“Our suffering is impermanent, and that is why we can transform it. And because happiness is impermanent, that is why we have to nourish it.”

Thich Nhat Hanh, The Art of Living

The View from 30,000 feet

Closing in on halfway through 2023, there are three words that can be used to describe the US economy – too much momentum. The financial markets, similarly, have their own catch phrase crystalizing around a singular theme – AI. With the release of Fed meeting minutes and a slew of data supporting persistent strength in the consumer and slower than hoped for progress in the battle against inflation, “Pause, Skip or Hike” has become the operative phrase for considering Fed policy, as well catchy new preschool playground game. Meanwhile, Congress and the Administration are engaged in preschool games of their own, triggering a downgrade in US debt from China’s rating agency and a warning from Fitch.

Ultimately, regardless of how messy it looks, the debt ceiling issue will be resolved and is likely to go down in history as only a distraction, but the residue will erode US credibility for years to come. Globally, revised GDP numbers from Germany indicate that the country has moved into a recession, and commodity prices are providing an ominous sign for China. With two out of three of the largest economic zones in the world, confirming a material slowdown, the argument that narrow leadership in the US founded in AI optimism can continue to lift all equities higher gets more perilous with each advance.

- The Fed is split on what to do next, but persistent data is boxing them into continuing to tighten policy

- Signs of a material slowdown continue to mount making each hike more perilous

- Theme of one – the story of 2023, there’s AI, and then there’s everything else

- The most Frequently Asked Question from client’s this week: If the economy is so strong can credit conditions really be that bad?

Fed is split on what to do next, but persistent data is boxing them into continuing to tighten policy

- The underlying message from Fed Meeting The Fed is divided into two camps:

- “retain optionality” camp – Driving the “pause” or “skip” narrative

- “additional policy firming” camp – Driving the “hike” narrative

- Just when the market was getting comfortable with it’s new preschool inspired “pause, skip or hike” headline, a fresh round of data and market action late in the week tipped the boat firmly in the hike camp.

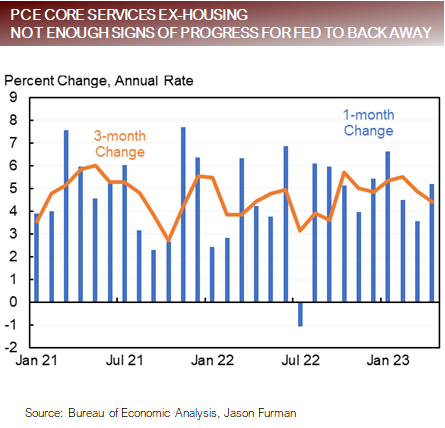

- PCE – Core Services Ex-Housing and PCE both came in above estimates and ticked up slightly for the month

- Consumer Spending – Reported nearly double the expected monthly advance

- Jobs – Initial Jobless Claims lighter than expected, with prior month revisions wiping away previous thinking on job market cooling

- Housing – Strength from builders and recent buying activity, suggesting burst of strength despite higher rates

- Parabolic Move in AI Stocks – NVIDIA’s blowout quarter driving manic buying of AI theme

- Bottom Line

- Although inflation has cooled from red hot, it’s still hot and not showing signs of returning to the 2% bound anytime soon. The economy is being supported by cash bloated consumers and companies who continue spend, which will keep the Fed’s foot on the brakes.

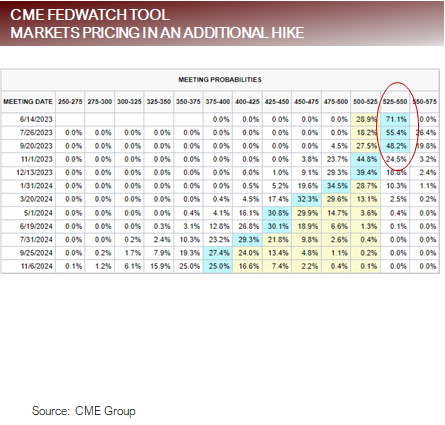

- Only 6 months ago the Federal Reserve Summary of Economic Projections, indicated the expected Fed Funds Rate at the end of 2023 would be 1%, with only two Fed dots on the dot plot indicating the Fed Funds Rate would be above 5.5%. As of Friday, there was a 71% probability that Fed Funds would reach 5.5% in June. It’s starting to feel like 2022 redux, with the Fed underestimating how far they have to go and the markets grossly underestimating the Fed’s commitment.

