Monday markets began to shake off last week’s slump that followed a fresh round of inflation and rate fears. Much remains uncertain regarding interest rates, however, and many investors remain comfortably camped in cash. For those considering adding to short-duration exposures, the NEOS Enhanced Income 1-3 Month T-Bill ETF (CSHI) generates high monthly tax-efficient income.

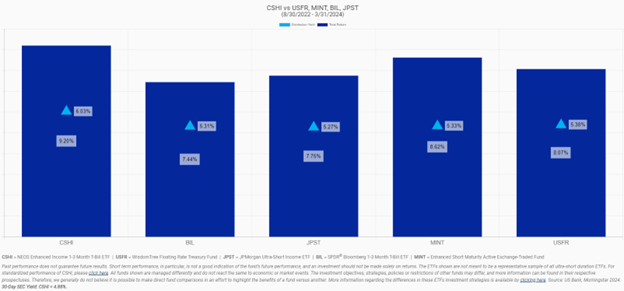

CSHI seeks to deliver 100-150 basis points above what 1-3 month Treasuries are yielding. It’s noteworthy for its tax efficiency and monthly income-oriented strategy. CSHI currently has a distribution yield of 6.03% and a 30-day SEC yield of 4.88% as of 03/31/2024.

The fund is actively managed and seeks to generate high monthly income and is options-based. It is long on three-month Treasuries and sells out-of-the-money SPX Index put spreads. These roll weekly to account for market changes and volatility.

Tax-Efficient High Monthly Income Within Short Duration

The fund also seeks to take advantage of tax-loss harvesting opportunities and the tax efficiency of index options. It offers significant performance since inception when comparing distribution yields and total returns to peers.

Image source: NEOS

The put options that the fund uses are not ETF options but instead are S&P 500 index options. These options receive favorable tax treatment as Section 1256 Contracts under IRS rules. This means the options held at the end of the year are treated as if sold on the last market day of the year at fair market value.

Any capital gains or losses are taxed as 60% long-term and 40% short-term. Notably, this tax treatment applies regardless of how long the options were held which can offer noteworthy tax advantages.

A portion of CSHI’s distributions also qualify as Return of Capital. These distributions are a return of some (or all) of the original investment made into an asset. In some cases, it is a return on premium earned by an investment as opposed to principal.

See also: “A Guide to Understanding Taxes on Income Distributions”

The fund’s managers also may engage in tax-loss harvesting opportunities throughout the year on the put options. CSHI has an expense ratio of 0.38%.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.