Investors continue flocking to ultra-short and short-duration bonds this year on interest rate uncertainty. Federal Reserve Chair Jerome Powell’s latest commentary after the May FOMC meeting indicates investors would do well to buckle in for higher for longer rates looking ahead.

Recent market volatility spikes on lower-than-expected first-quarter real GDP and a higher-than-expected CPI print in April showcase the uncertainty investors feel regarding inflation and rates. Seemingly conflicting economic and inflation data paints a muddled picture while the Fed remains in wait-and-see mode.

The Fed doubled down this month on its need for a clearer indication of falling inflation before it would consider rate cuts, citing a lack of confidence in the inflation trajectory.

“It is likely that gaining such greater confidence will take longer than previously expected,” Powell commented after the May meeting, reported CNBC. “We are prepared to maintain the current target federal funds rate for as long as appropriate.”

For the elevated number of investors camped out defensively in short-term bonds, it’s business as usual for now. The three largest short- and ultra-short-duration bond ETFs brought in over $6.5 billion in net flows year-to-date as of 05/06/2024 according to FactSet data. Over $2 billion of those flows were generated in the last four weeks.

See also: “Troy Cates Talks Growth of Options-Based Strategies”

Enhance Your Short-Duration Income Potential With CSHI

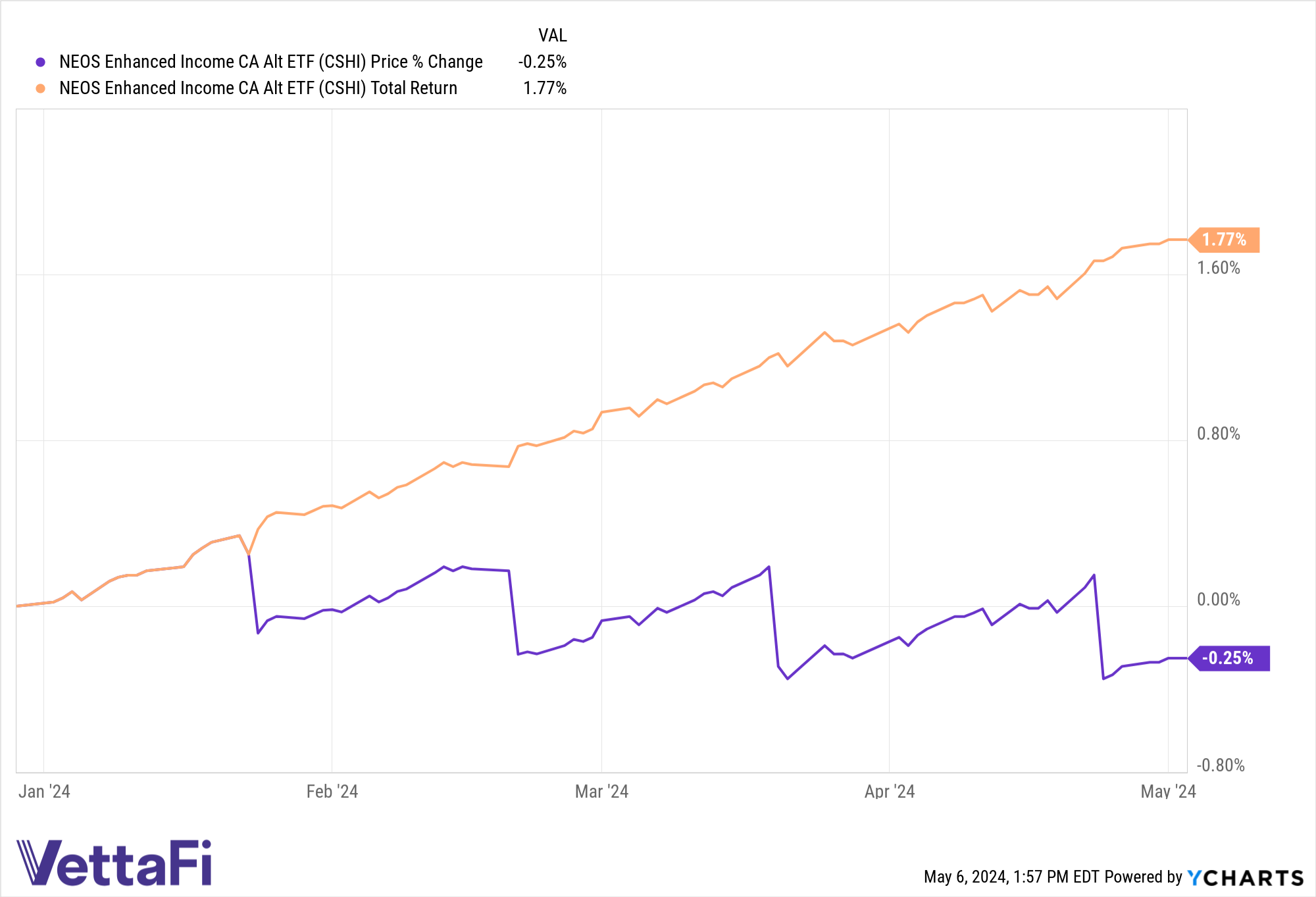

When looking to short-duration, investors seeking to enhance their income and tax efficiency would do well to consider the NEOS Enhanced Income 1-3 Month T-Bill ETF (CSHI). CSHI seeks to deliver 100-150 basis points above what 1-3 month Treasuries are yielding. The fund currently has a distribution yield of 6.03% and a 30-day SEC yield of 5.01% as of 04/30/2024.

CSHI is actively managed and seeks to generate high monthly income with its options-based strategy. It is long on three-month Treasuries and sells out-of-the-money SPX Index put spreads. These roll weekly to account for market changes and volatility.

The put options that the fund uses are not ETF options but instead are S&P 500 index options. These options receive favorable tax treatment as Section 1256 Contracts under IRS rules. This means the options held at the end of the year are treated as if sold on the last market day of the year at fair market value.

Any capital gains or losses are taxed as 60% long-term and 40% short-term. Notably, this tax treatment applies regardless of how long the options were held which can offer noteworthy tax advantages.

A portion of CSHI’s distributions also qualify as Return of Capital. These distributions are a return of some (or all) of the original investment made into an asset. In some cases, it is a return on premium earned by an investment as opposed to principal.

The fund’s managers also may engage in tax-loss harvesting opportunities throughout the year on the put options. CSHI has an expense ratio of 0.38%.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.