The biggest investors are thinking differently about the macro picture this year. The same holds true for portfolio construction. In a recent survey from Natixis Investment Managers, fund selectors indicated that 2024 uncertainty means better positioning in existing allocations and a strong preference for active strategies this year.

Despite a changing market regime, fund selectors aren’t looking to shake up anything significantly in how they’re approaching portfolio construction. Instead, this year is all about enhancing return potential and mitigating risk, given the macro outlook. You can find a summary of fund selectors’ macro perspectives here.

The 2024 Natixis Global Fund Selector Outlook Survey included 500 investment professionals from 26 different countries with a combined AUM of nearly $35 trillion. Conducted between November and December 2023, results underscored the challenges investors face this year.

Opportunities for Portfolio Construction This Year

Widespread increased volatility is expected this year, and 62% of fund selectors are looking to large caps for performance. Despite increased volatility, “most believe dispersions (47%) and correlations (47%) will remain the same,” explained Dave Goodsell, executive director, Natixis Center for Investor Insight, the author of the survey.

Image source: Natixis Asset Managers

Arguably, the biggest shift is regarding active strategies. Overall, 58% of fund selectors revealed that active strategies outperformed passive on their platforms last year. Nearly two-thirds (63%) believe active strategies will outperform this year.

“Given an uncertain outlook, 75% believe active investments will be essential to finding alpha in 2024,” Goodsell wrote.

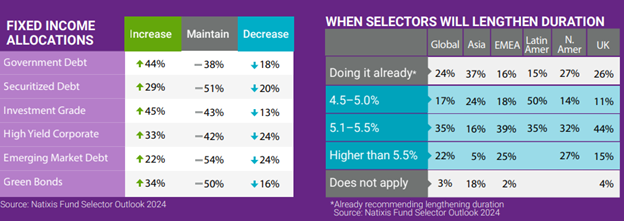

On the bonds side, timing duration remains the largest challenge this year. Six in 10 (62%) of fund selectors believe long duration will perform better than short duration this year. However, only a quarter of selectors have moved into longer-duration bonds. As they wait for the Fed to begin cutting rates, 61% of fund selectors hold positions in short-duration bond ETFs to counterbalance portfolio duration risk.

Image source: Natixis Asset Managers

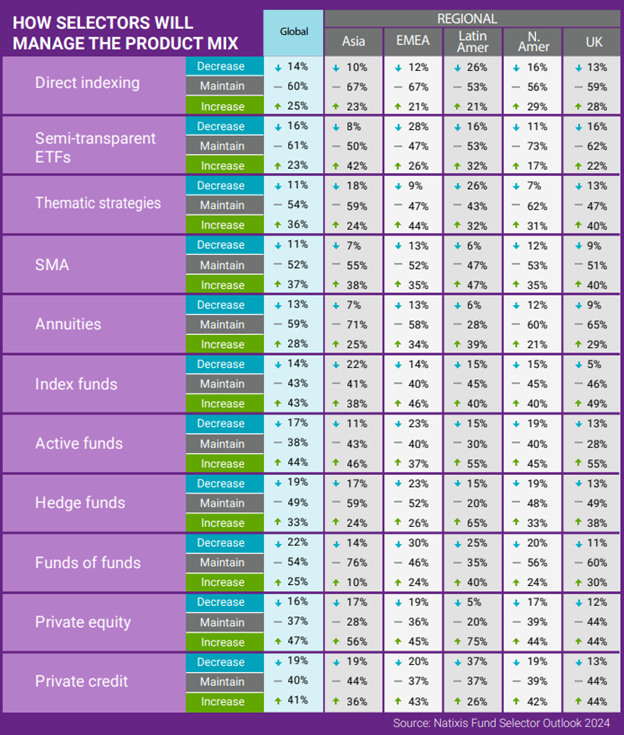

Alternatives flourished in 2023, while market uncertainty remained pronounced. This year will likely be about maintaining existing exposures and honing in on pockets of opportunity. The biggest areas in which fund selectors are looking to increase allocations are private assets, specifically private equity (55% are bullish) and private debt (57% bullish).

“Overall, almost two-thirds (66%) of those surveyed believe there is a significant delta between the returns of private and public markets,” explained Goodsell.

Model Portfolios Shine in 2024

Of the 500 fund selectors surveyed, 85% reported their firms offer model portfolio options, whether in-house (65%) or third-party (26%). However, third-party model managers are likely to take increasing market share as more firms look to expand their offerings for clients this year.

The increased popularity of model portfolios comes from dual drivers of increasing firm interest as well as growing client demand. Core benefits of model portfolios for clients include an additional layer of due diligence and increased retention in uncertain times. Meanwhile, on the firm side, cited benefits include streamlining as well as better risk management.

“At a time when firms are asking advisors to provide a more comprehensive planning relationship, 63% say models help advisors to deepen their client relationships,” Goodsell wrote.

The growth of model portfolios also brings along with it an increase in specialty models. Key areas that fund selectors are looking at this year include high net worth, thematic, and ESG models.

For more news, information, and analysis, visit the Portfolio Construction Channel.