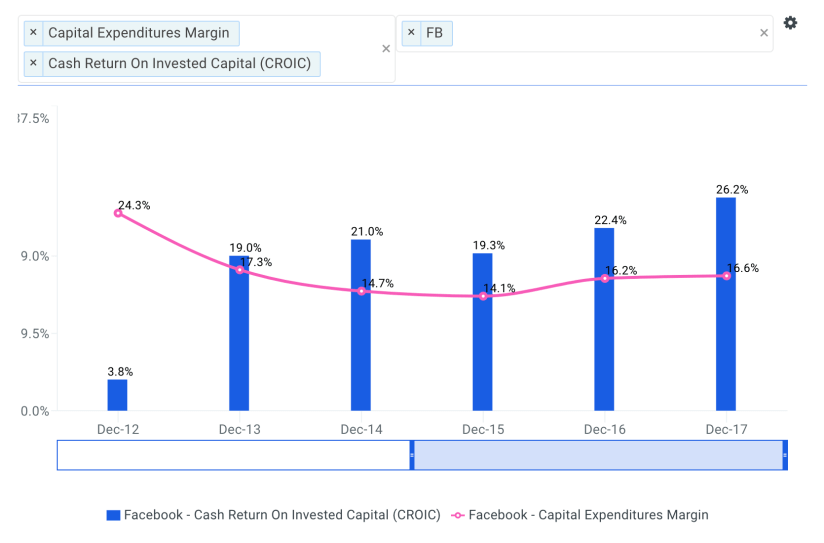

Furthermore, return on invested capital that exceeds a company’s weighted average cost of capital adds value for investors. Using CAPM, finbox.io estimates Facebook’s WACC at 10.5%.

Sources of Revenue Growth

The world population was 7.5 billion as of 2017. Asia claims 60% of the world’s population, and Facebook only has 18% of that number registered as MAU, providing a major opportunity for further growth. The highest percentage of growth in population is projected to come from Africa. According to The Guardian,

“Africa is home to over 1.2 billion people, but only 226 million smartphones were connected to the internet by the end of 2015. That number connected is expected to triple by 2020.”

Facebook saw this opportunity and has initiated connectivity projects to increase the number of individuals connected to the internet. In North America, Facebook counts 66% of the population as MAU. Population forecasts predict growth in the North American region by 34 million through 2030. In Europe, Facebook counts 50% of the 742 million individuals as MAU. If Facebook achieves the same 66% share in Europe as it has in North America, that would be an additional 118 million MAU.

New Product and Services Development

Facebook has some intriguing prospects that are coming to fruition. During the latest conference call Mark Zuckerberg said “on the VR side were excited to get Oculus GO into people’s hands this year. Time magazine named it one of the top inventions in 2017, and I can’t wait for more people to use it.” Though it may be a small part of the business to begin with, such a product has potential to change the game.

Facebook is also investing heavily on long-term initiatives in Augmented Reality, Virtual Reality, Artificial Intelligence and Connectivity. A few of these initiatives have started bearing fruit while others may take more time to develop. With these investments, Facebook hopes to improve products and services it already offers as well as develop new and completely separate products and services.

Facebook’s Intrinsic Value

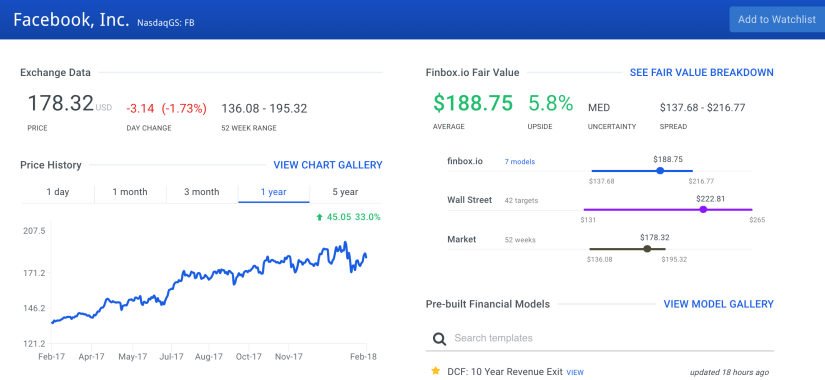

Applying the consensus Wall Street expectations in seven separate valuation models, finbox.io calculates an intrinsic value of $188.75 per share. This implies that Facebook’s stock is currently undervalued by 5.8%.

Risks

Facebook faces a multitude of risks and this list is not meant to be exhaustive. To start, nearly all of Facebook’s revenues come from selling advertising to businesses. That concentration of revenues poses a risk for investors. Social network users are not necessarily a sticky bunch.

Do you remember Myspace? A mass exodus of users is not entirely unrealistic. In addition, the recent negative publicity surrounding Facebook’s role during the 2016 U.S. presidential elections has brought unwanted attention from regulators in the United States. Any action taken by regulators poses a risk to the business.

Overall, Facebook has reached a critical mass and is still growing its user base. They have opportunities to expand services to existing populations and potential to grow simply through population growth. In addition, they have optimized their two-pronged approach to revenue growth: (1) growing the number of MAU and (2) monetizing those users with a growing average revenue per user.

This article was republished with permission from Vintage Value Investing.