Plenty of commodities are on torrid paces this year. Copper is doing particularly well, although its status as an economic activity indicator has not resulted in significant pure play opportunities.

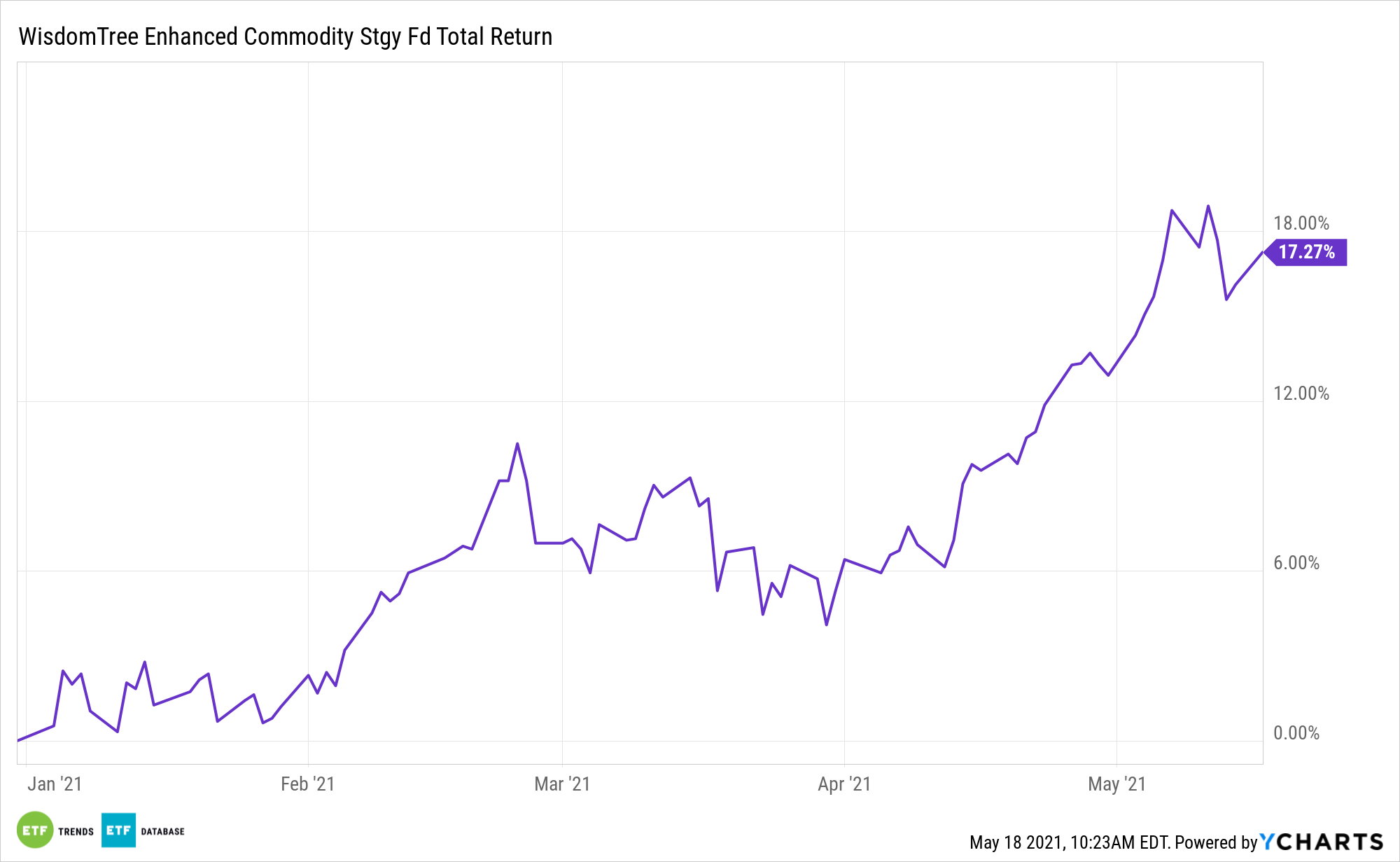

Investors can consider diversified commodities strategies however, including the WisdomTree Enhanced Commodity Strategy Fund (GCC), for exposure to red metal. GCC offers benefits some rival exchange traded products do not.

GCC “is an actively managed exchange-traded fund and intends to provide broad-based exposure to the following four commodity sectors: Energy, Agriculture, Industrial Metals, and Precious Metals primarily through investments in futures contracts,” according to WisdomTree.

As an active fund, GCC can adjust its allocations to various commodities, including copper, to take advantage of opportunities as markets present them.

The Copper Craze

Several factors underscore GCC’s exposure as a plus for investors seeking commodities exposure.

“The front month LME copper is currently trading at $10,329 per metric ton, more than the high of $10,190 per ton reached in February 2011,” according to a new note from WisdomTree. “We believe that a combination of tight supply and strong demand could push copper prices back to all-time highs. As a metal that will be a key enabler in the upcoming energy transition and burgeoning global infrastructure boom, the longer-term projections for copper also look positive.”

The International Copper Study Group (ICSG) is forecasting the red metal will be in a supply deficit. Not surprisingly, professional traders are positioned bullishly in the industrial metal.

“Net positioning in LME copper futures hit a decade high of 73,000 contracts net long in December 2020. Since then, positioning has cooled to just 50,000 contracts net long,” notes WisdomTree. “We think this is a healthy development that has opened up a better entry point into copper.”

GCC is overweight copper relative to traditional commodities benchmarks. The fund’s target weight for the metal can be as high as 8.5%, or more than 350 basis points higher than the allocation in the widely followed S&P GSCI Index.

The allure of GCC’s copper exposure is further enhanced by way of natural resources’ reputation as inflation-fighting vehicles. An electric vehicle boost could be even bigger. By some estimates, EVs require quadruple the amount of copper as internal combustion engine vehicles.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.