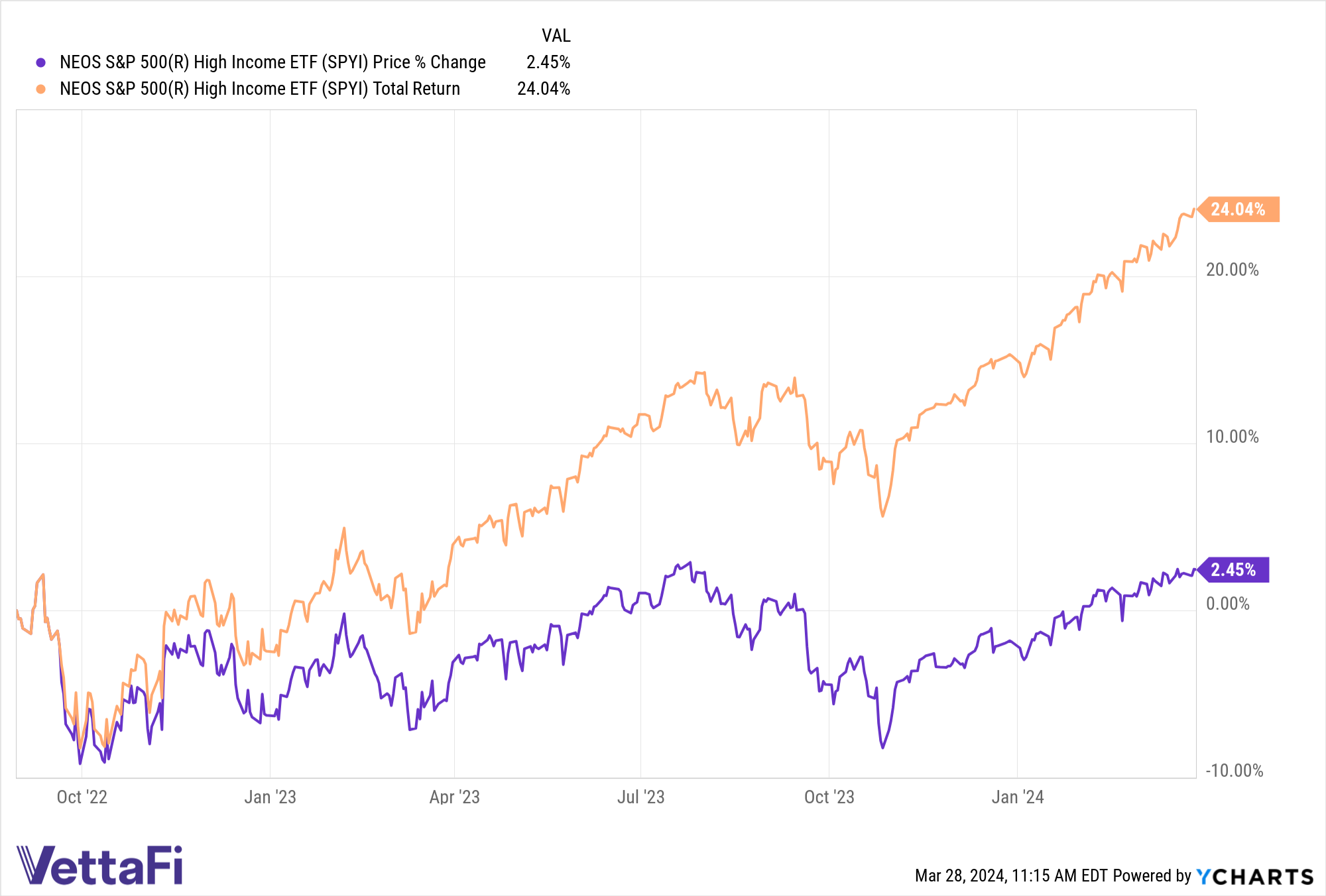

The options-based income category rose to prominence in the last two years and continues to garner investor interest. The NEOS S&P 500 High Income ETF (SPYI), launched in the latter half of 2022, recently surpassed $1 billion in AUM. It makes SPYI a noteworthy fund within the category.

SPYI crossed the $1 billion mark in trading at the end of last week. The fund is up over $455 million YTD according to FactSet data.

Troy Cates, co-founder and managing partner at NEOS, explained in a recent interview with VettaFi that the fund has many similarities to institutionalized products on the market.

“It’s more institutional because of our active management of the options,” Cates explained. “That’s where we focus our expertise, our history, and our knowledge of the options market.”

See also: “Troy Cates Talks Growth of Options-Based Strategies”

It’s no wonder that SPYI continues to attract investors since its launch on 08/30/22. The fund consistently offers noteworthy distribution yields, currently at 12.14% as of 02/29/24. Distribution yield annualizes the most recent distribution and divides by the fund’s NAV at the time of distribution. It’s a good forward-looking indicator for investors.

The fund seeks to provide exposure to the S&P 500 while generating high monthly income for investors through call options. The fund uses money earned from written calls to buy long, out-of-the-money call options on the S&P 500 Index.

An out-of-the-money call option has no intrinsic value. That’s because the current price of the underlying asset is below the strike price of the call. Should equities rise or fall, NEOS can actively manage the call options to capture gains in the underlying assets or minimize losses.

The options that the fund uses are index options, taxed favorably as Section 1256 Contracts under IRS rules. Options held at year’s end are treated as if sold at fair market value on the last market day. Any capital gains or losses are taxed as 60% long term and 40% short term, no matter how long investors hold them. This can offer noteworthy tax advantages.

The fund’s managers also engage in tax-loss harvesting opportunities throughout the year on the call options, equity holdings, or both.

SPYI has an expense ratio of 0.68%.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.