The last two years benefited options-based strategies enormously as investors sought to boost their income in challenging markets. I recently sat down with Troy Cates, co-founder and managing partner at NEOS investments LLC, to talk about the firm’s most recent fund launch and the mainstreaming of options-based strategies.

Karrie Gordon, staff writer: Troy, I appreciate you taking time to sit down with me today. I know the launch of your most recent ETF keeps you busy. Options strategies became almost prolific in the last two years as broad-based adoption grew. With so many big name firms launching their own variations of options income funds, what sets NEOS apart?

Troy Cates, co-founder, managing partner at NEOS: That’s a great question. My co-founding partner Garrett Paolella and I launched a lot of the early options-based ETFs that are still currently in the market. Back then, everything was about passively tracking indexes from providers like CBOE and others.

Things evolved a lot over the past 10 years though, specifically the last two to three years. We’ve seen a lot of the larger asset managers in the space really dive into options-based ETFs. And we’ve seen the space grow a lot, not just from the big names but other providers as well.

What sets us apart is that we have a lot of experience in this area. We’ve been managing and trading options portfolios for most of our careers. And these are strategies that we’re very passionate about. It’s not a side business for us where we have a different ETF lineup and we’re launching some options-based ETFs to fill a need.

We at NEOS are completely focused on the options-based ETF space and we have decades of experience managing these types of products.

The Evolution of Options Strategies

Gordon: Both you and Garrett, as well as others on the NEOS team, bring a bevy of options investing experience to the table. Tell me a bit about the evolution of how you approach options investing now from when you initially pioneered options ETF strategies.

Cates: Looking back to when we initially got into the space, the conversations back then with advisors weren’t so much “Tell me about your option portfolio and how it’s going to lower my volatility.” Back then it was more about what an ETF was and why you would ever put an option in it.

Now I think as the active ETF space has grown a lot, there’s wider adoption of these types of products. Now when we talk to a client, they want to know how our options-based product is different from some of the competitors out there. We focus a lot on the tax-efficiency aspect.

