Economic indicators are released every week to help provide insight into the overall health of the U.S. economy. Despite the economic calendar’s light load last week, there were still important releases that warrant attention. In this article, we explore three of those important economic releases from the past week: the S&P Global Services PMI, the ISM Services PMI, and the trade balance. By examining these data points, we gain a better understanding of the strength of the country’s services sector as well as the latest trajectory of the country’s economic growth.

Policymakers and advisors closely monitor economic indicators, such as these three, to understand the direction of interest rates, as the data can significantly impact business decisions and financial markets. In the week ending on June 8, the SPDR S&P 500 ETF Trust (SPY) rose 1.73%, while the Invesco S&P 500® Equal Weight ETF (RSP) was up 3.32%. The next interest rate decision meeting will be held June 13–14, and the Fed is currently split on what to do next.

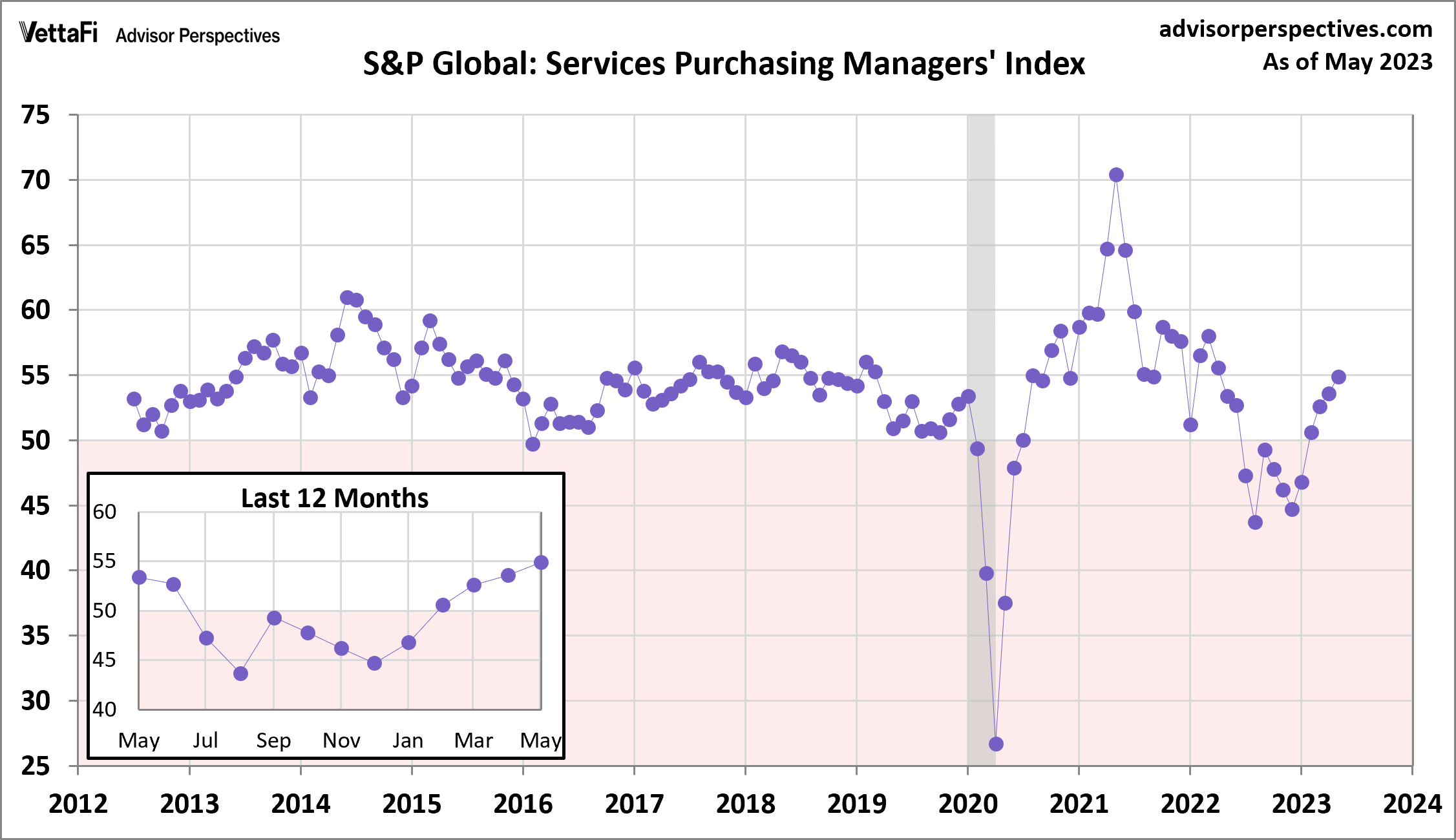

S&P Global Services PMI

The U.S.’s services sector showed continued growth in May, according to the S&P Global Services Purchasing Managers’ Index (PMI). In May, the index climbed to 54.9 — just below the 55.1 forecast. The latest reading marked the fourth consecutive monthly expansion and was the strongest pace in over a year.

