Delving deeper into the data, the Commerce Department reported retail sales fell 1.2 percent. In addition, November data was revised lower to show retail sales were up 0.1 percent as opposed to the previously reported 0.2 percent.

Economists polled by Reuters were forecasting retail sales to be up 0.2 percent in the month of December.

Earlier this year, the National Retail Federation (NRF) projected retail sales figures to grow from 3.8 to 4.4 percent, which is lower than the 4.6 percent growth experienced in 2018. Whether it hurts the ETFs will depend on how the market interprets the data, but the NRF says the forecast comes “despite threats from an ongoing trade war, the volatile stock market and the effects of the government shutdown.”

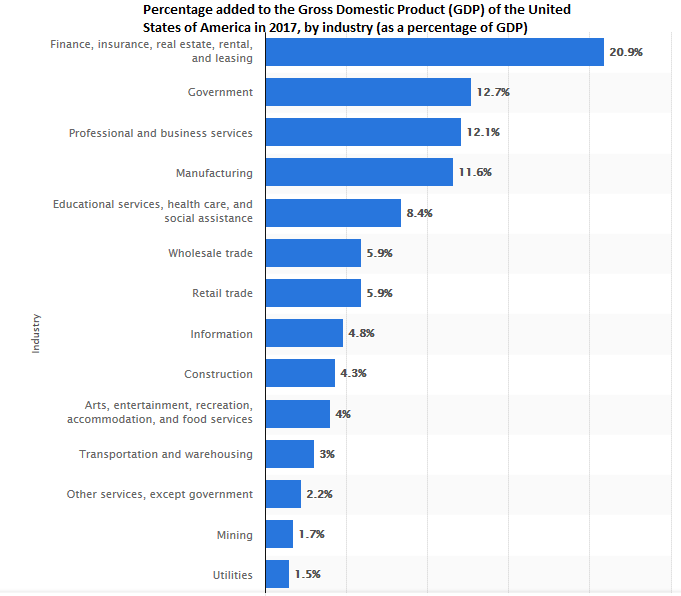

With the retail sector being a solid contributor to gross domestic product, investors can look to ETF plays featuring cyclical sectors versus defensive sectors.

For investors looking for continued upside in U.S. cyclical sectors over defensive sectors, the Direxion MSCI Cyclicals Over Defensives ETF (NYSEArca: RWCD) offers them the ability to benefit not only from cyclical sectors potentially performing well, but from their outperformance compared to defensive sectors.

Conversely, if investors believe that U.S. defensive sectors will outperform cyclical sectors, the Direxion MSCI Defensives Over Cyclicals ETF (NYSEArca: RWDC) provides a means to not only see defensive sectors perform well, but a way to capitalize on their outperformance compared to cyclical sectors.

For more information on the consumer sector, visit our consumer discretionary category.