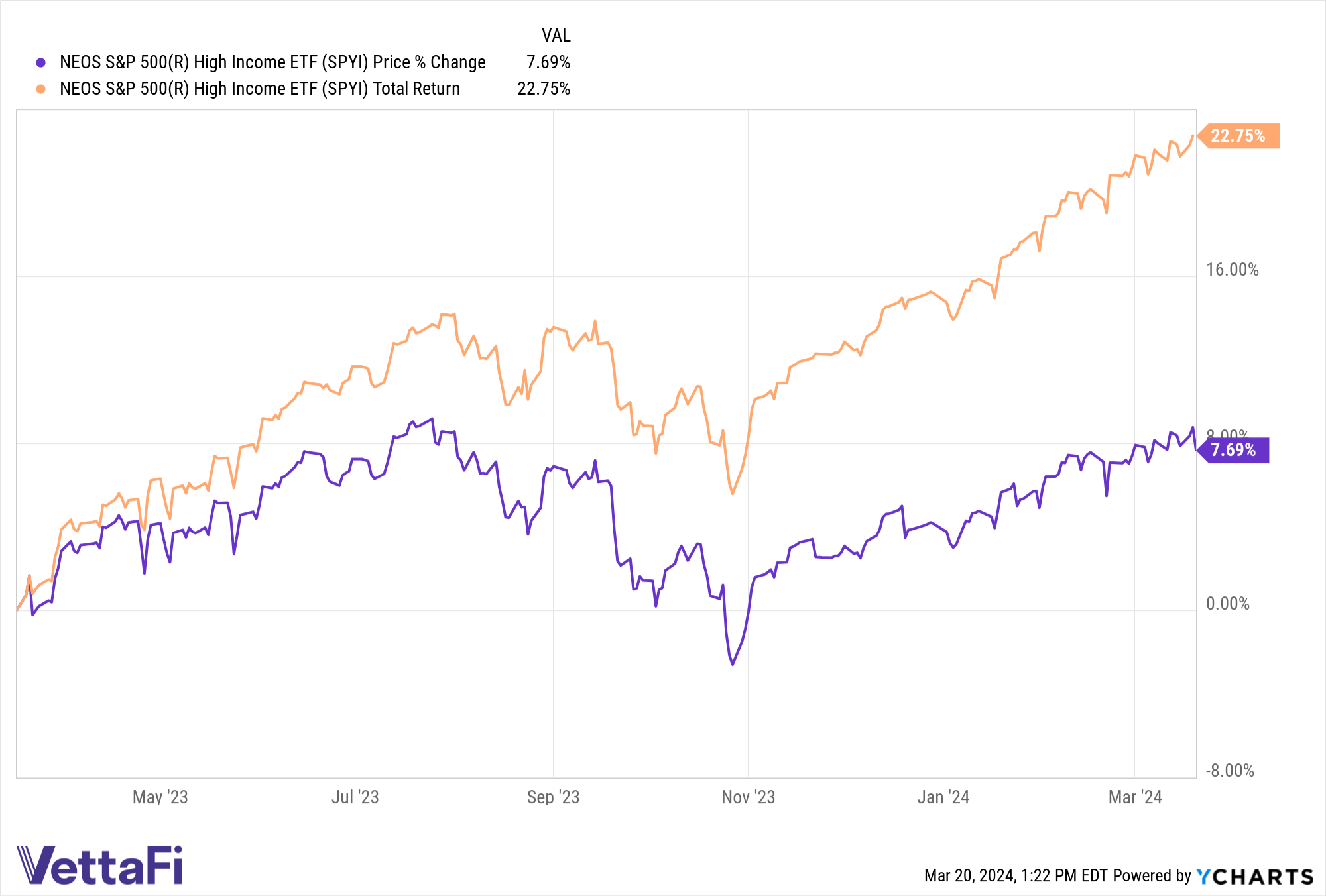

Instead of an ETF, or a single name option, or an equity linked note, we utilize index options offering an added layer of tax-efficiency due to their classification as 1256 contracts. Additionally, when we have a product like our [NEOS] S&P 500 High Income ETF (SPYI), we want to not only provide that tax-efficient monthly income. We want to appreciate as the market moves higher so that we don’t erode principal. The rules-based systematic strategies for our options portfolios inside our ETFs have several mechanisms that pursue long-term market appreciation in addition to the primary objective of tax-efficient monthly income.

To give an example, SPYI right now is about 85% covered. QQQI [NEOS Nasdaq 100 High Income ETF] is about 75% covered, which means there’s a good 25% of the portfolio not covered by the short calls. That can change month to month, depending on where volatility is. We roll these options monthly and you can see the holdings anytime on our website.

Honing in on SPYI’s Performance and Popularity

Gordon: Let’s talk a bit about SPYI. It’s been a great year for the fund, and it recently crossed $1 billion in AUM. How does SPYI compare to other equity income strategies, and what sets it apart?

Cates: SPYI compares a lot to some of the more institutionalized products out there. When we’re talking to advisors, people often compare it to JEPI [JPMorgan Equity Premium Income ETF], the largest actively managed ETF out there. That or one of our previous products that are passively managed at the money buys. They’re very different but bucket similarly by looking for income with exposure to the S&P 500.

It’s more institutional because of our active management of the options. That’s where we focus on our expertise, our history, and our knowledge of the options market. It’s in how we manage the options and overall package for tax-efficiency and consistent monthly distributions. SPYI currently distributes 1% a month with a 12% distribution yield and QQQI our goal is 12-15% a year. We just had our first distribution at about 120 basis points, which is a distribution yield of 14.4%.

Expanding the NEOS Lineup With QQQI

Gordon: You just launched your newest fund, QQQI, in January. As you mentioned, it’s doing fantastic, and offers targeted exposure to the Nasdaq-100. Can you tell me a bit about the decision to launch this fund, and how its options are different from SPYI?

Cates: When you’re looking at the S&P 500, you get that overall core exposure for your portfolio. When you look at the Nasdaq-100, it’s a more tech growth focused portfolio. While the holdings do overlap between the two, the weightings aren’t always the same.

The underlying Nasdaq-100 names are usually on average anywhere from 20-25% more volatile than the S&P 500. You see that with the potential returns you might get in a Nasdaq-100 product versus an S&P 500 product. Look at least year, for example, with the S&P up 26% and the Nasdaq-100 up 55%. That added volatility gives us an opportunity in the options market to bring in more income from the Nasdaq-100 index options we use.

We try to use index options whenever we can, whether it’s SPX or NDX. Index options receive a different tax treatment from the IRS known as Section Rule 1256. They are taxed at 60% long-term cap gains and 40% short-term gap gains, no matter the holding period. If you hold it for a day, a week, a month, a year, you’re still getting that 60/40 tax treatment.

It’s very different from what some of our competitors are doing. Some might use ETF or single name options, or equity linked notes, which don’t get that same preferential tax treatment. You’re basically paying either short term cap gains or it’s all being distributed as ordinary income.

Where Options-Based Strategies Fit Into Portfolios

Gordon: Many investors are newer to including options-based strategies in their portfolios. Do these kinds of funds make for good all-weather investments, or are they better in certain market climates?

Cates: I think they bucket anywhere. We have clients that look at them as a core part of their portfolios. But then a lot of clients bucket them into the alternatives portion where there’s option income. A lot of advisors have clients that need to have income producing products for their clients, whether they live off that income or need it for another reason. If they can get that income in a tax-efficient manner, it’s even better for them.

As we look at what the Fed might do over the next year, will rates come back or stay higher for longer, I think sourcing income from the options market is a good place to turn. For the past three plus years, you’ve had a really tough time in the fixed income market bringing income in. Now with more products out there in the option-based ETF space, there’s certainly a lot of products that can source income from different places.

‘All Options Strategies Are Not Created Equal’

Gordon: Troy, this has been really great. Before we wrap, is there anything about your funds or options-based income strategies you get asked a lot by advisors that you want to share?

Cates: I think all option strategies are not created equal. It’s really important for a client as a potential shareholder to do their homework. There’s a number of sources, whether it’s our website or VettaFi, where people can look into the funds and see what the risks are and what the product actually does.

If you look at SPYI and QQQI, we provide income sourced from the S&P 500 or the Nasdaq-100 and we’re trying to participate in the upside. These two products are not hedged, but they will outperform in the flat to down markets for the underlying equities. If you’re looking for a hedged product, do your homework. If you’re looking for more upside participation, look for that and do your homework. It’s all about education and really diving in because there are more and more options-based products coming out every day. And they’re definitely not all the same.

NEOS also offers the NEOS Enhanced Income 1-3 Month T-Bill ETF (CSHI) and the NEOS Enhanced Income Aggregate Bond ETF (BNDI).

For more news, information, and analysis, visit the Tax-Efficient Income Channel.