Economic data seems all over the place. GDP is up 2.4% for the second quarter, a bigger increase than we saw in the first quarter. Inflation seems to be cooling, but the Fed also just hiked rates by a quarter point and is likely to do so again this year.

Consumer confidence is at its highest level in two years, and the job market is weakening somewhat but remains elevated. In the stock market, growth is definitively outstripping value’s performance, and market breadth is improving.

Is this situation as unprecedented as it seems? How solid or fragile is the U.S. economy right now? What risks should investors be watching out for or preparing for? Is fixed income a safe harbor in a scenario like this?

Mild Recession Expectations

Todd Rosenbluth, director of research: I’m not sure I’m smart enough to talk about how fragile the economy is, but thankfully we can leverage. This week, VettaFi hosted a fixed income symposium with David Braun, portfolio manager of the PIMCO Active Bond ETF (BOND), kicking off the event. (Catch the replay.)

David said that PIMCO is seeing a mild recession for the latter part of this year or early next year. The firm’s forecast expects the Fed’s significant tightening to impact lending. According to PIMCO’s research, he said, tight monetary policy usually works with a six- to eight-quarter lag — and we’re right “smack in the middle” of that range.

“There’s no reason to go play the role of a hero right now and go out and buy a lot of below investment grade bonds, junk bonds that are closer to default,” Braun added. “You’ve got to be humble in this environment, a lot of uncertainty. Make sure you have liquidity, make sure you have resiliency in your portfolio, and make sure you have dry powder to take advantage of volatility overshoots, which are likely to be inevitable in the coming year.”

He favored agency mortgages.

A Possible Recovery Phase

I also moderated a webcast on Tuesday with Invesco where they talked about how the U.S. economy was growing below trend but was still growing, and inflation expectations had declined meaningfully. Invesco viewed the U.S. as being in a recovery phase. The focus to them should be on investment-grade corporates and intermediate-duration government bonds.

Invesco offers its own actively managed core bond fund, the Invesco Total Return Bond ETF (GTO). The fund invests in high-grade government and corporate bonds. For those advisors looking at investment-grade corporates, the Vanguard Intermediate-Term Corporate Bond ETF (VCIT) and the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) are the two largest ETFs. They have durations of roughly six and eight years, respectively.

I’ll defer to Jen Nash about the historical perspective of the economic data.

A Psychological Disconnect

Dave Nadig, financial futurist: I think part of why folks are sort of “nervous” about markets is that there’s a psychological disconnect between various things in the economy and market. For example: There’s absolutely a narrative that labor is in a strong position, consumers are bullish, companies are reporting great earnings, and inflation may be coming under control. That all sounds swell.

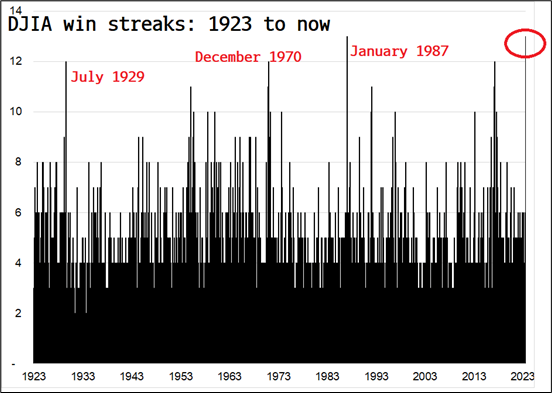

But at the same time, win streaks on low-vol like we’ve had historically don’t end well (chart courtesy of Spectramarkets.com):

That’s just one of a dozen “bear” charts you’ll find floating around in permabear circles. But I think there’s a missing piece to the dynamic. Markets are increasingly disconnected from economic fundamentals for very real structural reasons.

We’re covering this in a webinar on Monday, but the main issue we’ll be investigating is whether the insane rise in 0DTE (zero days to expiration) options has effectively conned the market into thinking there’s no volatility anymore. So much dealer hedging is going on in the index options that any positive Gamma means the market really can’t move more than a percent or two in either direction because so much has to be bought or sold countercyclical to any market move.