Strong inflation data not only pricing out cuts, but pricing in hikes

Signs of a material slowdown continue to mount making each hike more perilous

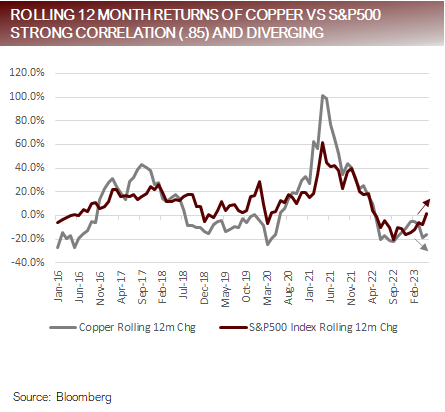

- Ominous signs from the commodity complex

- The Bloomberg Commodity Index down -11.3% YTD and over the last 12 months is down -4%.

- The S&P500 Index is up +9.5% YTD and over the last 12 months is up +1.8%.

- Since 2016 the S&P500 and the Bloomberg Commodity indices have had a 85 correlation (high correlation) for their rolling 12-month returns, with commodities consistently leading equities. Today the two indices are diverging, with commodities down and equities up.

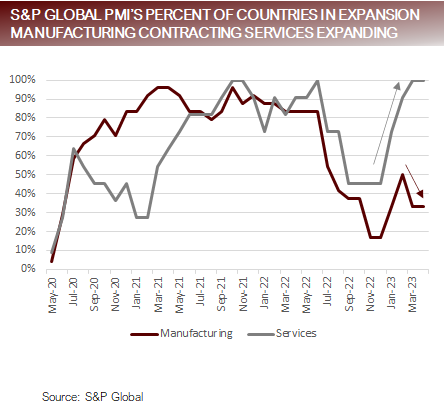

- Global Manufacturing PMIs hitting stall speed, while Services continue to accelerate, signaling sticky wage inflation

- When looking at the S&P Global PMIs for Manufacturing, the percentage of countries in expansion (PMI above 50), peaked in June of 2022 at 83%, and as since dropped to 33%.

- The S&P Global PMIs for Services, continues to pick up momentum with 100% of countries in expansion and the monthly measurement rising for the past 4 With labor being the biggest cost component, persistent strength in Services suggests continuing upward pressure on wages.

- Germany recession has arrived, and the third revision of Q1 US GDP shows signs that the US slowed more than expected

- The German ZEW Indicator of Economic Sentiment fell from 1 to -10.7 in May, falling below 0 for the first time since March of 2022.

- Although German exports were higher by 4% in Q1, shipments to China fell -12%, signaling the follow through from China re-open momentum is waning (and confirmed by commodity prices). Hopes for a strong Chinese recovery have faded and taken down with them the European luxury stocks such as LVMH and Gucci, with the sector losing $60b in market cap over the last week.

- German GDP was revised lower to -0.3% in Q1, following a contraction of -0.5% in Q4.

- With Euroarea inflation still above 7% and its largest economy entering into recession, the probabilities for a smooth outcome for the Euroarea have diminished.

- Averaging GDP and GDI (also known to econo-geeks as GDO) provides a reading of -0.5% for Q1, to add to the -0.4% decline in Q4, and signaling that the weakness in the US economy may be more pronounced than coincident data is indicating.

