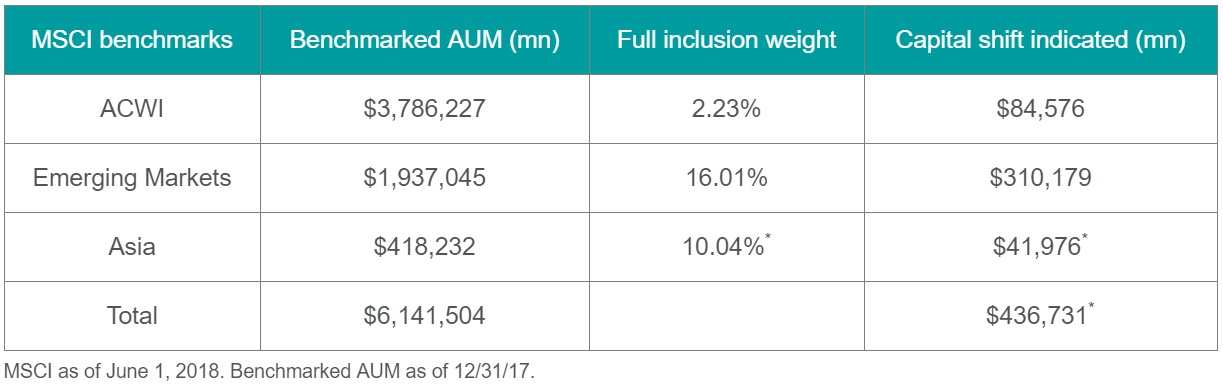

In fact, our estimate is that more than $400 billion will go into A-shares once full inclusion happens, largely thanks to more than a quarter trillion from emerging market indexes alone. Not only will this help to further globalize the Chinese market, but it will make a complete China investment crucial to achieving proper foreign market exposure.

![]()

Diversification

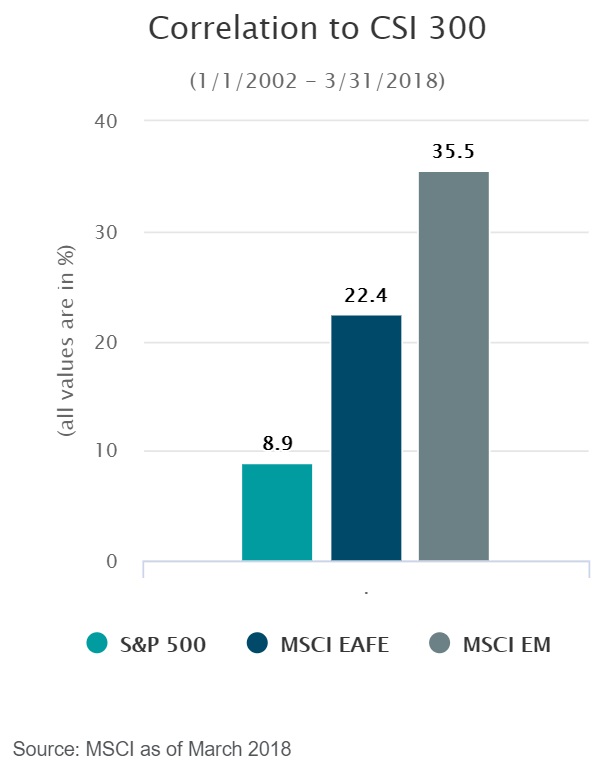

In addition to this return potential, China—and in particular A-Shares—offers investors incredible diversification potential. The correlation between the main China benchmark, CSI 300, and global markets is astoundingly low.

And though correlations may rise as the market becomes more open, China remains a very unique market with its own economic and demographic drivers. That could help correlations remain subdued in the years ahead.

Buffett Indicator

While these factors sound great, it isn’t going to mean much if valuations do not line up. Fortunately, valuations for China’s equity market are pretty reasonable, at least if one considers the ‘Buffett Indicator’ first.

This measure, which looks at the ratio of stock market capitalization to GDP, has been called by Buffett as ‘probably the best single measure of where valuations stand at any given moment’, so it is worth investigating. From this look, China is not only at a relative discount to American markets, but versus global markets as well, suggesting that, at least by this measure, Chinese securities are not overvalued.

Source: World bank as of May, 2018

Bottom Line

Some investors focus on the short-term, and in that respect there are some clouds on the horizon for China. However, over the long-haul the future for China investing appears bright, as evidenced by many key stories which have long term appeal.

Projects like the One Belt One Road are likely to last decades, while others—such as A-Share inclusion—could take years to play out. This suggests that many of the trends underpinning the bull case for China are quite durable, and that it might be worthwhile to look past the short-term issues and consider the long-term case for this surging economy.