Summer is approaching, and with it comes the Great American Cookout. Everyone has their preferred menu of options for a backyard buffet, but some options stand above the rest. They help “make” a cookout special, but getting that balance of options right is key. Investors should think about investing in much the same way, according to Richard Bernstein Advisors (RBA). The firm offers one option to do so in the multi-asset ETF, IRBA, the iMGP RBA Responsible Global Allocation ETF.

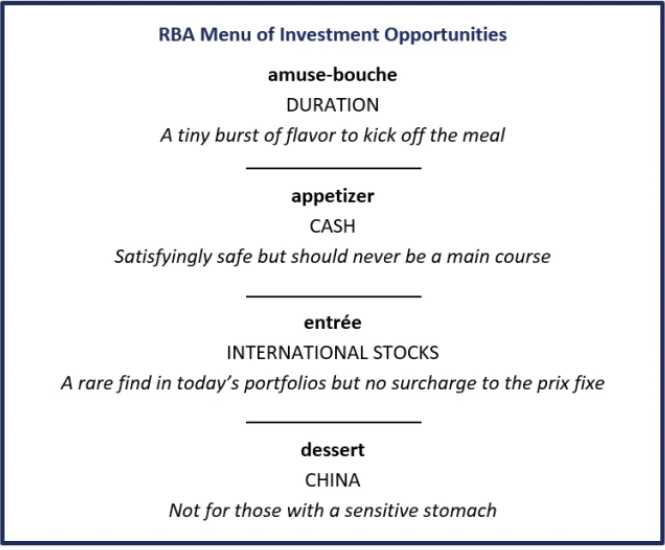

According to Dan Suzuki, the firm’s deputy chief investment officer (CIO), the firm’s “menu” includes both fixed income and equities. RBA offers a balanced menu ranging from the appetizer (cash) to a dessert that may not be for everyone (China).

IRBA’s “menu” of assets.

Suzuki notes that cash offers income and stability in the short term, while duration adds income and longer term upside. International stocks decrease concentration in overhyped bubbles with added profit and liquidity, too. These “dishes” emerge from a kitchen honed by RBA’s profits-oriented research, investing in sectors benefitting from accelerating or decelerating profits.

See more: “Q&A With RBA’s Director of Research, Lisa Kirschner”

For investors interested in that approach, IRBA’s multi-asset ETF investing style offers one option. IRBA actively invests across the asset spectrum, using an ETF-of-ETFs approach to craft a bespoke exposure with an ESG screen. IRBA invests across countries, sectors, styles, and more, from currencies and cash to commodities and even more. The ETF expects an allocation of 65% for equities and 35% for fixed income over ten years.

The Multi-Asset ETF Approach

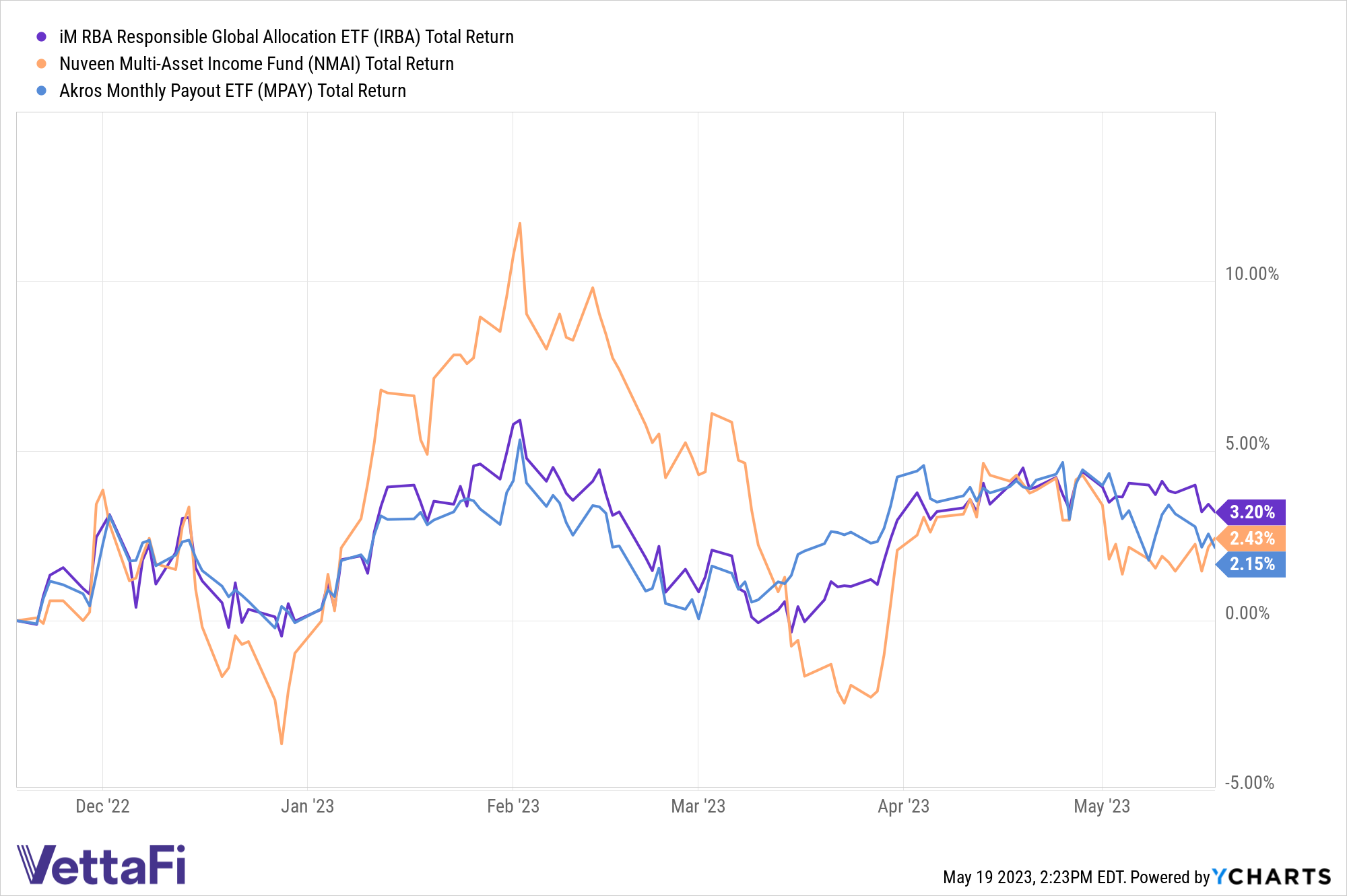

The strategy charges a 69 basis-point fee, weighting the iShares ESG Aware U.S. Aggregate Bond ETF (EAGG) at 30.8%. That makes EAGG its largest-weighted fund, followed by the iShares MSCI Global Sustainable Development Goals ETF (SDG) at 18%. Despite launching just last year, IRBA has outperformed rival multi-asset ETFs, according to YCharts.

IRBA compared to ETFs NMAI and MPAY

Combining assets together in one vehicle could boost investors’ portfolios in a complicated 2023. For those looking for a solid menu of asset options to hold at the cookout, IRBA may merit consideration.

For more news, information, and analysis, visit the Richard Bernstein Advisors Channel.