The expansion in May was largely due to an upturn in employment, increased business and consumer confidence, and improved demand in both domestic and international markets. However, just as demand in the services sector has grown, so have inflationary pressures. Both input cost inflation and output charge inflation remained elevated in May. Service providers reported upward pressure on wages, and increased supplier prices led to greater business expenses. Consequently, those higher costs were passed along to consumers, which led to greater selling prices.

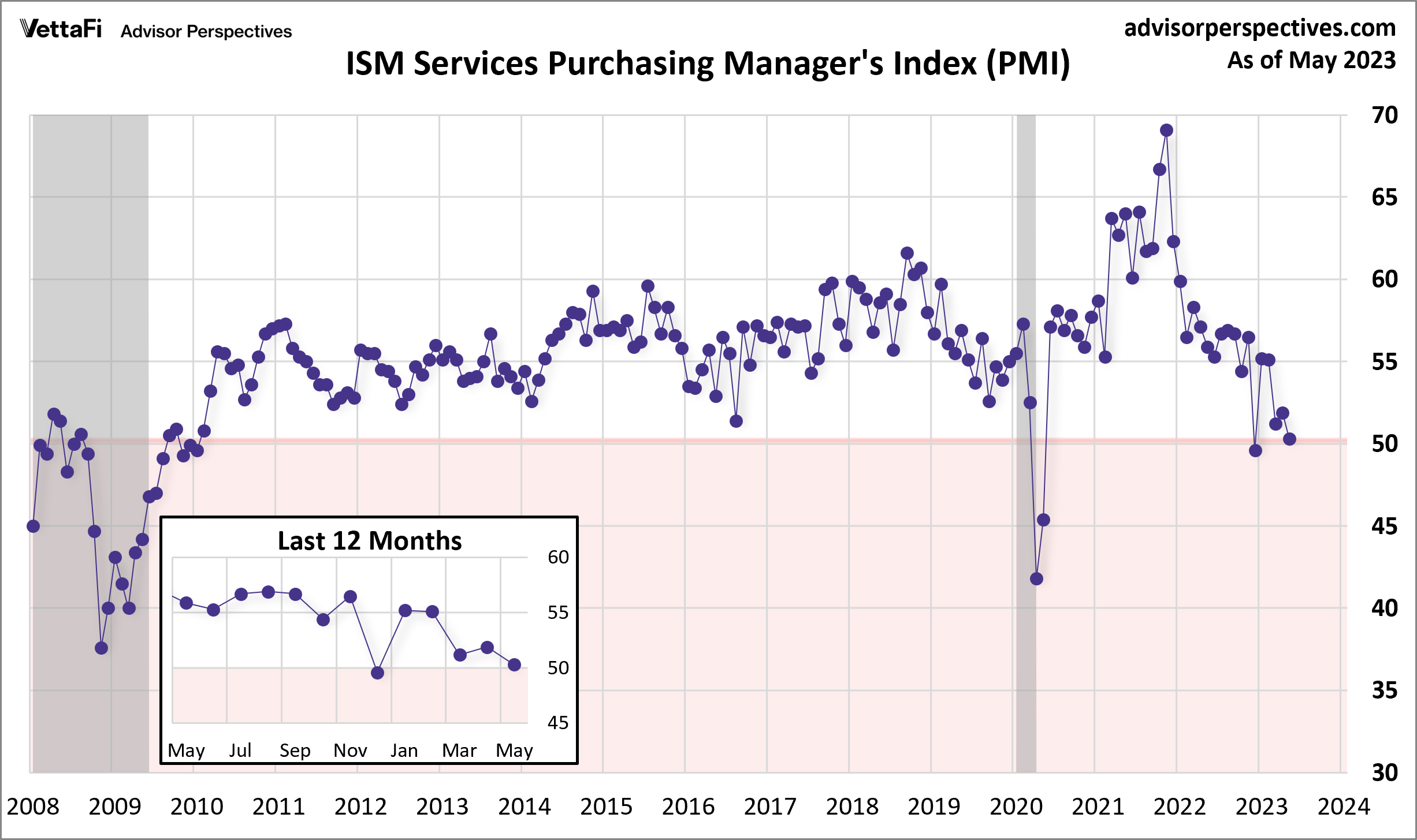

ISM Services PMI

Economic activity expanded in the services sector for the fifth straight month in May. The ISM Services PMI came in at 50.3, which was below the forecast of 51.8. For much of the index’s lifetime, the services sector has experienced sustained growth. Dating back to early 2010, the index has indicated monthly expansion (a reading above 50) for all but three months. With that said, this month’s reading is the lowest of all the expansion months during this time. This signals a significant slowdown in the rate of growth for the services sector.

The growth in May is from expansion in the index subcomponents of business activity, new orders, inventories, new export orders, and prices. The slower rate of growth is a result of decreases in the index subcomponents of employment and order backlog. Overall, the business conditions in the services sector are currently stable. However, respondents’ concerns about a slowing economy mirror the slowdown seen in the ISM services PMI since the end of 2021.