So it’s absolutely possible that simply for flow and structural reasons, the market could grind higher, with low volatility, while the actual economic underpinnings start to deteriorate into a recession. The phrase I’ve heard from traders this morning is: It feels stupid to be bearish stocks, but crazy to be optimistic. (Credit to Brent Donnelly of Spectra for that one…)

Quality Factor Could See Demand

Rosenbluth: If it is stupid to be bearish and crazy to be optimistic, Dave, then quality should remain in vogue. Whether that’s free-cash-flow-focused ETFs like the Pacer US Cash Cows 100 ETF (COWZ) and the VictoryShares Free Cash Flow ETF (VFLO) or broader quality ones like the Invesco S&P 500 Quality ETF (SPHQ) and the iShares MSCI USA Quality Factor ETF (QUAL), companies with stronger balance sheets and solid growth are going to be in demand.

Jen Nash, economic and market research analyst: It was no surprise the Fed raised rates at Wednesday’s meeting. However, it will be interesting to see if another hike occurs later this year. At this point, every piece of economic data will play a critical role in its decision-making.

In terms of the economic data, consumers are driving the economy right now. Consumer spending is what propelled much of Q2’s GDP growth. Consumers are feeling the best they have in the last few years (as seen by the CB consumer confidence index and the Michigan sentiment index). This is largely because of easing inflation and positive feelings regarding the labor market. Consumers see jobs as plentiful, so there isn’t much concern about employment and income in the next six to 12 months.

Inflation Data Is Key

Something to consider, however, is the end of the student loan pause. Over the past few years, consumers have had an extra few hundred dollars each month for discretionary spending. That will no longer be the case in a few months. Regarding inflation, I think [Friday’s] PCE price index reading will be crucial.

We’ve seen CPI drop tremendously over the past year from 9.1% in June 2022 to 3.0% in June 2023. So yes, inflation is easing. However, the Fed’s favored measure of inflation, which is core PCE, has hung around the 4.6%-4.7% range over the last six months, so the fight to get to the 2% target still has a long way to go. [Inflation data released Friday morning included a 4.1% rate for core PCE.]

Tom Lydon, vice chairman: Excellent points all around. A year ago, financial advisors’ number-one concern was inflation. Today, it’s market volatility. Only 16% of financial advisors are most concerned about inflation.

If Dave is right and index option activity is masking volatility, most advisors and investors don’t know it. We’ve seen years like this before where we’re coming out of a bear market, markets are stabilizing, and investors don’t believe it. Hence the $6.2 trillion in money market funds.

Post-Labor Day will be interesting. If the economy is stable, inflation continues to decline, and earnings continue to beat expectations, we could see a FOMO rally going into the fall.

Valuation is the second-biggest concern for financial advisors today and, when looking at the S&P 500, it’s justified. Have you noticed that the Russell 2000 has been keeping pace with the S&P 500 the last three months? Are investors finally buying mid- and small-caps? After a decade, I think we’d all appreciate it if the pendulum swung.

Lengthening Duration

Finally, following our Fixed Income Symposium this week, we’re seeing that advisors are confident enough to go longer-duration going into 2024. Most feel the Fed is doing its job and, if we do have a recession, it won’t be that painful. The big takeaway was that many advisors are getting creative in the way they’re capturing income. Alternative income strategies are here to stay as yields are attractive and most have volatility controls.

Rosenbluth: Tom, in a piece I published based on another advisor survey (we love hearing from advisors at VettaFi!) there was some confidence that mid- and small-caps would do better than large-caps. Twenty-five percent of respondents chose mid-caps, and 22% chose small-caps when asked which style is going to perform best in the second half compared to just 33% picking large-caps. Year-to-date, the iShares Core S&P 500 ETF (IVV) is beating the iShares Russell 2000 ETF (IWM) by over 600 basis points, though as you note, small-caps have been in the lead in recent months.

Roxanna Islam Swan, associate director of research: I like how Dave put it — it’s stupid to be bearish on stocks but also crazy to be optimistic. I think recession chances are further away now, and many people aren’t expecting a recession for another few years. So there is some relief there, but there’s still a lot of caution around how long the market can remain strong. 2022 was very recent, so it’s still fresh in our minds how fast things can deteriorate.

For more news, information, and analysis, visit the Portfolio Strategies Channel.