Signs that the global manufacturing sector is contracting in commodity and PMI data

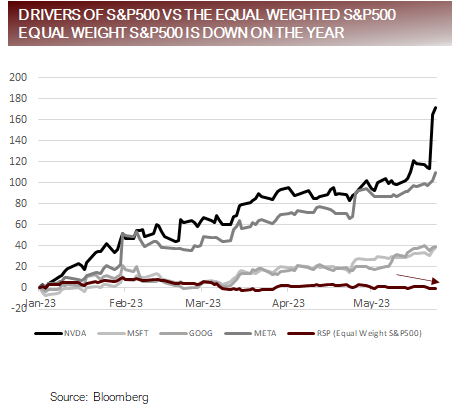

Theme of one – the story of 2023, there’s AI, and then there’s everything else

- NVIDIA added $207b to its market cap last To put this in context, according to Bloomberg the two-day gain last week was larger than the market cap in all but the top 48 largest companies in the world.

- NVIDIA strength propelled the stock to the extreme range of overbought, with an RSI of above 80. Perhaps this time will be different based on follow through from explosive guidance, but each of the last four occasions the stock traded with an RSI above 80, it was significantly lower in the following months.

- The AI story being propelling NVIDIA higher (25x current year sales) has also propelled buyers into to Microsoft, Meta and Alphabet, each of which are major participants in the AI frenzy.

- Perhaps it’s worthwhile taking a look at some of the metrics of the markets. The table below highlights Friday’s closing values versus market highs since the top of the market in January 2022. This analysis highlights that the current rally is taking place against a backdrop of weaker breadth, higher interest rates and wider spreads, indicating not all is well under the surface.

Narrow rally in thematic tech names is reminiscent of late 1990’s and early 2000’s

FAQ: If the economy is so strong can credit conditions really be that bad?

- Findings from the Atlanta Fed Survey of Business Uncertainty – Special Questions on Credit – posted on Federal Reserve of Atlanta’s blog

- The survey was conducted based on national sampling from private nonagricultural employers.

- Of applicants who applied for credit in the 3 months, 89% received the entire amount requested.

- Companies applying for credit tended to be larger (greater than 250 employees) in current the period as compared to prior periods, 40% this year vs. 30% last year.

- Smaller companies (less than 250 employees) tend to utilize smaller banks (44%) larger companies (17%).

- 25% of companies seeking credit are doing so to refinance existing lines of credit.

- 21% of companies said they were not planning on seeking additional credit because rates were too high.

- 60% of companies surveyed indicated that have enough cash on hand to cover expected activity over the next year.

- Conclusions

- Companies are holding high cash balances and are scaling back demand for credit because interest rates are viewed as too high.

- Smaller companies have a disproportionally high exposure to smaller banks who may be most adversely impacted by the rapid rise in interest rates over the last year and will be most likely to tighten credit.

- Although banks have indicated they are tightening standards, the vast majority of those companies seeking credit still have access to credit, but they are paying a higher rate.

- With 25% of companies being forced to refinance in the next year, and a view that rates are too high, with smaller companies having the largest exposures to the most vulnerable banks, smaller companies will be looking to scale back spending needs.

Credit standards and demand lagging being helped by companies’ high cash balances

Putting it all together

- Data and price action in the markets poured cold water on the notion that the Fed planned to cut rates in Hotter than expected data and signs that risk taking is coming back to life will keep the Fed on guard for the foreseeable future.

- PCE came in hotter than expected

- Consumer Spending was better than expected

- Revisions in jobless claim data erased signs that labor market was cooling

- The housing market continued to show signs of life, in spite mortgage rates skyrocketing

- Equites have latched on to a thematic trade around AI that has created a parabolic rise in a handful of names and reignited animal spirits

- Coincident data is popping and so are a handful of equities, which is serving to build a base of confidence that the current rally might be sustained.

- However, the latest reading on Q1 GDP, leading data and the broader base of the market are weak.

