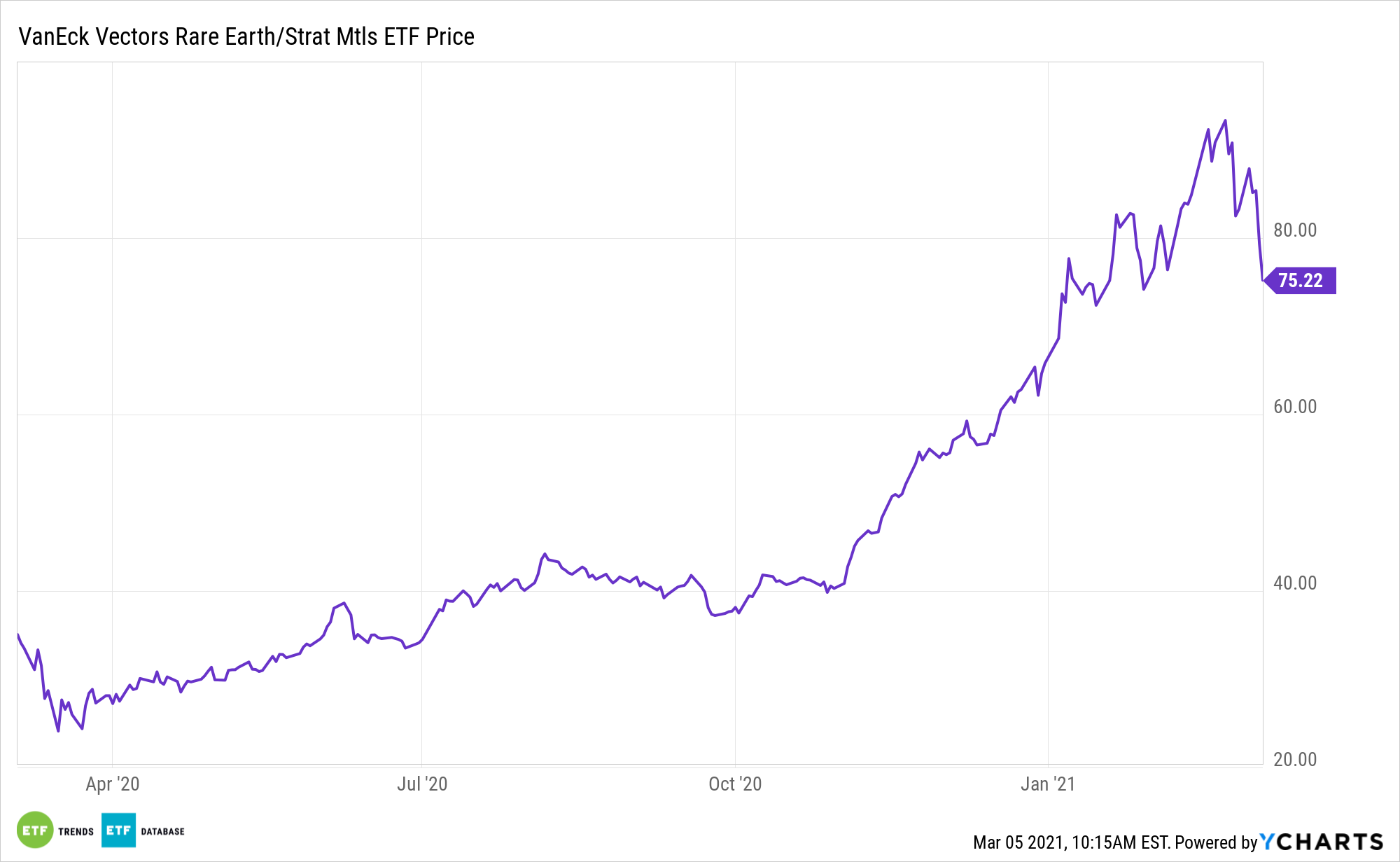

Whether its clean energy, consumer electronics, or national defense, rare earths may not get the limelight they deserve. Yet they are pivotal parts of our everyday lives, with opportunity abounding in ETFs like the VanEck Vectors Rare Earth/Strategic Metals ETF (NYSEArca: REMX).

REMX seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS Global Rare Earth/Strategic Metals Index (MVREMXTR), which is intended to track the overall performance of companies involved in producing, refining, and recycling of rare earth and strategic metals and minerals. REMX offers investors the opportunity to participate in the rare earth metals arena, without as much of the risk presented when investing in individual rare earth stocks.

REMX is worth considering as a tactical allocation at a time when the U.S. and other major developed economies are looking to grow rare earths stockpiles while reducing dependence on China.

“The U.S. domination of the global rare earth market began to decline in the 1980s-90s as American firms relocated their factories to countries with fewer regulations and lower wages,” notes VanEck analyst Meghana Pakala. “At the same time, the Chinese government was developing its own domestic manufacturing and trade capabilities, and a surge in production of rare earth elements in the 1990s saw a shift in supply and prices. As China increased its own exports and acquired offshore companies, it grew to control 80% of global supply by 2019.”

Reviewing REMX Potential

Given their sheer size, it’s no surprise to see that the two largest economies poised for growth in the rare earth metals industry. Thanks to their large economies of scale, the U.S. and China will experience exponential growth that could help propel REMX to further gains.

“The urgency to establish domestic sources of rare earths has been accelerating as the world becomes increasingly aware of the threat of climate change and the unsustainable cost of fossil fuels. Governments and corporations alike have acknowledged that new sources of energy are necessary to power the economy and support the population, and rare earths are essential to this effort,” notes Pakala.

See also: Rare Earth Metals Get the Presidential Treatment

Rare earth metals are crucial factors in the 21st century, as they are a part of industries as disparate as electronics, mobility, and sustainable energy. Strategic Metals include rare earth elements as well as specialty metals used in nuclear reactors, LEDs, magnets, electric motors, sensors, and many other components used in smartphones, flat screens, hybrid vehicles, and other home goods. Now they are becoming available for physical investment, including secure storage in bonded warehouses.

“Unlike many commodities, rare earths do not have traded futures, so the investment opportunity lies primarily in the companies extracting and refining the materials. VanEck Vectors Rare Earth/Strategic Metals ETF (REMX) provides a unique opportunity to gain exposure to these companies across the globe and invest in the future of technological and environmental innovation,” concludes Pakala.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.