It’s no secret that the investing playbook continues changing to meet the unique macro environment and evolving market regime. As revealed in a recent Natixis Investment Managers survey, fund selectors, in particular, are reassessing how they approach and think about the challenges and opportunities for investors this year.

As investors contend with various risk factors, complexity, and uncertainty remain key elements of 2024 markets. The 2024 Natixis Global Fund Selector Outlook Survey included 500 investment professionals from 26 different countries with a combined AUM of nearly $35 trillion. Conducted between November and December 2023, results underscored the challenges investors face this year.

Overall macro uncertainty weighed on long-term return assumptions that dropped from 8.8% in 2023 to 6.3% this year. Increasing concern about the resilience of consumers and the job market led to elevated concerns regarding the economy. Recession risk amid slowing growth forecasts ranked highest (52%) for economic concerns, with stagflation risks elevated as well.

“Ultimately, projections for a recession may actually be a case of preparing for the worst and hoping for the best,” Dave Goodsell, Executive Director, Natixis Center for Investor Insight, the author of the survey, wrote.

Close on the heels of recession worries is war and terrorism this year for 50% of respondents. It’s not unsurprising, given the current geopolitical arena. Other major risk factors closely watched this year include the timing of interest rate cuts and escalating energy prices.

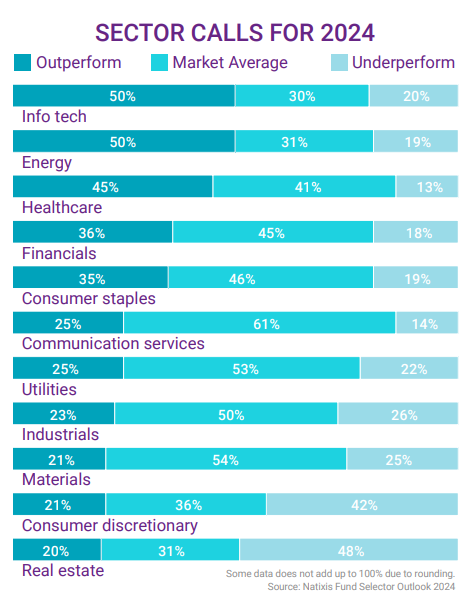

Where Fund Selectors See Opportunity

Despite the uncertainty and a muted outlook, fund selectors see several pockets of opportunity. The technology sector looks to be a primary beneficiary in an environment of rising energy prices and recession risk.

Image source: 2024 Natixis Global Fund Selector Outlook Survey

Fund selectors also believe AI will remain a fount of opportunity in 2024. “In fact, two-thirds believe AI will supercharge growth for the tech sector. Most think the boom will be sustainable, as only 34% think AI is a bubble,” wrote Goodsell.

There exists strong bullish sentiment for bonds in 2024, given expectations of rate cuts and easing inflation. Overall, 70% of respondents believe Europe, Middle East, and Africa (EMEA) bonds look best this year, followed by UK bonds at 66% and U.S. bonds at 65%. Other pockets of opportunity within fixed income in 2024 include private debt.

‘Valuations Matter in 2024’

Equities are a mixed bag this year, with fund selectors split on bullish or bearish sentiment. Of the global equity markets, North America carries the most optimism (55% bullish), but investors should beware of high valuations.

“In fact, more than two-thirds (69%) of fund selectors globally are concerned that valuations still do not reflect company fundamentals,” explained Goodsell. “Given prospects for a more volatile market, more than three-quarters (77%) of those surveyed predict that markets will recognize that valuations matter in 2024.”

Overseas, China, and global growth concerns weigh heavily on emerging market equity outlooks. While EM markets aren’t believed to outperform, they still present investment opportunities. Approximately half of the fund selectors plan to maintain current EM exposures, and over a third plan to increase their allocations. Areas of opportunity include Asia ex-China, Eastern Europe, and Latin America.

Image source: 2024 Natixis Global Fund Selector Outlook Survey

Stay tuned for part 2, a discussion of how the fund selectors’ macro outlook translates to portfolio construction and strategy selection.

For more news, information, and analysis, visit the Portfolio Construction Channel.