The inflation narrative remains a complex one, extending investor uncertainty and volatility in equities and bonds alike. Advisors and investors seeking consistent income opportunities need look no further than the NEOS Enhanced Income Cash Alternative ETF (CSHI) for its steady monthly distributions this year.

July’s CPI print of 3.2% comes in slightly higher month-over-month than June’s but still below forecasts. While it signaled that many inflationary pressures could be easing, Friday’s report of July’s hot wholesale price gains proved the inflation narrative remains complex.

Wholesale prices, measured by the producer price index, rose 0.3% in July, the largest gain since January this year. What’s more, core PPI (excludes food and energy) gained 0.3% month-over-month as well after falling 0.1% in June. The Fed watches PPI closely as it’s usually seen as a more forward indicator of inflationary pressures.

Markets currently are not pricing in another rate hike from the Fed in September, but it’s clear the narrative remains uncertain and the specter of yet another interest rate hike in the fourth quarter looms over bonds.

Optimize Cash Allocations With CSHI

Given prolonged uncertainty, it’s been a great year for money markets and cash alternatives. With uncertainty persisting well into the second half, there is an opportunity to put cash allocations to work right now and generate consistent monthly income.

See also: “Are You Leaving Income Opportunities on the Table?”

CSHI is an actively managed ETF that generates high monthly income and is an options-based fund. CSHI is long on three-month Treasuries and also sells out-of-the-money SPX Index put spreads. These roll weekly to account for market changes and volatility.

CSHI is up 5.23% on a total return basis year-to-date while the iShares Core U.S. Aggregate Bond ETF (AGG) is down 2.38% YTD.

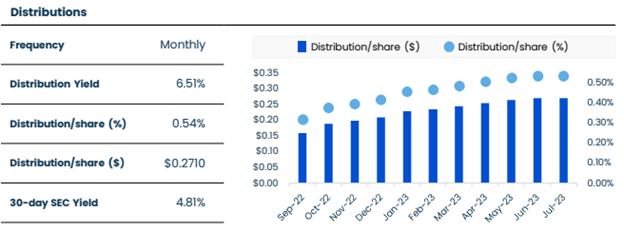

Image source: NEOS

CSHI currently offers a distribution yield of 6.51% as of July 31, 2023, and a 30-day SEC yield of 4.81%. Distribution yield is calculated by annualizing the most recent distribution and dividing by the fund’s NAV. Thirty-day SEC yield excludes yield earned on options.

Using Options Enhances CSHI’s Consistent Income

CSHI seeks to deliver 100–150 basis points above what 90-day Treasuries are yielding. CSHI also seeks to take advantage of tax-loss harvesting opportunities and the tax efficiency of index options.

The put options that the fund uses are not ETF options but instead are S&P 500 index options. These options receive favorable tax treatment as Section 1256 Contracts under IRS rules. This means that the options held at the end of the year are treated as if they had been sold on the last market day of the year at fair market value.

Any capital gains or losses are taxed as 60% long-term and 40% short-term, regardless of how long the options were held. This can offer noteworthy tax advantages, and the fund’s managers also may engage in tax-loss harvesting opportunities throughout the year on the put options.

CSHI has an expense ratio of 0.38%.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.