The NEOS income-seeking ETF suite offers income opportunities within core asset classes. The funds offer familiar risk profiles for advisors and investors while also optimizing the tax efficiency of the income earned in core portfolio allocations.

The NEOS S&P 500 High Income ETF (SPYI) seeks to capture income opportunities within equities. Meanwhile the NEOS Enhanced Income Aggregate Bond ETF (BNDI) invests across the broad bond market. For advisors looking at ultra-short duration opportunities, the NEOS Enhanced Income Cash Alternative ETF (CSHI) invests in 90-day Treasury bills.

Tax-Efficient Income Opportunities Within Core Allocations

All three funds utilize options on the S&P 500 index to enhance tax-efficient income opportunities. SPYI writes call spreads on equities while BNDI and CSHI utilize put spreads.

These options are options classified as Section 1256 contracts that have favorable tax rates. 60% of capital gains from the premiums are taxed as long-term, and 40% are taxed as short-term, regardless of how long the options were held.

Image source: NEOS

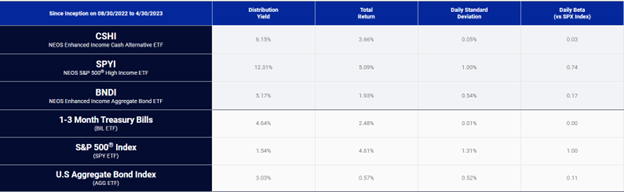

Since inception in August 2022, all three funds have outperformed each asset class benchmark. This outperformance includes both distribution yield and total return through 04/30/23.

- CSHI’s distribution yield of 6.15% since inception is well above the SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) at 4.64%. Total returns for CSHI are 3.66% compared to BIL’s 2.48% over the same period. CSHI has an expense ratio of 0.38%.

- SPYI’s distribution yield of 12.31% is significantly above the SPDR S&P 500 ETF Trust (SPY)’s 1.54% distribution yield. Total returns are a beat too, with SPYI yielding 5.09% total returns compared to SPY’s 4.61% over the same period. SPYI has an expense ratio of 0.68%.

- BNDI’s distribution yield was 5.17% versus the iShares Core U.S. Aggregate Bond ETF (AGG) distribution yield of 3.03%. Total returns for BNDI were 1.93% compared to AGG’s 0.57% in the same period. BNDI has an expense ratio of 0.58%.

Though the funds are young, it is noteworthy performance and advisors and investors continue to take note. Collectively, the three funds have brought in almost $92 million YTD.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.