The year is already off to a turbulent start with a higher-than-expected January CPI print casting doubt on rate cut timing. With several macro risks looming over markets and investors, optimizing income taxes earned on core allocations could prove advantageous.

Not All Income Is Created Equal

Distributions from investments come in a variety of types and fall under several tax umbrellas. In a year when outlooks remain muddied and uncertain, revisiting your portfolio’s tax profile to ensure optimal income capture could provide meaningful benefits.

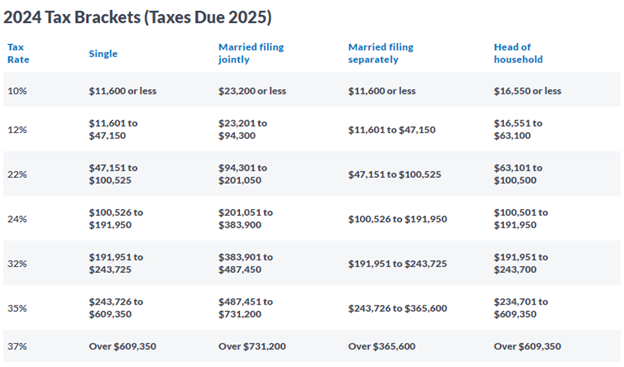

The three main ways that income distributions are taxed are ordinary income, capital gains, or tax-advantaged. Ordinary income is taxed in various brackets up to 37% come tax season. Distributions that fall under ordinary income tax brackets include short-term capital gains (applies to assets held one year or less), interest income, and unqualified dividends. All distributions that fall into ordinary income tax brackets also potentially are subject to local and state taxes.

Image source: CNBC

Long-term capital gains on assets held over a year bring significant tax savings. Income distributions that qualify as a long-term capital gain are taxed at either 0%, 15%, or 20% maximum. These distributions are also likely subject to local and state taxes. Qualified dividends also fall under long-term capital gains tax rates.

For both short- and long-term capital gains, it’s important to note that high earners often pay an additional net investment income tax of 3.8%.

Tax-Advantaged Income Creates Flexibility

Tax-advantaged distributions come from assets that receive tax exemption at the local and/or federal level. Also under the tax-advantaged umbrella are those distributions that qualify for tax-deferment or tax benefits.

Tax-advantaged income comes from a wide range of investments, such as municipal bonds, annuities, 401(k)s, Roth IRAs, and more. When balancing and optimizing income, it’s important to understand what income, like that from municipal bonds, is tax-exempt, and what is only deferred. One of the most common types of tax-deferred income is that from a 401(k).

Return of Capital distributions are a subset of tax-advantaged distributions. These distributions are a return on some or all of the investment made into an asset. In some cases, it is a return on premium from an investment as opposed to principal. RoC distributions typically aren’t taxed in the same year they’re paid, allowing for flexibility come tax season.

The NEOS suite of ETFs offers tax-efficient income for investors across core allocations. These include the NEOS S&P 500 High Income ETF (SPYI), the NEOS Enhanced Income Aggregate Bond ETF (BNDI), and the NEOS Enhanced Income Cash Alternative ETF (CSHI). All three ETFs are actively managed.

The funds employ multiple layers of tax efficiency, including using options that qualify as Section 1256 Contracts. All capital gains or losses receive a tax treatment of 60% long-term and 40% short-term, regardless of how long the strategy invested in the options. The fund managers engage in tax-loss harvesting opportunities throughout the year on all three funds. In addition, part of the distributions are Return of Capital but do not come from the principal. This means that the NAV remains flat and doesn’t erode over time.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.