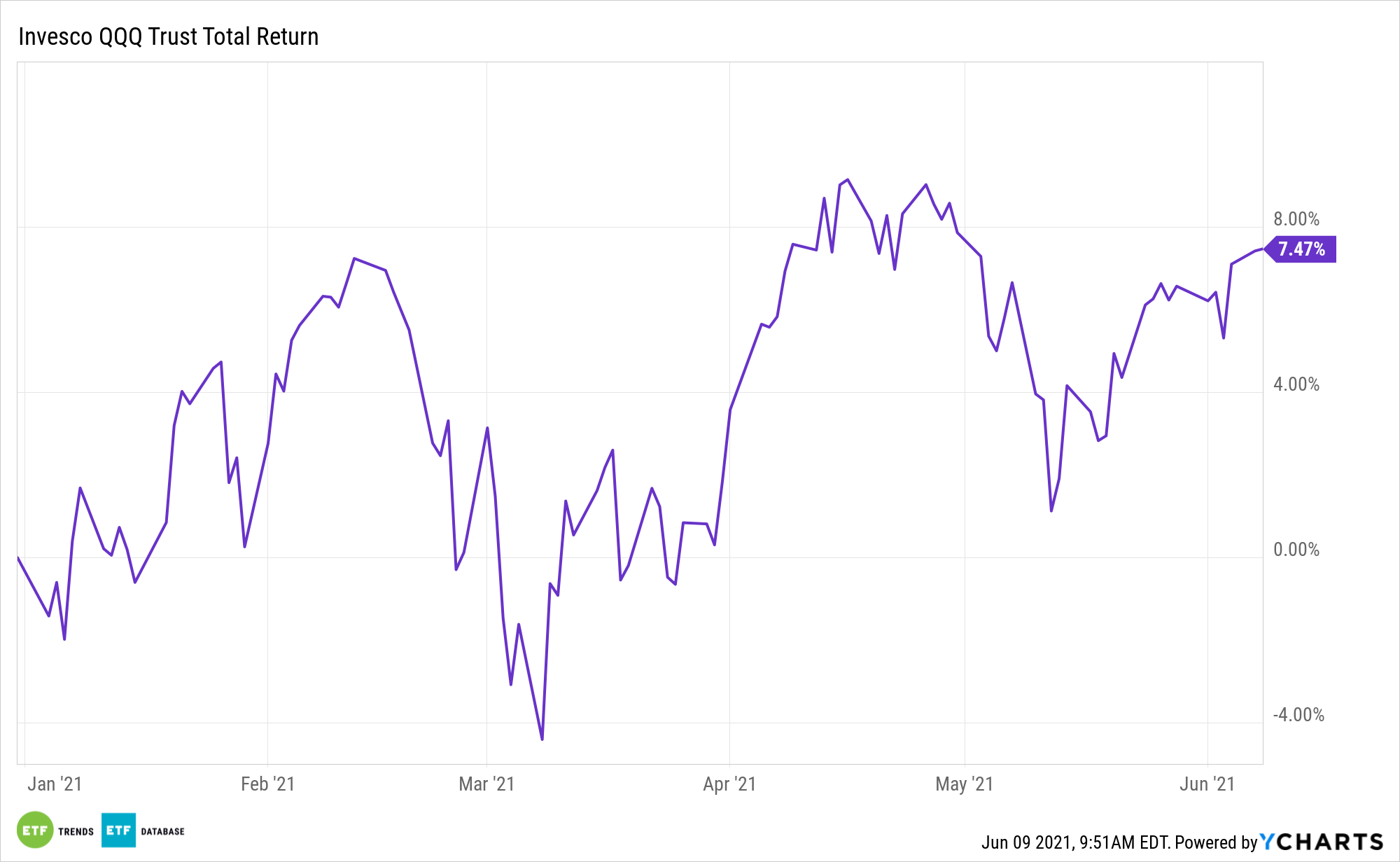

The Invesco QQQ Trust (QQQ) is up 7.29% year-to-date, well off the nearly 13% pace set by the S&P 500, but investors should remember the exchange traded fund and the Nasdaq-100 Index (NDX) have history on their side.

It’s not complicated explaining QQQ’s lethargy in 2021. The fund allocates over 68% of its weight to technology and communication services stocks.

After being in a slumber for the better part of a decade, value’s run may last awhile with support from the rebounding U.S. economy. However, investors shouldn’t be eager to bet against QQQ and the NDX. In 11 of the past 13 years, the Nasdaq-100 Index topped the S&P 500, according to Nasdaq Investment Intelligence. Important to skittish investors is that NDX doesn’t deliver added volatility alongside its stellar long-term track record.

“One year rolling volatility (calculated by taking the standard deviation of daily returns, annualized) was 93% correlated between Dec. 31, 2007 and March 31, 2021, when comparing the two indexes,” notes Nasdaq. “Given the large exposure the Nasdaq-100 has towards Technology, the ability for the Nasdaq-100 to closely track the volatility of the S&P 500 is rather impressive.”

With QQQ, NDX Sector Weights Matter

As noted above, QQQ allocates over 68% of its weight to tech and communication services stocks. Throw in the 17.12% weight to consumer discretionary names and that’s over 85% of the fund.

Due to a nearly 2% year-to-date loss by Amazon (NASDAQ: AMZN) – a QQQ holding and the largest component in cap-weighted consumer discretionary indices – that sector is lagging in 2021 as well, up less than 7%. For now, those sector exposures may be frustrating for QQQ investors, but there remains substantial long-term promise in those groups, cementing the notion that the fund’s sector weights are suitable for long-term investors.

“The long-run growth trend of companies in these industries has remained strong in spite of the widespread economic disruption from the COVID-19 pandemic,” according to Nasdaq. “Given the way technology is influencing the world and making companies more efficient, there is a strong possibility that this trend continues into the future.”

One way for investors stay engaged with QQQ and NDX is to remember that tech and many of the communication services names that used to be part of that sector knocked the cover off the first-quarter ball when it comes to beating earnings estimates. As more ex-U.S. economies – important due to tech’s export-heavy status – shake off the effects of the coronavirus pandemic, earnings growth could quicken and support further QQQ upside.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.