The 2020 coronavirus market slide may seem like a distant memory today, but it taught investors some important lessons. One lesson was that when the going gets tough, it’s best to side with sturdy companies while eschewing financially flimsy fare.

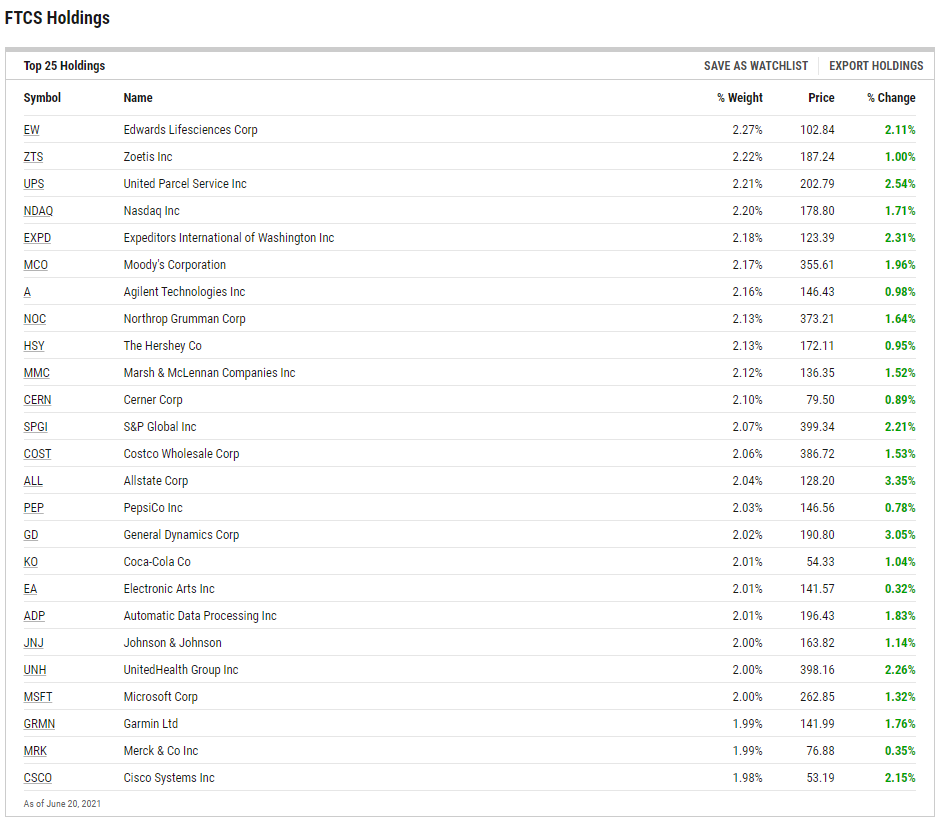

Investors that want to focus on companies with legitimate financial strength can find a basket of those names in the First Trust Capital Strength ETF (FTCS). The $8 billion FTCS tracks the Capital Strength Index.

“The Capital Strength Index seeks to provide exposure to well-capitalized companies with strong market positions that have the potential to provide their stockholders with a greater degree of stability and performance over time,” according to Nasdaq Global Indexes. “The companies are screened so that the index constituents generally have strong balance sheets, a high degree of liquidity, the ability to generate earnings growth, and a record of financial strength and profit growth. The Index is composed of 50 stocks selected objectively based on cash on hand, debt ratios and volatility. The index components are equally weighted at each quarterly rebalance.”

Breaking Down the FTCS Methodology

One of the key points regarding the early 2020 equity market slide was that companies with weak balance sheets were exposed. Those proved to be among the more volatile names when stocks tumbled and many were dividend offenders, cutting or suspending payouts.

FTCS goes in the opposite direction, focusing on balance sheet strength, lack of leverage, and low volatility as criteria for inclusion. The 51 components in the First Trust ETF are “ranked by a combined short-term (90 days) and long-term (260 days) realized volatility,” according to the issuer.

FTCS also features quality traits, which are relevant for long-term investors due to the durability of the quality factor. Additionally, the quality factor could be poised to come back into fashion as the economic recovery moves into the mid-cycle phase. The First Trust ETF mandates that member firms have long-term debt-to-market capitalization ratios of less than 30% and return on equity (ROE) exceeding 15%.

The ETF has another advantage: its components are equally weighted, a methodology that’s topping cap-weighted benchmarks this year. In other words, single stock risk is minimized in FTCS.

Industrial stocks account for almost 30% of the fund – the highest industry weight permitted by the fund’s rules. Healthcare and consumer staples names combine for over 36%. No energy, materials, real estate, and utilities stocks currently reside in FTCS.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.