It’s no surprise, given prolonged market volatility and uncertainty, that risk management remains the top concern of clients. That’s according to advisors polled in a recent NEOS webcast hosted on the VettaFi platform. Advisors reported generating reliable income as the next highest concern but could be leaving income opportunities on the table by overlooking options strategies.

“I’m a huge fan of options,” said Matt Fuller, founder and managing director of XO Wealth Management, on the webcast. “Used properly, they are outstanding risk management tools, …they can really help you lessen volatility.” Fuller encourages advisors to educate themselves on options for the benefits they can provide portfolios.

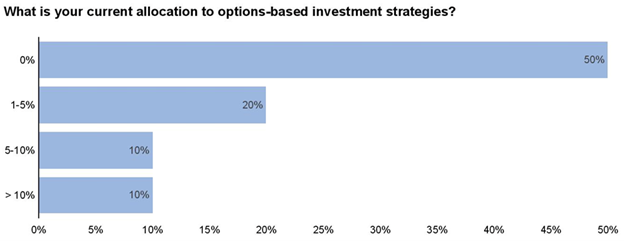

Image source: VettaFi

When asked how much of their portfolios advisors currently allocated to options strategies, 50% of respondents had none. Furthermore, 50% of respondents reported never using options-based strategies to boost their tax-efficient income potential.

Troy Cates, co-founder and managing partner of NEOS, believes that lack of education is the largest barrier to advisor investment in options. Typical conversations with advisors regarding the NEOS ETFs include questions about the types of options used. Cates reported that advisors also frequently ask NEOS, “How you could extract a tax-efficient income from an option-based portfolio?”

Enhanced Income Opportunities Plus Tax-Efficiency

Advisors and investors allocated heavily to cash and cash alternatives in the last year. It’s unsurprising, given market volatility, risk, and uncertainty. Those advisors now find themselves in a position to shift those allocations back into the markets.

“In the products we offer, using options can help them bring that money back to work,” Cates said.

The NEOS suite of ETFs offers monthly tax-efficient income within core market allocations. The strategies utilize a particular type of options to enhance income in a tax-efficient manner and within equities, allow for upside capture.

The NEOS S&P 500 High Income ETF (SPYI) seeks to capture income opportunities within equities. Meanwhile, the NEOS Enhanced Income Aggregate Bond ETF (BNDI) invests across the broad bond market. For advisors looking at ultra-short duration opportunities, the NEOS Enhanced Income Cash Alternative ETF (CSHI) invests in 1-3 month Treasury bills.

All three funds utilize options on the S&P 500 index to enhance tax-efficient income opportunities. SPYI writes call spreads on equities while BNDI and CSHI utilize put spreads.

These options are classified as Section 1256 contracts that have favorable tax rates. 60% of capital gains from the premiums are taxed as long-term, and 40% are taxed as short-term, regardless of how long the options were held.

The ETFs are all actively managed but utilize a rules-based methodology.

“These strategies are all rules-based and systematic in a sense of when we’re rolling, how we’re rolling, and what the model is telling us to roll into,” Cates explained.

See also: “Upgrade Your Core Allocations For Income With NEOS“

NEOS ETFs Offer Significant Yields Within Core Allocations

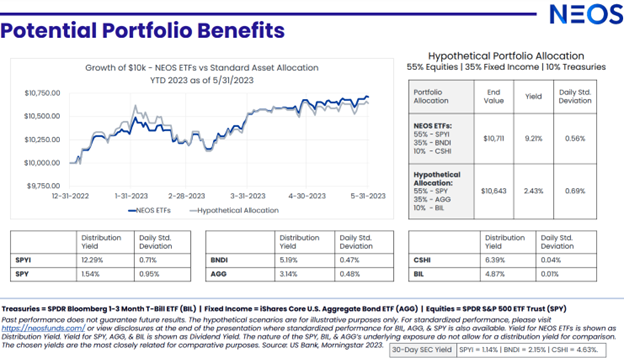

Image source: NEOS

SPYI invests in the S&P 500 as well as utilizing calls (currently a call ladder) on SPX options. The fund currently offers a distribution yield of 12.29% as of 05/31/23 and carries an expense ratio of 0.68%.

CSHI invests in 1-3 month Treasury bills and offers a distribution yield of 6.39% as of 05/31/23. The fund also utilizes SPX put spreads and carries an expense ratio of 0.38%.

BNDI invests across the bond market through the Vanguard Total Bond Market ETF (BND) and the iShares Core U.S. Aggregate Bond ETF (AGG) and utilizes an SPX put spread. The fund offers a distribution yield of 5.19% as of 05/31/23 with an expense ratio of 0.58%.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.