- How long the current rally lasts is debatable and so is how it ends, but the probabilities continue to point to it ending in tears. The key to how long the rally is sustained will be based on three factors:

- How long the parabolic move in AI names can continue

- How long the bloated post-pandemic cash balances last

- How long the strength in the job market is sustained

For more news, information, and analysis, visit VettaFi | ETF Trends.

DISCLOSURES AND IMPORTANT RISK INFORMATION

Performance data quoted represents past performance, which is not a guarantee of future results. No representation is made that a client will, or is likely to, achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Focus Point LMI LLC

For more information, please visit www.focuspointlmi.com or contact us at [email protected] Copyright 2023, Focus Point LMI LLC. All rights reserved.

The text, images and other materials contained or displayed on any Focus Point LMI LLC Inc. product, service, report, e-mail or web site are proprietary to Focus Point LMI LLC Inc. and constitute valuable intellectual property and copyright. No material from any part of any Focus Point LMI LLC Inc. website may be downloaded, transmitted, broadcast, transferred, assigned, reproduced or in any other way used or otherwise disseminated in any form to any person or entity, without the explicit written consent of Focus Point LMI LLC Inc. All unauthorized reproduction or other use of material from Focus Point LMI LLC Inc. shall be deemed willful infringement(s) of Focus Point LMI LLC Inc. copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Focus Point LMI LLC Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Focus Point LMI LLC Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

All unauthorized use of material shall be deemed willful infringement of Focus Point LMI LLC Inc. copyright and other proprietary and intellectual property rights. While Focus Point LMI LLC will use its reasonable best efforts to provide accurate and informative Information Services to Subscriber, Focus Point LMI LLC but cannot guarantee the accuracy, relevance and/or completeness of the Information Services, or other information used in connection therewith. Focus Point LMI LLC, its affiliates, shareholders, directors, officers, and employees shall have no liability, contingent or otherwise, for any claims or damages arising in connection with (i) the use by Subscriber of the Information Services and/or (ii) any errors, omissions or inaccuracies in the Information Services. The Information Services are provided for the benefit of the Subscriber. It is not to be used or otherwise relied on by any other person. Some of the data contained in this publication may have been obtained from The Federal Reserve, Bloomberg Barclays Indices; Bloomberg Finance L.P.; CBRE Inc.; IHS Markit; MSCI Inc. Neither MSCI Inc. nor any other party involved in or related to compiling, computing or creating the MSCI Inc. data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice.

Important Disclosures

This communication reflects our analysts’ current opinions and may be updated as views or information change. Past results do not guarantee future performance. Business and market conditions, laws, regulations, and other factors affecting performance all change over time, which could change the status of the information in this publication. Using any graph, chart, formula, model, or other device to assist in making investment decisions presents many difficulties and their effectiveness has significant limitations, including that prior patterns may not repeat themselves and market participants using such devices can impact the market in a way that changes their effectiveness. Focus Point LMI LLC believes no individual graph, chart, formula, model, or other device should be used as the sole basis for any investment decision. Focus Point LMI LLC or its affiliated companies or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. Neither Focus Point LMI LLC nor the author is rendering investment, tax, or legal advice, nor offering individualized advice tailored to any specific portfolio or to any individual’s particular suitability or needs. Investors should seek professional investment, tax, legal, and accounting advice prior to making investment decisions. Focus Point LMI LLC’s publications do not constitute an offer to sell any security, nor a solicitation of an offer to buy any security. They are designed to provide information, data and analysis believed to be accurate, but they are not guaranteed and are provided “as is” without warranty of any kind, either express or implied.

FOCUS POINT LMI LLC DISCLAIMS ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY, SUITABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE.

Focus Point LMI LLC, its affiliates, officers, or employees, and any third-party data provider shall not have any liability for any loss sustained by anyone who has relied on the information contained in any Focus Point LMI LLC publication, and they shall not be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the information or opinions contained Focus Point LMI LLC publications even if advised of the possibility of such damages.