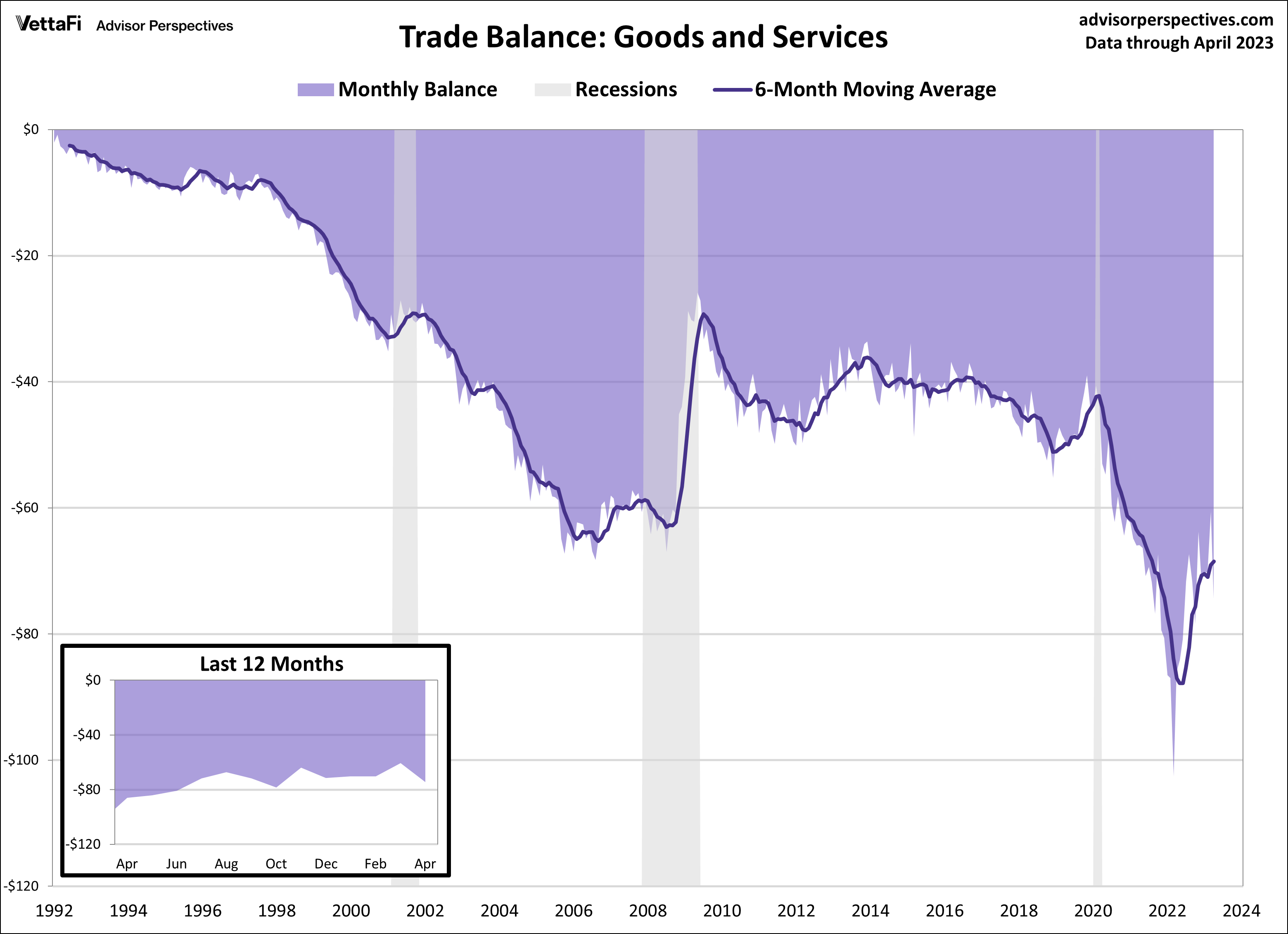

Trade Balance

The U.S. international trade deficit expanded by 23.0% in April to $74.6 billion due to a decrease in exports and an increase in imports. The trade balance reports on the country’s imports and exports of goods and services. The flows of foreign trade can help determine whether the overall economy is growing or not. In April, the goods deficit increased by $14.5 billion, while the services surplus increased by $0.6 billion. The latest reading showed the largest gap the trade balance has seen in the last six months. However, due to the extreme volatility of this monthly indicator, it’s best to look at the six-month moving average for a clearer picture of the overall trend. The six-month moving average dropped to $68.5 billion, its lowest level since August 2021.

Be on the lookout for these important indicators this week: consumer price index (CPI), producer price index (PPI), and retail sales. These reports will provide more insight into the U.S.’s inflation situation as well as consumer spending patterns. Headline CPI is expected to increase 0.3%, while core CPI is expected to rise 0.4% from April. Both headline and core PPI are forecasted to continue their slowdown to 1.1% and 2.9% year-over-year, respectively. Retail sales, which will impact interest in the SPDR S&P Retail ETF (XRT), are expected to show an increase of 2.2% year-over-year after posting a 1.6% increase in April.

For more news, information, and analysis, visit the Portfolio Strategies Channel.